Hundreds of businesses to attend Vietnam Medipharm Expo 2024

The event will provide a platform for foreign companies to study Vietnam’s distribution channels and competitive landscape, opening doors to new opportunities in this dynamic market. It will welcome numerous experts, physicians, distributors, and importers.

In the pharmaceutical supply sector, domestic brands will include Vi Dieu Nam Medicine and Pharmacy Limited Company, specialising in the distribution of natural products and traditional Vietnamese herbal remedies.

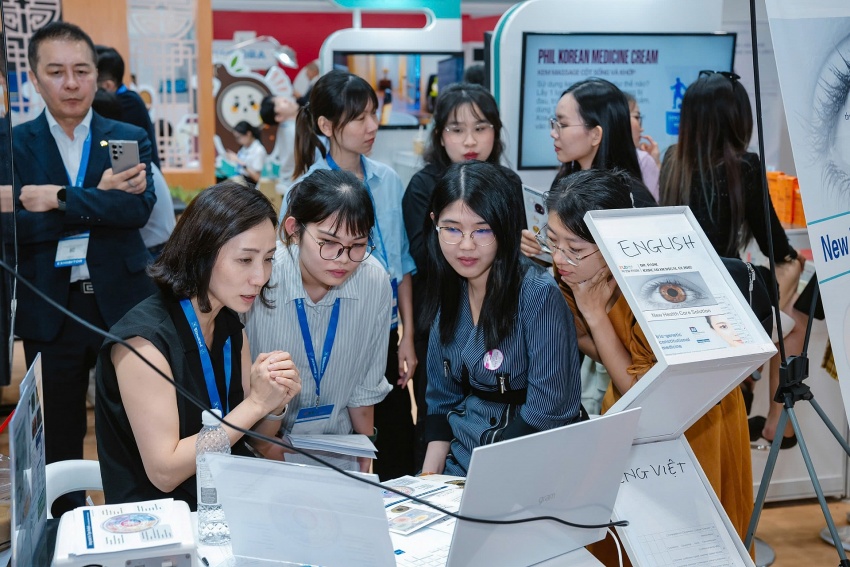

|

| Vietnam Medipharm Expo 2023. Photo: Vinexad |

Another highlight is Nature Gift Pharma JSC, known for its range of health supplements imported from the US. The company emphasises rigorous quality control to provide affordable, high-quality products tailored to Vietnamese consumers.

A dedicated area will be set aside for biopharma technology products, showcasing advancements in this emerging field. For example, HIT Trading Service JSC will display health supplements produced using Japanese Biopharma technology.

Elsewhere, BCC Group - Vietnam Biochemical Technology JSC will represent the medical equipment and materials sector, specialising in research and the supply of biotechnology and biochemical solutions. BCC Group primarily partners with research institutes and state agencies in the medical and pharmaceutical industries.

The exhibition will also feature Van Minh Co., Ltd., a supplier of industrial chemicals, pure chemicals, and laboratory equipment. Van Minh is the exclusive distributor of devices of the MEMMERT brand from Germany, further solidifying its market position.

Notable overseas participants include two renowned South Korean brands, Mario Bio and Jeil Pharma, known for their pharmaceuticals, medicines, and health supplements, which are widely distributed across the globe and imported by numerous countries.

|

| Vietnam Medipharm Expo 2023. Photo: Vinexad |

In the medical equipment sector, Dr. Park from India is expected to draw significant attention with its diverse range of products, including nasal sprays, eye drops, oral medicines, and injectables, all catering to the healthcare needs of the Vietnamese population, particularly during seasonal changes.

Besides that, the booth of Esmond Natural, Inc from the US is sure to attract many visitors with its display of herbal products and dietary supplements, perfectly suited to the health and wellness needs of the Vietnamese population, especially in adapting to seasonal changes.

From China, PRCXI Bioinformatics, with over a decade of experience supplying medical equipment, technology and solution for laboratories to a billion-strong market, will share valuable practical insights through its participation in specialised seminars.

Additionally, Taiwan’s Smart Surgery, specialising in intelligent surgical equipment, will showcase advanced tools designed to assist doctors in performing procedures more efficiently and safely.

Each participating brand represents not only an opportunity to promote products, but also a chance to forge deeper, more sustainable partnerships. Vietnamese businesses are encouraged to seize this opportunity to learn, refine their strategies, and adopt market-penetration solutions from the international enterprises representing eight countries and territories at the expo.

The highlight of this year’s exhibition is the series of specialised seminars covering topics of great interest, such as molecular biology testing, Thai herbal health supplements, healthcare data, and the future of the pharmaceutical industry, including the potential application of AI, as well as supply chain concerns.

|

| Vietnam Medipharm Expo 2023. Photo: Vinexad |

These seminars will provide a valuable platform for businesses, partners, and customers to exchange insights, share in-depth knowledge, and explore new products and technologies.

Vietnam Medipharm Expo marks its 30th annual edition this year, as it aspires to remain the top choice for businesses looking to step beyond their comfort zones, solidify their foothold, and underscore the strategic importance of Vietnam’s medical and pharmaceutical industry.

Recently, Vietnam has achieved remarkable success in trade diplomacy, highlighted by a series of bilateral and multilateral agreements. Vietnam has also become a strategic partner for many major global economies. These developments have laid the groundwork for key sectors, including medical and pharmaceutical products and services, to expand their cross-border connections.

Vietnam's GDP per person has seen continuous growth, rising from $121 in 1990 to $4,622 in 2024 (according to Statista). As living standards improve, the demand for healthcare products and services has grown, driving significant development in the medical and pharmaceutical industries.

Additionally, the rapid proliferation of social media has played a pivotal role in spreading awareness about public health, environmental issues, and disease prevention to urban and rural communities alike. This trend has indirectly spurred demand for health-enhancing products, medical equipment, and healthcare services.

A 2023 market overview by the Ministry of Health reveals that Vietnam has approximately 1,500 hospitals, nearly 1,300 of which are public hospitals. The market value of medical equipment utilisation is estimated at over $1.67 billion, with a compound annual growth rate of 10.2 per cent, based on research by strategic consulting and market analysis firm Report Ocean.

The pharmaceutical industry in Vietnam witnessed impressive growth in the first half of 2024. According to the JobsGo Employment Information Report, job opportunities in this sector increased by 142 per cent. Meanwhile, the EU-Vietnam Business Network reported a significant rise in pharmaceutical enterprises, with approximately 250 manufacturing plants, 200 import-export facilities, 4,300 wholesale agents, and over 62,000 retail outlets now operating in the country. Furthermore, numerous international pharmaceutical products have been imported and distributed within Vietnam.

In northern Vietnam, the medical and pharmaceutical sector has long been home to many prominent brands. Businesses continue to expand, stay aligned with market trends, and enhance cross-border collaborations. For instance, in Hai Duong Province, Indian partners have confirmed plans to invest $10-12 billion in developing a 900-hectare pharmaceutical park spanning the Binh Giang and Thanh Mien districts.

Similarly, Thai Binh province has signed agreements with Makara Capital Partners of Singapore, Sakae Corporate Advisory, and Vietnam’s Newtechco Group JSC to establish the country’s first Biopharma Industrial Park. This 300-hectare facility in Quynh Phu district is projected to require an investment of $150-200 million initially, with total registered investment reaching $800 million during 2024–2027 and $1.2 billion in 2028–2030.

| Dreaming big for the Vietnamese pharma industry Vietnam has prioritised advancing its pharmaceutical industry, with a particular focus on developing a domestic generic industry to meet the demands of its citizens. |

| Opportunities abound for innovative pharma industry Countries around the world are hoping to entice investment for their innovative pharmaceutical industries in order to bring socioeconomic benefits towards sustainable development strategies. Emin Turan, chairman of Pharma Group, talked to VIR’s Bich Thuy about the specific opportunities for Vietnam in this regard. |

| Incentives ahead for pharma industry Vietnam’s pharmaceutical industry has reached level three under the World Health Organisation’s classification, as the country can now produce some basic raw materials. However, it has yet to fully develop raw material production, as it cannot compete with imported materials. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Healthcare Platform

- PM outlines new tasks for healthcare sector

- Opella and Long Chau join forces to enhance digestive and bone health

- Hanoi intensifies airport monitoring amid Nipah disease risks

- Cosmetics rules set for overhaul under draft decree

- Policy obstacles being addressed in drug licensing and renewal

Related Contents

Latest News

More News

- Japanese technology set for Mekong Delta rice cultivation (March 05, 2026 | 11:03)

- VN-EAEU trade talks target market access and supply diversification (March 04, 2026 | 11:27)

- Ericsson and Viettel to accelerate autonomous network development (March 03, 2026 | 17:00)

- Spring Fair 2026 boosts domestic demand (March 02, 2026 | 16:30)

- New rules help in setting up representative offices (March 01, 2026 | 06:00)

- Academic-policy network planned to support VIFC development (February 28, 2026 | 08:00)

- Hanoi sees launch of new innovation centre with state-private model (February 27, 2026 | 16:45)

- SpaceX appoints Vietnamese CEO to lead Starlink Vietnam operations (February 26, 2026 | 17:53)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- Agentic AI set to reshape Vietnam’s enterprise landscape (February 10, 2026 | 12:06)

Mobile Version

Mobile Version