Incentives ahead for pharma industry

Currently, Vietnam can only meet 6 per cent of its demand for raw materials for drug production. Domestic pharmaceutical production satisfies about 70 per cent of market demand in terms of quantity, but accounts for nearly half of total drug consumption value. Products derived from medicinal herbs contribute less than 4 per cent of this.

|

| Dr. Ta Manh Hung, deputy director, Drug Administration, Ministry of Health |

Although innovative and high-tech pharmaceuticals account for a large proportion of the total drug value at medical facilities and large hospitals, they represent just 3 per cent of the quantity used, while accounting for 22 per cent of the value. Most of these are imported.

The local industry largely focuses on producing generic drugs using traditional tech and lacks research and development (R&D) capacity to promote advanced tech, such as biotechnology, which is required to produce original branded drugs, treatments for emerging diseases, high-tech medicines, and vaccines.

Vietnam has substantial potential for developing medicines from medicinal plants, with nearly 4,000 species used in traditional remedies. This opens the door for producing more drugs and medicinal ingredients from these herbs, which would also align with current trends in environmental protection.

In terms of vaccines and biological drugs, the country mainly produces some vaccines using traditional technology, but there is a shortage of high-quality biological products for the treatment of specialised and dangerous diseases, as well as emerging epidemics. The local capacity for R&D in this field is still limited, with no modern biological technology available. While domestic production meets the demand for 12 of the 13 vaccines in the national expanded vaccination programme, this represents less than 10 per cent of the demand for vaccination services.

Vietnam has around 300 pharmaceutical factories, 17 of which meet EU-GMP standards or equivalent, while four meet PIC/s-GMP standards. The majority of domestic companies (60 per cent) have investment capital below $12.5 million. Companies with over VND500 billion ($20 million) account for 18.75 per cent, and those with more than VND1 trillion (nearly $4.2 million) represent just over 10 per cent of the industry.

When it comes to projects eligible for investment incentives, only three pharmaceutical projects – Nanogen, Mediplantex, and Hataphar – qualify. The majority of pharmaceutical projects benefiting from incentives are based on regional criteria, rather than industry or profession-based incentives. These projects fail to meet the scale required under the Investment Law for such incentives.

The performance of the pharmaceutical industry in recent years shows it has not achieved the goals set in the national strategy for the sector’s development to 2020 and vision to 2030. These targets include meeting 20 per cent of the demand for raw materials in drug production, domestic products accounting for 80 per cent of the total market value, drugs from medicinal herbs making up 30 per cent of domestic value, and domestic vaccines meeting 30 per cent of in-service vaccination needs.

Amendments to the Law on Pharmacy aim to introduce new and more innovative policies to attract investment and further support the domestic pharmaceutical industry. This includes focusing on R&D in pharmaceutical ingredients, technology transfer, and the production of high-tech and biotechnological drugs.

The proposed changes to the law offer preferential policies in several areas. The first is promoting R&D and technology transfer to produce herbal medicines, traditional drugs from domestic herbs, pharmaceutical ingredients, original branded products, rare medicines, first generic drugs, high-tech items, and vaccines. Second, the amendments focus on preserving and developing rare and endemic medicinal plants, and creating new varieties with high economic value. Third, they support the cultivation of medicinal herbs in socio-economically disadvantaged regions.

During the drafting process, the drafting committee has gathered input to develop regulations related to investment incentives. The goal is to implement breakthrough reforms that will create a more favourable environment for the development of the domestic pharmaceutical industry. The proposal includes offering incentives under the Investment Law in areas where the pharmaceutical industry remains limited and requires further development.

Other proposed preferential regulations are tailored to the scale and current situation of the industry, including provisions for corporate income tax incentives, and adjustments to import taxes on pharmaceutical ingredients that Vietnam cannot produce. The draft also suggests simplifying the procedures for marketing authorisation of drugs covered by special investment incentives, prioritising authorisation and import licences for rare drugs, pre-evaluated vaccines, and products that have undergone clinical trials in Vietnam.

With these new policies and amendments, alongside five key policies already approved by the National Assembly, it is expected that the existing shortcomings in state management of the pharmaceutical sector will be addressed.

| Vietnam's pharmaceutical market boasts immense potential Vietnam is a country with one of the highest pharmaceutical values and growth rates in the world. |

| Pharma to experience robust growth Vietnam healthcare market size is estimated to reach $23.7 billion and grow at an average rate of 7.5 per cent annually from 2023 to 2028. Healthcare expenditure per capita is also projected to increase from $237 to $328 in that time. |

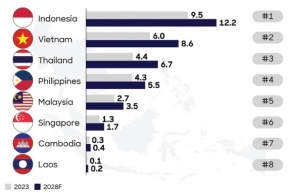

| Competition within ASEAN for pharma investment With an ageing population, rising disease burden, and advancements in healthcare science, the global pharmaceutical market has seen significant growth in recent years. In 2023, the total market was estimated at $1.6 trillion, an increase in over $100 billion compared to 2022. As one of the largest and fastest-growing industries, the sector drives healthcare innovation globally. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version