How Vietnam can reimagine tourism

|

| Margaux Constantin and Matthieu Francois, associate partners in Ho Chi Minh City McKinsey & Company |

For most players in the travel industry, the idea of holiday-goers lounging on a beach thousands of miles from home or sailing the high seas seems like a distant memory. Globally, countries experienced a decline of 35-48 per cent in tourism expenditures last year compared with 2019. Vietnam, with its year-long international border closures, has not been exempted.

As Vietnam’s travel sector continues to evolve and as prospects of international travel become increasingly feasible with vaccination rollouts, travel and tourism players have to adapt to survive.

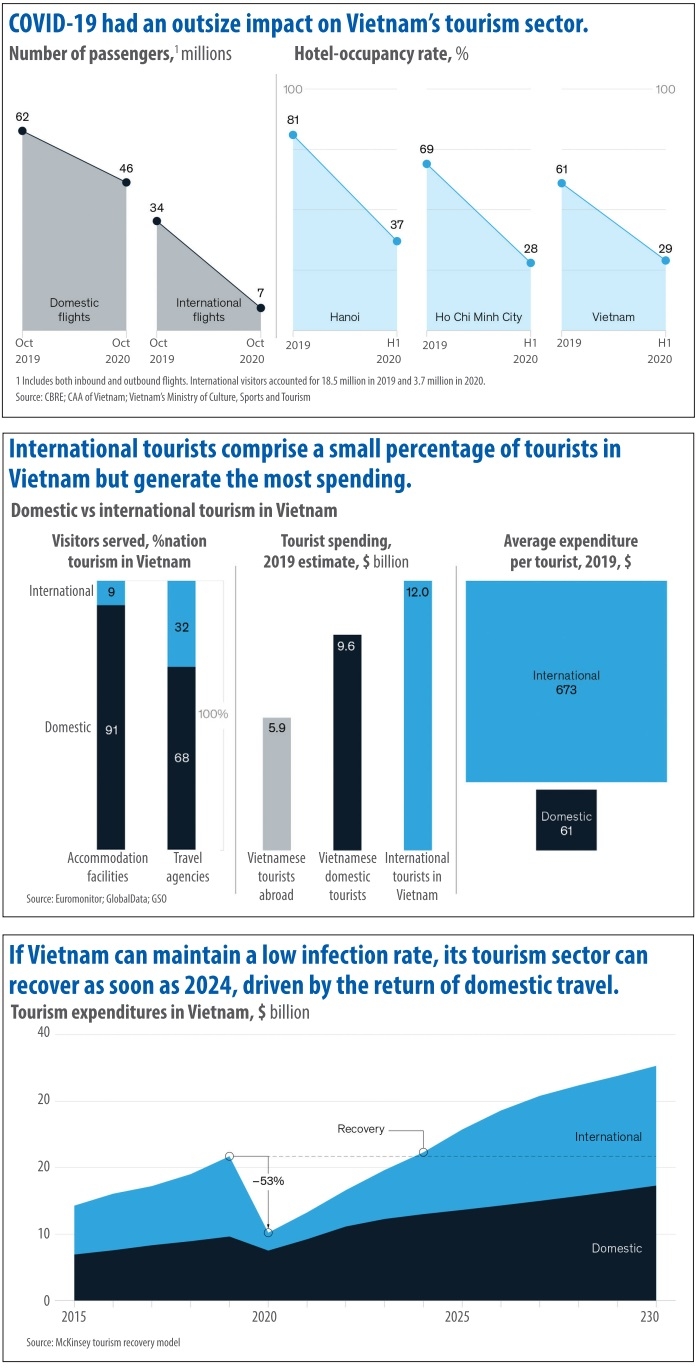

The tourism sector relies heavily on international travel, which plunged last year. International flights dropped 80 per cent in October from the same period a year earlier. Hotels filled only 30 per cent of their rooms.

The sharp drop in foreign travellers has had an outsized impact on tourism expenditures, and Vietnam’s overall economy, because they spend significantly more than their local counterparts. In 2019, a year in which the tourism industry accounted for 12 per cent of the country’s GDP, international travellers made up only 17 per cent of overall tourists in Vietnam, yet accounted for more than half of all tourism spending – averaging $673 per traveller compared with $61 spent on average by domestic ones.

The tourism sector created 660,000 jobs between 2014 and 2019, and this sharp expenditure dive has also stunted the country’s food and beverage and retail industries. As a return to pre-pandemic levels of international tourism may be far off, the travel sector’s short-term revival could depend on local tourism.

|

In 2019, Vietnamese tourists spent $15.5 billion, of which $5.9 billion flowed overseas. The majority of tourists are unable to leave the country, so they are looking domestically to scratch their travel itch. Travel companies should therefore rise to the occasion and capture value from this opportunity.

Even with favourable tailwinds driven by domestic tourism, Vietnam will be dependent on international markets, which represent around $12 billion in spending. The majority of Vietnam’s international tourists come from Asian markets, with those from China, Japan, South Korea, and Taiwan accounting for around 80 per cent of Vietnam’s foreign tourism spending. Vietnam’s strong economic ties with these markets could lead to a relatively fast tourism industry recovery compared with other key tourist destinations in Europe and North America.

To make the most of these ties, Vietnam has been pursuing a zero-case-first strategy since the start of the pandemic. This strategy is associated with markets in which COVID-19 transmission rates are low and as a result traveller confidence, at least on a domestic level, is relatively high.

By implementing this approach and taking into account Vietnam’s resilient local economy and proactive government campaigns, Vietnam’s tourism sector could recover to pre-crisis levels in 2024, and the country can expect to see international tourism rebound first with travellers from other Asian economies.

With borders remaining closed for outbound travel, an increase in domestic luxury trips could occur as travellers reallocate their budgets. Of course, as noted above, the spending power of domestic tourists is weaker than that of foreign tourists, so this type of travel cannot completely fill the gap created by the lack of globetrotters.

Meanwhile, Vietnam currently has strict travel restrictions in place and allows only a select number of weekly international flights for travel by experts and diplomats, who are subject to mandatory quarantine on arrival. Vietnam needs to protect the status quo of having near-zero rates of COVID-19 cases and cannot risk opening its borders freely until herd immunity is reached, most likely through mass vaccinations. Thus, it could take some time before inbound foreign tourism returns at scale.

In the meantime, there might be some opportunity to pursue more gradual and less risky measures. For instance, there have been discussions about establishing travel bubbles to allow travel between other countries with zero or near-zero transmissions, such as Australia, China, and Singapore. Travel companies should be prepared for two scenarios: one in which travel bubbles open up for inflows of international tourists, and the other in which domestic tourism remains the main driver of value.

The time for digital

Even before the pandemic, consumer reliance on digital for travel-related bookings had been growing. In 2018, online travel activity made up 19 per cent of the total tours and activity market size. The pandemic has made the adoption of mobile and digital tools even more essential. Strategic collaborations, such as online travel agencies providing ticket-booking services via instant messaging and social-media platforms, could offer an opportunity for increased market penetration.

At the same time, travel companies should revamp their online touchpoints and experiences to improve the customer experience. This is already starting to happen: the website of the Vietnam National Administration of Tourism has virtual tours for its most popular destinations, and some tour guides have organised real-time online tours for international customers.

In addition, a commercial titled, “Why not Vietnam” aired on CNN in October 2020 to drive international traffic to the website, and on a domestic level, a reality show with the same name offered up weekly online travel photo contests to engage viewers.

Companies could also think about placing digital tools in new places within the customer journey. They must recognise that factors promoting customer loyalty may have changed; near-term uncertainty may mean, for example, that the ability to cancel a reservation matters more than brand choice or price.

Furthermore, to capture early outbound demand, travel players could benefit from tracking the development of travel bubbles. This is especially relevant for Vietnam, as the majority of tourists are from nearby regions with strong economic ties and relatively low transmission rates. As already stated, our analysis finds that nearby countries such as China, Malaysia, and Thailand could provide inbound expenditure growth of at least compound annual growth rate between 2020 and 2025.

Local operators, as fact, who often lag behind big travel companies in terms of resources but are more agile in organising personalised activities, can leverage increasingly popular online players to connect directly with customers and provide these options.

International online travel agencies such as TripAdvisor, as well as closer-to-home players such as Traveloka and Triip.me, have been building dedicated “experience” platforms to inspire users and allow them to choose the most suitable tours by providing a range of attractive options for destination adventures. Tourism companies could shift their efforts away from building resorts and selling sightseeing tickets to design exceptional activities, and leverage these platforms to take advantage of travel-experience trends.

Government role in tourism

In most countries, reinventing the tourism industry will involve industry professionals working in concert with industry groups and governments. Vietnamese tourism administrators have an exciting opportunity to reimagine their roles and lead the sector through recovery and beyond

Firstly, this is by boosting domestic demand to make up for lost income from international travellers, and second by promoting Vietnam’s image as a country that has managed the pandemic fairly well. To do this, three things should occur.

In the short term, the government and industry associations need to ensure survival of operators. They can experiment with new and sustainable financing options such as hotel revenue pooling, in which a subset of hotels operating at higher occupancy rates share revenue with others. This would allow hotels to optimise variable costs and reduce the need for government stimulus plans.

After that, government-backed digital and analytic transformation is necessary, especially to level the playing field for small- and medium-sized enterprises, which made up more than 50 per cent of travel suppliers in 2018.

Finally, Vietnam has a solid opportunity to boost its stature as an adventure destination. Authorities and associations can leverage the overall momentum of the country, as well as the expected return of international travel, to boost demand. Our analysis finds that in the Asia–Pacific region, adventure remains the leading travel trend searched by travellers, so Vietnam is well positioned to leverage this trend.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Manila becomes a new check-in destination for Vietnamese youth (December 11, 2025 | 18:07)

- Vietjet launches mega year-end ticket promotion (December 10, 2025 | 11:33)

- Dalat leads Vietnam’s 2025 search trends (December 09, 2025 | 13:44)

- Vietnam welcomes record wave of international visitors (December 09, 2025 | 13:43)

- Vietjet launches daily Manila flights to celebrate year-end festive peak season (December 05, 2025 | 13:47)

- The destinations powering Vietnam’s festive season travel demand (December 04, 2025 | 18:33)

- Vietnam named among the world’s most exciting winter destinations (December 04, 2025 | 15:10)

- Phu Tho emerges as northern Vietnam’s new tourism hub (December 01, 2025 | 17:00)

- Vietjet completes Airbus A320/A321 updates ahead of deadline (December 01, 2025 | 09:49)

- Vietjet resumes Con Dao flights from early December (November 28, 2025 | 15:24)

Mobile Version

Mobile Version