Vietjet reports impressive growth on international routes

|

| Vietjet reported very successful business performance in 2018 |

Vietjet has just announced its 2018 audited financial statement with very upbeat business results.

Accordingly, the carrier posted VND53.577 trillion ($2.33 billion) in revenue and VND5.816 trillion ($252.9 million) in pre-tax profit last year.

Despite oil price rising by 30 per cent, the company’s revenue and pre-tax profit from aviation transport hit VND33.779 trillion ($1.47 billion) and VND3.045 trillion ($132.4 million), increases of 49.8 and 48.9 per cent on-year.

This attests to Vietjet’s expertise in revenue generation and cost management. It is significant to note that Vietjet’s record growth last year came mostly from its core aviation transport business.

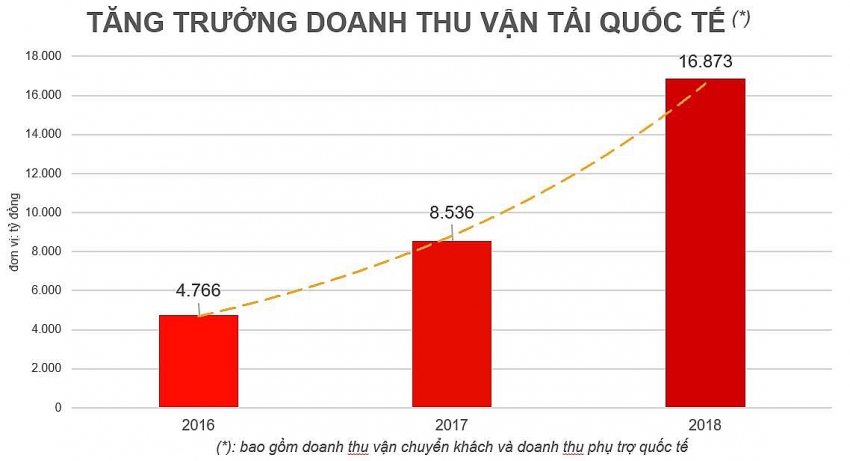

Incremental revenue growth in international passenger transport

Vietjet and the national flag carrier Vietnam Airlines hold almost the entirety of the domestic market. Vietjet has posted nearly 20 per cent revenue growth from aviation transport in the domestic market and continued holding the pole position in passenger volumes on domestic routes.

The company also saw impressive growth in international routes. Five years ago, Vietjet only counted VND178 billion ($7.7 million) in international passenger transport revenue, this figure jumped to VND802 billion ($34.9 million) in 2016.

In the past two years, the company posted exponential growth on its international routes, with last year’s international passenger transport revenue nearly doubling against 2017.

|

| Vietjet's revenue growth on international routes (including from passenger transport and value-added services; Unit: billion VND) |

Accordingly, the company posted VND24.681 trillion ($1.07 billion) in total passenger transport revenue last year. Likewise, the revenue from value-added services which features high profit margins (selling souvenirs, food, and in-flight advertising, among others) amounted to VND8.410 trillion ($365.7 million), a 53.5 per cent jump on-year.

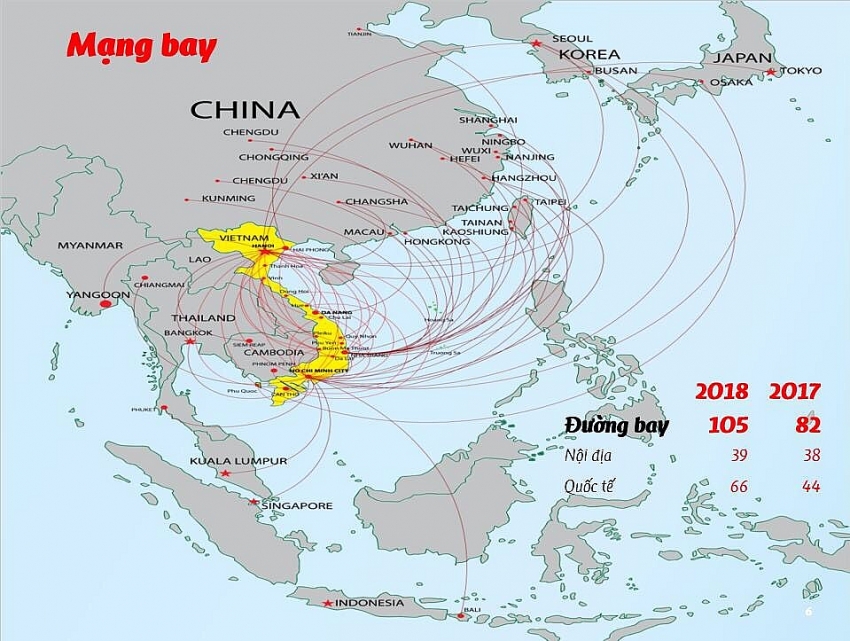

Excelling on international flight provision

According to figures from Vietjet and the Civil Aviation Authority of Vietnam, last year Vietjet performed 118,923 flights, over 21,000 flights more than in 2017, with 34,990 flights to international destinations, a 56.25 per cent jump against 2017.

Vietjet’s growth in flight numbers far surpassed rivals in the domestic market and also exceeded the whole aviation industry’s average growth rate of 9 per cent.

Last year, all other air carriers in the domestic market only increased flight numbers by a combined 4,000 flights in total.

|

| Vietjet's international routes |

Effective cost management has bolstered Vietjet’s competitive capacity in the international market. Its direct operating expenses not including fuel costs (cost per available seat kilometre – CASK ex-fuel) went down by 0.1 per cent last year to 2.38 US cents by virtue of modern fleet and cost-saving measures, besides support for fuel cost optimisation from the engine manufacturer.

The average CASK rose by 4-5 per cent in 2018 (Source: IATA), helping Vietjet boost profit on international routes which accounted for more than 60 per cent of the company’s total aviation transport profit last year.

| Aside from solid development in its home market, Vietjet aims to push up international route expansion to avail itself of lower fuel cost advantages on the international routes. |

Besides a plethora of options in time schedules and destinations, Vietjet is approaching higher-income passengers with an array of priority services. Passengers on international routes have larger payment capacity for both ticket price and value-added services.

Aside from solid development in its home market, Vietjet aims to push up international route expansion to avail itself of lower fuel cost advantages on the international routes.

The company counts that international routes have surpassed local routes in terms of revenue contribution.

Through increasingly launching flights to developed nations in north-eastern Asia and populous nations with stable development like India, Vietnam aims to reach passenger groups of higher average income, from there raising the proportion of foreign currency income sources in the company’s total money streams.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Visa data highlights five key payment and travel trends in Vietnam for 2026 (January 14, 2026 | 10:42)

- New Year tourism receipts top $40m in key cities (January 06, 2026 | 08:36)

- Vietnamese passport climbs on global ranking (December 16, 2025 | 08:00)

- Manila becomes a new check-in destination for Vietnamese youth (December 11, 2025 | 18:07)

- Vietjet launches mega year-end ticket promotion (December 10, 2025 | 11:33)

- Dalat leads Vietnam’s 2025 search trends (December 09, 2025 | 13:44)

- Vietnam welcomes record wave of international visitors (December 09, 2025 | 13:43)

- Vietjet launches daily Manila flights to celebrate year-end festive peak season (December 05, 2025 | 13:47)

- The destinations powering Vietnam’s festive season travel demand (December 04, 2025 | 18:33)

- Vietnam named among the world’s most exciting winter destinations (December 04, 2025 | 15:10)

Tag:

Tag:

Mobile Version

Mobile Version