VIB’s SmartDepo is the smart way to handle idle cash

|

Compared to traditional savings solutions, SmartDepo’s key differentiation lies not in headline interest rates, but in product design philosophy. For years, financial markets have followed a linear model: customers have money, choose a tenor, and earn interest. This works when cash flows are stable and plans rarely change. However, in an increasingly volatile world, such rigidity reveals its limitations.

SmartDepo takes the opposite approach. Instead of asking customers, 'How long would you like to deposit?', VIB asks, 'When will you need this money?'. From that question, the SmartDepo ecosystem is built to align with users’ financial rhythms, rather than forcing users to adapt to products.

To understand why SmartDepo has been rapidly embraced by millions of users, it is essential to look at three defining behaviours of customers with idle funds – a group that is strongly shaping today’s savings trends.

First, these customers prioritise capital preservation. Safety comes first, but preservation does not mean accepting erosion of value over time. They seek solutions that are both secure and capable of generating incremental returns during idle periods.

Second, they resist rigid capital lock-in. Market experience has reinforced the belief that funds must remain readily accessible. Flexibility has become just as important as yield.

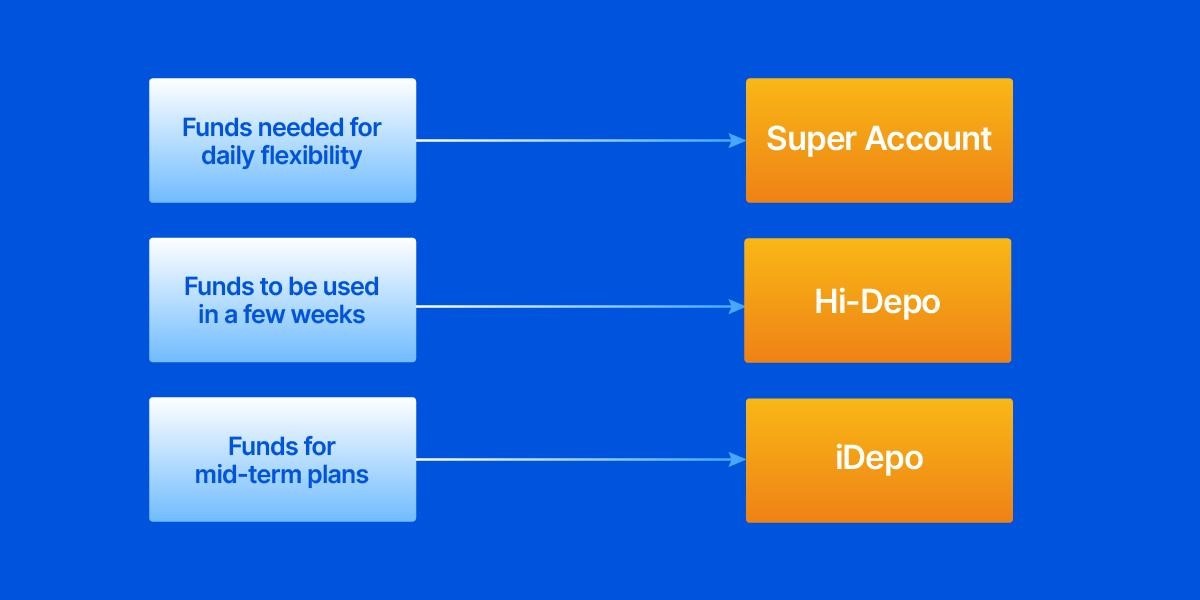

Third, they allocate money by purpose: daily spending, personal and family reserves, and funds waiting for investment or mid-term plans. Historically, few savings solutions have fully aligned with this logic. This gap is precisely what SmartDepo is designed to address.

SmartDepo: a three-layer intelligent savings architecture

SmartDepo is built as a comprehensive intelligent savings ecosystem for idle cash daily, weekly, and monthly. Instead of fixed tenors, it organises cash flows based on actual usage rhythms, guided by a simple yet powerful principle: money waiting to be spent, money waiting for opportunity, and money waiting for plans all deserve to earn returns.

Beyond competitive interest rates, the core lies in how VIB structures and operates cash flows. From this philosophy emerge three complementary product layers, forming a seamless ecosystem.

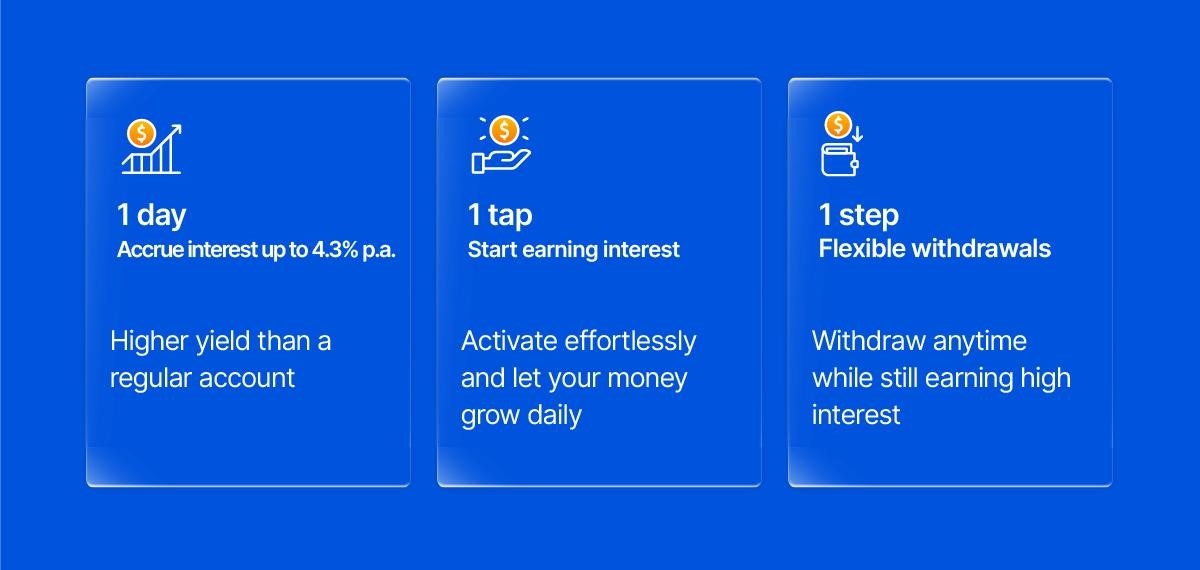

Super Account: making daily idle cash work

At the first layer is the Super Account, designed for cash that requires daily flexibility. Three standout features define its appeal: daily returns of up to 4.3 per cent per annum; one-touch activation; and instant withdrawals.

|

With a single tap on the MyVIB digital banking app, idle balances in the payment account automatically earn daily interest while remaining fully available for transfers, withdrawals, or payments at any time, without affecting accrued returns. This combination of yield and liquidity marks a critical differentiator.

Nearly one million users have already chosen the Super Account. Its appeal lies in solving a practical problem: money once considered dormant in payment accounts is now continuously working, generating returns every day.

Hi-Depo: a smart haven for short-term idle cash

The second layer is Hi-Depo – a flexible weekly term deposit solution. It caters to funds waiting for a few weeks, such as pending inventory payments, recently realised investment proceeds, or funds awaiting disbursement.

With tenors ranging from 1 to 12 weeks and yields rising with holding duration up to 5.6 per cent per annum, Hi-Depo supports agile financial management. Minimum deposit denominations range from VN 50 million ($1,928) to VND1 billion ($38,573), accommodating diverse customer segments.

Hi-Depo functions as a smart parking space: delivering higher returns than payment accounts while retaining flexibility when new opportunities arise.

iDepo: redefining mid-term savings standards

At the third layer, iDepo serves short- and mid-term savings needs. Customers can deposit from VND50 million ($1,928), earn interest rates of up to 7.4 per cent per annum (depending on segment), choose 24- or 36-month tenors, receive interest periodically, and crucially, transfer deposits at any time without forfeiting accrued returns.

Operating entirely on the MyVIB platform, iDepo empowers customers to buy, sell, transfer, or designate buyers for deposits whenever needed, addressing a long-standing concern – early withdrawal no longer means losing interest.

In 2025, the number of Hi-Depo and iDepo users increased nearly 1.5 times compared to 2024, reflecting a clear behavioural shift towards flexible, yield-generating, customer-empowered solutions.

SmartDepo is not merely about returns – it reshapes how users structure their financial plans. Customers choose Super Account, Hi-Depo, and iDepo not for speculative gains, but to assign each sum a clear role within an integrated financial strategy.

Take Minh, a 35-year-old mid-level manager in Ho Chi Minh City, who has accumulated VND 1.6 billion ($61,717) over a decade of work and investing. Rather than committing all assets to one channel, he now allocates funds into three buckets: day-to-day living funds earning flexible daily returns via Super Account; short-term idle money optimised via Hi-Depo; and medium-term savings using iDepo. Therefore, Minh can earn attractive gains with liquidity and flexibility as his plans change.

|

SmartDepo stands apart in three ways. First, while markets sell interest rates, SmartDepo sells a cash-flow management formula. Second, instead of forcing customers to choose tenors, it enables allocation by purpose. Third, rather than asking, 'How long will you deposit?', it delivers returns aligned with daily, weekly, and monthly cash rhythms.

By combining all three layers, customers are not just optimising individual sums – they are building a resilient, long-term financial foundation capable of adapting across economic cycles.

At a broader level, SmartDepo’s impact extends beyond individuals. When millions of users optimise idle cash, liquidity continues circulating within the economy. Banks gain stable funding for productive lending, while customers retain full control over their assets – creating a smoother, more resilient financial ecosystem.

SmartDepo empowers customers to take control of every unit of money, aligned with personal rhythms and plans. When idle cash earns returns daily, weekly, and monthly, saving transforms from a passive state into a proactive, strategic, and sustainable choice for the future.

| VIB's Dual Earnings solution reshapes personal money management VIB's Dual Earnings solution, which is reshaping how Vietnamese people manage their personal finances, has quickly become a preferred choice for many of today's young, forward-thinking consumers. |

| VIB named Best Customer Satisfaction Bank in Vietnam 2025 Vietnam International Bank (VIB) has received new recognition for customer satisfaction, reflecting its continued focus on customer experience. |

| VIB puts customer experience at centre of long-term growth At Vietnam International Bank (VIB), customer experience is not merely a service standard – it is a long-term strategic axis, embedded throughout the entire journey of saving, spending, and borrowing. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- US fintech startup invests $5 million in Vietnam (January 28, 2026 | 11:58)

- VIB puts customer experience at centre of long-term growth (January 16, 2026 | 10:25)

- Visa data highlights five key payment and travel trends in Vietnam for 2026 (January 14, 2026 | 10:42)

- Visa launches card-based trade payment platform (January 08, 2026 | 09:14)

- Corporate Excellence Award affirms VIB’s leadership in sustainable retail banking (December 30, 2025 | 16:03)

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version