How technology is changing the bank card

|

Products of technology

One Sunday morning, Phuong Anh and her husband began their day with a run. Carrying only a smartwatch, they completed their two-hour jog and stopped at a café for coffee and snacks. To pay, Phuong Anh simply tapped her smartwatch on the POS machine, completing the transaction in seconds using her favourite credit card stored in the device.

Later that day, the couple dined at a Korean restaurant with friends. Their meal cost nearly $118, but Phuong Anh received an $11.82 cashback, thanks to the card’s rewards programme. Staying updated on promotions is also seamless—she can consult Vie, a virtual financial assistant on the card, for real-time advice.

Like Phuong Anh, millions of bank cardholders in Vietnam are embracing VIB cards for daily transactions, shifting away from cash due to their unmatched convenience. Over the past 5-6 years, bank cards have become integral to everyday life, offering advanced features that continually redefine the payment experience.

Leading the card technology race

Today’s bank cards are not just tools for payment but technological marvels. With constant innovation, cards have evolved to become one of the most advanced banking products. Recognising their potential, banks, including VIB, have heavily invested in cutting-edge technology to enhance competitiveness and meet consumer needs.

Since restructuring its credit card segment in late 2018, VIB has prioritised technology leadership alongside customer experience and benefits. This strategy underpins the bank’s vision of “Leading the card trend.”

Becoming a leader in card technology requires more than adopting advanced systems. It involves strategic foresight, sensitivity to market trends, and a commitment to addressing customer needs. VIB has consistently pioneered new technologies in Vietnam, setting benchmarks in the industry.

In early 2019, VIB became the first bank in Vietnam to integrate a smart card solution combining virtual cards, contactless payment, and Green PIN technology. In 2020, it introduced Big Data and AI technology to streamline card approvals and issuance. Customers could open credit cards online and get approved within 15 minutes, a significant improvement over the traditional 5-7 days. This innovation made online card opening a standard practice among Vietnamese banks.

|

Tuong Nguyen, head of VIB’s Card Division, noted, “When developing card products, we focus on integrating technology to best serve customers. This requires comprehensive investment, from researching solutions to choosing the right technology providers and ensuring compatibility with our systems.”

Over the past six years, VIB has consistently introduced new features that enhance the user experience. However, the bank emphasises that technology must deliver real benefits. “The most advanced technology is meaningless if it doesn’t create value for users,” Tuong added.

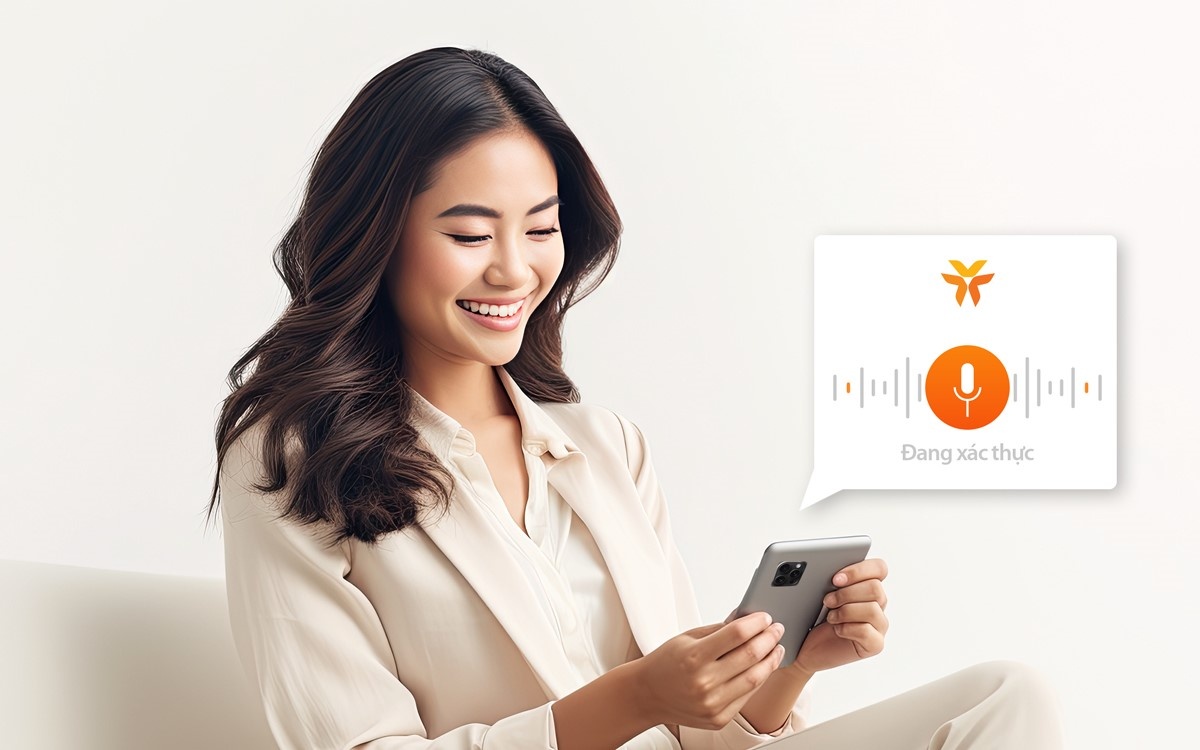

Since 2023, VIB has implemented six advanced technologies to improve the cardholder experience. These include integrating international payment and credit cards onto a single chip, voice authentication for customer identification, and embedding virtual reality (VR) and augmented reality (AR) features into cards. These innovations have captivated users, encouraging them to explore the bank’s latest offerings.

Seamless experiences: Fast, convenient, and secure

VIB’s technologies are designed to provide a fast, convenient, and secure experience.

For speed, VIB has developed an online credit card opening process using eKYC and Big Data credit scoring, enabling customers to apply and start using virtual cards within 15-30 minutes. It is also the first bank to leverage the VNeID electronic identification system for online credit card issuance.

|

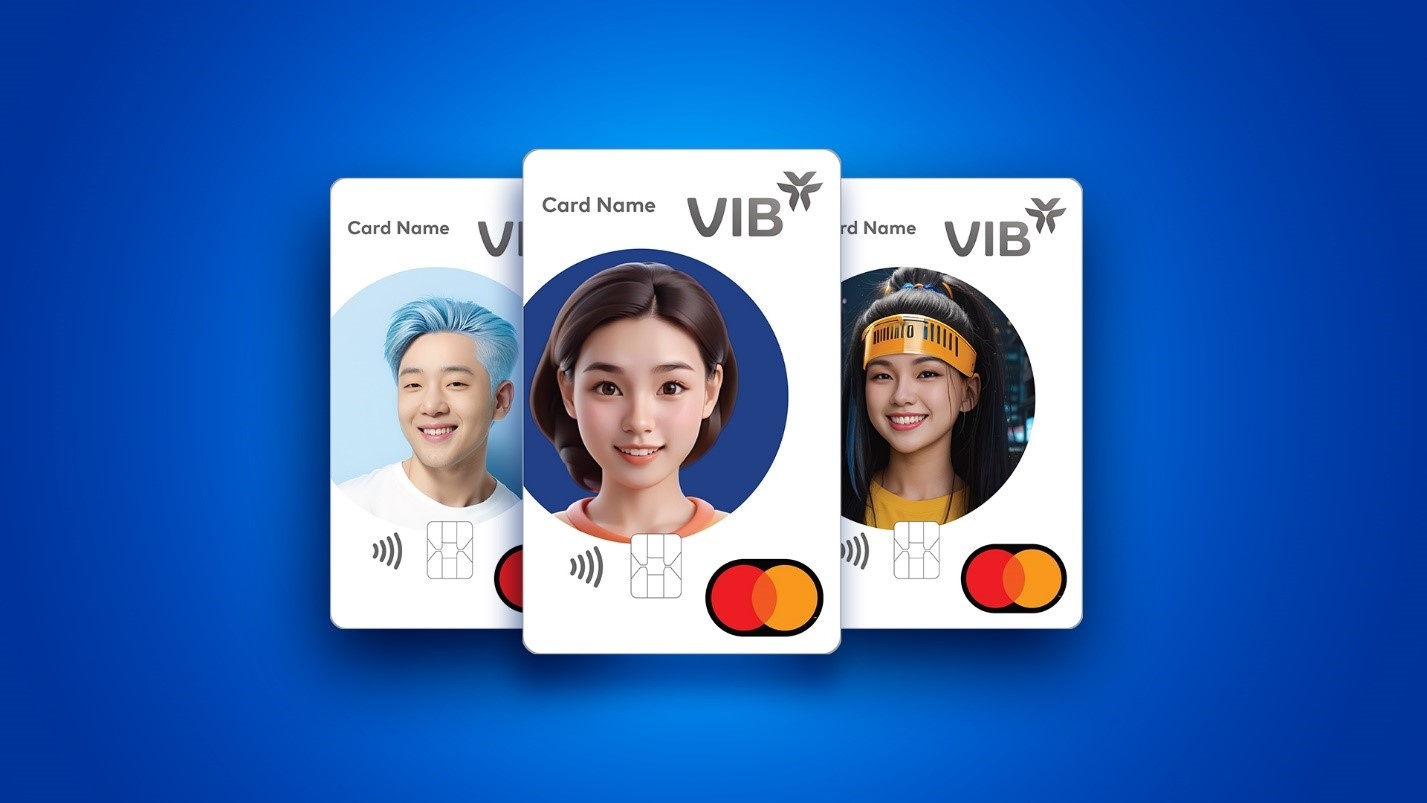

In terms of convenience, VIB integrates international and domestic payment functionalities on a single card, allowing customers to transact effortlessly. Additionally, VIB offers personalised card features, enabling users to design cards with custom images, choose card numbers, and tailor benefits like cashback and statements.

Regarding security, VIB adopts advanced measures such as eKYC, Green PIN, 3D Secure, and multi-layered systems to safeguard customer information and minimise fraud risks. By connecting with the VNeID platform, VIB further strengthens identification processes during card issuance.

VIB is also leveraging AI to personalise card services, including the recently launched Card Design On Demand feature, which allows users to customise credit card designs. In the first 20 days of the launch, nearly 20,000 personalised card designs were created, reflecting strong customer interest in unique features.

Beyond aesthetics, AI plays a crucial role in enhancing functionality. For instance, AI analyses spending patterns, flags unusual transactions, and provides tailored financial advice to help users manage their personal finances more effectively.

Tuong Nguyen highlighted the transformative potential of AI in creating smarter services. “AI enables us to recommend goods and services that align with each customer’s financial needs, tailor rewards to their spending habits, and ensure more personalised experiences,” he said.

Celebrating a journey of innovation

VIB is preparing to celebrate the sixth anniversary of its card restructuring journey (2018-2024). As of October 2024, the bank had 810,000 cards in circulation–a ninefold increase over the past six years. Credit card spending during this period has grown nearly 15 times, reaching $4.9 billion in 2024. These achievements place VIB among Mastercard’s top-ranked banks in Vietnam.

The success stems from VIB’s unwavering commitment to its strategy of “Leading in technology,” “Leading in experience,” and “Leading in benefits.”

To mark this milestone, VIB is launching a gratitude programme with attractive incentives. Customers can share memorable moments with their VIB cards to receive vouchers worth VND6 million ($236.4), vote for their favourite cards to enjoy lifetime fee waivers, or receive a travel package with lounge access and fast-track services by completing six transactions totalling VND6 million during the anniversary week.

For more information about the programme and other card offers, visit VIB's website.

| VIB becomes first bank to launch online credit card issuance via VNeID VIB has become the first bank to utilise information from an electronic identification and authentication system (VNeID) to issue credit cards online starting from October 17. |

| VIB launches Card Design On Demand powered by GenAI technology VIB announced on October 18 the official launch of its Card Design On Demand, powered by Generative AI (GenAI) technology from Fiza x Zalo AI. |

| VIB receives award for card design feature VIB has been recognised by the Vietnam Record Organisation and Mastercard with a National Record and the Innovation Breakthrough 2024 Award as the first bank in Vietnam to allow customers to design their own credit card images through generative AI technology from Fiza x Zalo AI. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- VIB hits $267.4 million in pre-tax profit over first nine months (October 29, 2025 | 12:12)

Mobile Version

Mobile Version