VIB's digitalisation journey begins with AWS-powered GenAI

What are the key objectives you aim to achieve with the launch of ViePro?

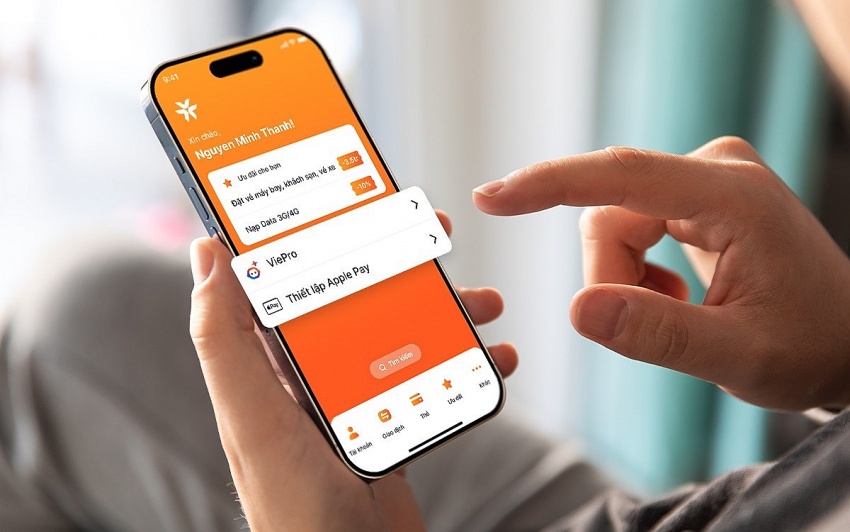

ViePro is VIB’s new generative AI assistant and marks a significant evolution in the user experience on our MyVIB digital banking platform. With ViePro, VIB becomes the first bank in Vietnam to offer millions of customers a highly accurate interactive assistant 24/7, powered by AWS, the world’s leading cloud computing provider.

|

| Tran Nhat Minh, deputy CEO and head of Digital Banking, VIB. Photo: VIB |

This innovation is designed to enhance customer satisfaction and service efficiency. We aim to boost productivity by 40 per cent, while also optimising IT and human resource requirements by up to 80 per cent, compared to current operations.

ViePro uses Claude 3 Haiku on Amazon Bedrock, enabling us to tailor outputs based on proprietary banking data stored in AWS and meet specific customer needs. In addition, VIB is utilising Amazon SageMaker, a fully managed machine learning service, to enhance operations and provide personalised customer recommendations like spending limits and discounts.

ViePro was first trialled with 12,000 employees in 189 VIB branches across Vietnam in September. We expanded the test to 200,000 selected customers the following month, and officially rolled out to millions of mobile banking customers starting in December.

|

| Photo: VIB |

Our primary goal for ViePro was to provide customers with personalised advice on products and services. Initially, the focus was on ensuring the GenAI virtual assistant to accurately answer a wide range of customer queries, including up-to-date information from our website. Moving forward, we plan to enhance ViePro’s capabilities, enabling it to replace service operators. Customers will be able to manage tasks like closing a card, transferring money, updating personal documents, or changing personal information seamlessly via the GenAI virtual assistant.

As we progress, ViePro will leverage customer data to offer highly personalised recommendations, optimising cross-selling opportunities and boosting revenue.

This approach will enable cross-selling opportunities and boost revenue by predicting customer needs through our machine learning models. The GenAI virtual assistant can recommend additional products or services based on a customer's existing portfolio, creating a more intuitive and value-driven experience. Of course, the sales process will not be confined to digital applications but will integrate with the entire network of VIB branches, helping to increase revenue while enhancing service quality.

Why did you choose AWS as a partner to modernise your core banking system?

The modernisation of our core banking system is a long-term initiative that requires at least two years for implementation and optimisation. We began implementing this undertaking in the first quarter this year, with a target completion in the first quarter of 2026.

AWS stood out as the global leader in cloud computing, with the largest market share in the world. Moreover, they are the first company in the world to deploy cloud computing. Traditional core banking deployments often require banks to spend a year setting up infrastructure, including servers and networks, before they can even test the software. With AWS, VIB was able to set up its infrastructure in just five days and conduct tests on a system supporting five million customers, all within three weeks. By the end of the month, VIB paid only for that single month of usage, eliminating the need for upfront infrastructure investment.

AWS also offers unmatched security and compliance, with over 140 internationally recognised certifications, surpassing the typical two certifications–PCI-DSS and ISO 27001–held by local data centres in Vietnam.

Given that banking operations run 24/7, moving to the cloud ensures that services are always available, enabling VIB to offer faster, more reliable banking experiences. MyVIB mobile banking users have praised the app’s performance, citing its speed, uninterrupted functionality and superior user experience compared to competitors.

In addition, AWS provided a dedicated technical team in Vietnam to support us throughout the implementation process.

What drove the decision to make VIB the first bank in Vietnam to migrate its website to the AWS cloud platform?

Migrating to the cloud represents a strategic leap forward, allowing us to leverage cutting-edge technology and strengthen operational resilience. Cloud security offers enhanced protection for sensitive banking operations compared to traditional local data centres, ensuring robust security and compliance standards.

Transitioning to the cloud also equips our employees with new, advanced skills, fostering a culture of innovation and adaptability. While this requires some initial training, it ultimately empowers our team to operate more efficiently and capitalise on the full potential of cloud technology, with AWS as our trusted partner.

For example, migrating our website to AWS helps us mitigate risks such as natural disasters. By doing so, we ensure VIB's digital infrastructure remains operational and unaffected by local disruptions, building a future-ready foundation that prioritises security, performance, and resilience.

|

| VIB is the first bank in Vietnam to offer AWS-Powered Gen AI on Mobile Banking. Photo: VIB |

What is VIB's vision for GenAI, and how does AWS fit into that vision?

We are only beginning to explore the vast potential of GenAI. The development of GenAI models has advanced rapidly in a short space of time, delivering impressive results. AWS, for instance, offers powerful models like Anthropic’s Claude 3.5 Sonnet, showcasing the flexibility and capabilities of GenAI across a range of applications.

The significance of GenAI lies in its ability to solve multiple challenges across industries. In banking, it can be used for programming, customer consultation, sales optimisation, and data analysis. As the technology continues to evolve, banks in Vietnam and beyond will be able to revolutionise their operations and deliver valuable outcomes. For instance, instead of relying on a data analyst, bank employees can simply query the system to get instant, accurate answers, all in Vietnamese. The system can also generate complex visualisations, like graphs and charts, without requiring any programming expertise.

This is just the beginning. In the future, GenAI will serve as a powerful interface for users, facilitating seamless access to banking services with AI and machine learning models.

Our core banking system is currently running on AWS for testing and is scheduled to go live in the first quarter of 2026, and we plan to migrate our Enterprise Data Platform from on-premises infrastructure to AWS in mid-2025. This will further integrate advanced AI and machine learning tools from GenAI and AWS, making them core components to VIB's cloud ecosystem.

| VIB receives award for card design feature VIB has been recognised by the Vietnam Record Organisation and Mastercard with a National Record and the Innovation Breakthrough 2024 Award as the first bank in Vietnam to allow customers to design their own credit card images through generative AI technology from Fiza x Zalo AI. |

| VIB and Flywire partner to streamline cross-border payments for students from Vietnam On November 14, Vietnam International Bank (VIB) announced a partnership with Flywire, a global payments enablement and software company based in Boston, the United States. |

| How technology is changing the bank card Over the past six years, VIB has continuously applied technology to introduce new and innovative features for its bank cards to keep pace with future trends. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Digital Transformation

- Dassault Systèmes and Nvidia to build platform powering virtual twins

- Sci-tech sector sees January revenue growth of 23 per cent

- Advanced semiconductor testing and packaging plant to become operational in 2027

- BIM and ISO 19650 seen as key to improving project efficiency

- Viettel starts construction of semiconductor chip production plant

Related Contents

Latest News

More News

- Digital shift reshaping Vietnam’s real estate brokerages (December 31, 2025 | 18:54)

- Allen & Gledhill recognised as Outstanding M&A Advisory Firm (December 18, 2025 | 14:19)

- Inside Lego Manufacturing Vietnam (December 18, 2025 | 11:45)

- The next leap in Cloud AI (December 11, 2025 | 18:19)

- Vietnam’s telecom industry: the next stage of growth (December 11, 2025 | 18:18)

- Five tech predictions for 2026 and beyond: new era of AI (December 11, 2025 | 18:16)

- CONINCO announces new chairman and CEO (December 10, 2025 | 11:00)

- How AWS is powering the next-gen data era (December 09, 2025 | 13:14)

- Outlook in M&A solid for Singapore (December 08, 2025 | 10:31)

- Vietnamese firms are resetting their strategy for global markets (December 05, 2025 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version