Manufacturers localise supply to circumvent chip shortages

Last week, Vingroup officially announced the shutdown of VinSmart, its smartphone and TV production arm, to focus on its automobile unit VinFast. The move is not seen as a surprising one as Vingroup has also withdrawn from retail, agriculture, and aviation in recent times to focus its resources on smart homes and electric vehicles.

Vingroup also plans to introduce its version of electric cars in the United States in 2022, with the conglomerate reportedly mulling an initial public offering in the US for VinFast that could raise $2 billion.

According to Nguyen Viet Quang, vice president and general director of Vingroup, the smartphone and TV production market is highly saturated with low-profit margins so many big players like Sony, LG, and HTC have also quit the game. Moreover, the costs for smartphone production are increasing significantly due to the severe shortage of chipsets and the rising costs of accessories over the past year, making it difficult to compete.

In the first quarter of 2021, VinSmart accounted for a 10-per-cent market share in Vietnam but its annual growth had been stagnant, according to a report by Singapore-based market analyst firm Canalys. The supply of critical components such as chipsets has quickly become a major concern and will hinder smartphone shipments in the coming quarters.

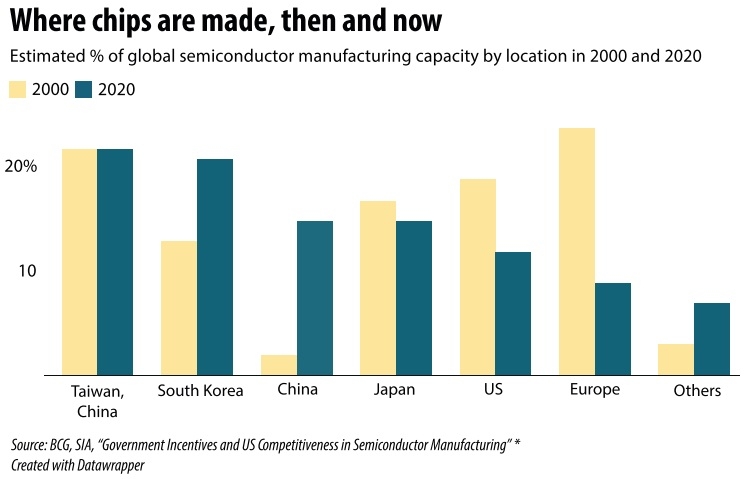

|

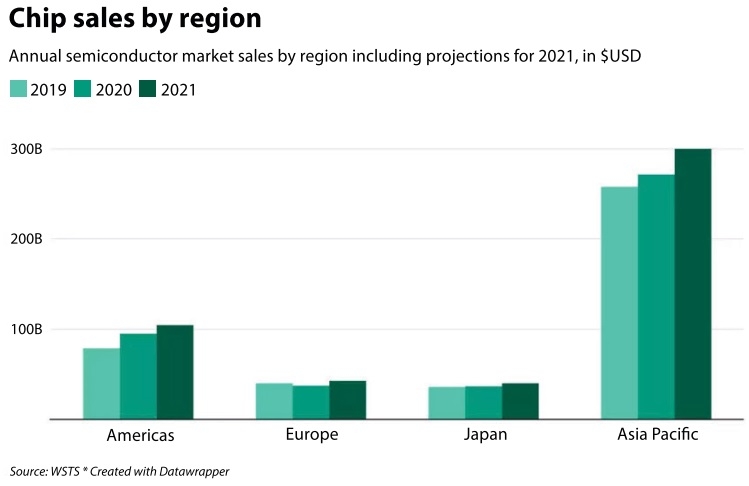

|

Holding up sales

The global shortage of chips is quickly spreading across different industries from smartphones to cars. On average, a car has between 50 and 150 of the semiconductors, which are used in a growing number of applications, including driver assistance systems and navigation control.

In Vietnam, a slew of car brands from Toyota, Kia, Mitsubishi, Mercedes Benz, and Suzuki have been affected by the problem. Most recently, Mitsubishi Vietnam has postponed delivery of the Xpander units due to the shortages. Meanwhile, Suzuki Vietnam announced that the volume of its XL7 and Ertiga models imported from Indonesia will be limited in the next three months because of slower production.

Other electronics manufacturers are also getting slammed by such shortages. Dang Van Chung, plant manager of Ho Chi Minh City-based Datalogic Vietnam LLC operating in Vietnam for 10 years, told VIR that the company has been in short supply of semiconductors since the end of last year. Datalogic is currently specialised in designing and producing barcode readers, mobile computers, and sensors, as well as vision and laser marking systems.

“We are trying to negotiate with our customers because we can’t deliver full orders for them. Furthermore, the industry-wide supply shortage also results in higher expenses and logistics costs for manufacturers. However, Datalogic is making efforts not to increase prices while looking for alternative suppliers in a desperate bid to keep supplies flowing,” Chung said.

Nguyen Tu Quang, CEO of Vietnam’s technology corporation BKAV, also pointed out the reasons behind the global chip shortage. He noted that Huawei Technologies has stockpiled critical chips amid the US-China trade tensions to ensure the supply to Chinese carriers in their rollout of 5G technology. Other Chinese manufacturers, fearing similar treatment, followed suit.

At the same time, the problem became worse in light of the unprecedented demand for semiconductors during the pandemic. National lockdowns saw a massive surge in the demand for virtual office devices such as laptops and network peripherals as companies scrambled to accommodate their employees in the mass shift to working from home.

“To overcome the challenges, technology manufacturers like BKAV are racing to find foreign suppliers who have changed their business plans and may have available components for sale. This sale and procurement of chipsets and electronic accessories is happening all over in the market,” Quang said.

Many chip producers and suppliers have reported shortages, warning that the delivery time could be extended to over 10 months.

Domestic development

Semiconductor chips are used everywhere, from simple ones like Vietnam’s new identity cards to common household electronic devices such as televisions, refrigerators, induction cooktops, and rice cookers. Furthermore, Vietnam has the growing demand for chips given that the country is preparing to roll out 5G and accelerate digital transformation. Therefore, the global shortage will disrupt supply chains and the digital transformation efforts of Vietnam.

This multifaceted issue shows no signs of abating. In a recent blog, Glenn O’Donnell, vice president and research director at advisory firm Forrester, believed the shortage could last into 2023. “The PC surge will soften a bit in the coming year but not a lot. Data-centre spending will resume after a dismal 2020, and edge computing will be the new ‘gold rush’ in technology,” he said. “Couple that with the unstoppable desire to instrument everything, along with continued growth in cloud computing and cryptocurrency mining, and we see nothing but boom times ahead for the chip demand.”

To be proactive in the chip supply and avoid risks, Vietnamese telecom giant Viettel had the ambition to develop its semiconductors for the core networks for its 5G services, though it could be challenging for Viettel to realise this target as it requires accumulated efforts and years to bear fruit. Meanwhile, the company would need numerous different chips to build a reliable system.

Meanwhile, other foreign investors are looking to increasing chip production in Vietnam. Austrian chipmaker AT&S intends to develop two factories in Vietnam with an investment capital of nearly $1.8 billion in the first phase. Ingolf Schröder, director of AT&S, said that his company is confident it can implement the factory in a short time to serve the huge demand in the field. The chipmaker is hurrying to inaugurate its factory by the end of the year.

In January, Danang Hi-Tech Park Management Board also granted an investment certificate to the US’ Hayward Quartz Technology to develop a semiconductor factory with the total investment capital of $110 million in the central city. Hayward Quartz Technology is based in Silicon Valley and a leading supplier supporting all major original equipment manufacturers in the semiconductor segment.

Covering an area of over 102,000 square metres, the Hayward factory is designed in two phases. The first has an area of more than 61,000sq.m with the investment capital of $66 million. The project is expected to begin construction in the second quarter of 2021 and be put into operation in the second quarter of 2023.

Also, Intel Corporation has invested a further $475 million in Intel Products Vietnam. This new investment comes in addition to $1 billion of funding to build a state-of-the-art chip assembly and test manufacturing facility in Saigon Hi-Tech Park, which was first announced in 2006.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Digital Transformation

- Dassault Systèmes and Nvidia to build platform powering virtual twins

- Sci-tech sector sees January revenue growth of 23 per cent

- Advanced semiconductor testing and packaging plant to become operational in 2027

- BIM and ISO 19650 seen as key to improving project efficiency

- Viettel starts construction of semiconductor chip production plant

Related Contents

Latest News

More News

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

Tag:

Tag:

Mobile Version

Mobile Version