Vietnam’s telecoms giants venture further into digital

State-owned MobiFone Corporation saw its parent company’s revenue of VND6.63 trillion ($288.26 million) in the first quarter, meeting 23.1 per cent of the yearly target and down 5.4 per cent on-year. Its pre-tax profit reached nearly was $36.7 million, meeting 38.9 per cent of the yearly target and down 27.2 per cent on-year.

|

| Vietnam’s telecoms giants venture further into digital, photo Le Toan |

MobiFone’s parent company state budget contribution also fell 42.6 per cent on-year to $24.04 million, fulfilling 26.3 per cent of the yearly target.

According to Minister of Information and Communications Nguyen Manh Hung, MobiFone is in a deadlock in terms of growth and new development space.

“There are two major problems occurred with MobiFone. The first is within the internal organisation and the second issue comes from external industry challenges,” he said. “Overcoming these two challenges, MobiFone will innovate both from the inside and from the outside. It should consider these two major problems as two important nudges to innovate, and to reinvent themselves.”

The minister made the statement when attending the corporation’s meeting to celebrate its 30-year anniversary on April 14.

The issues have driven back the company’s growth for a year. In 2022, the mobile network operator failed to meet the yearly targets, although it set lower targets than 2021.

The difficulties continue in the first months of 2023 with the poor performance. According to the Commission for the Management of State Capital at Enterprises (CMSC), MobiFone cut its pre-tax profit target for this year by half.

In a move to change the situation and tap into the digital transformation trend in 2023, MobiFone will implement a strategy to promote business in new fields such as digital finance, health, and education.

Strengthening cooperation at home and abroad is key to MobiFone’s strategy. For example, it attended the Mobile World Congress in Spain, signed a cooperation agreement with Nokia, and joined the China visit by the delegation of the CMSC.

Other big telecommunications businesses in Vietnam are in similar situations, growing below the country’s GDP growth.

Vietnam Posts and Telecommunications Group (VNPT) made consolidated revenue of $590.43 million in the first three months of the year, of which the parent company’s revenue reached $413.47 million, or 22.6 per cent of the yearly plan.

The group’s before-tax consolidated profit was estimated at $70 million during the period, of which the parent company’s pre-tax profit was $52.6 million, or 22.9 per cent of the plan, up 3.2 per cent on-year.

VNPT has embraced the digital age. It signed comprehensive cooperation agreements with a number of cities and provinces and cities, and promoting strategic cooperation with a number of private economic groups and local banks such as Vietinbank, Vietnam Airlines, and others.

The group has been deploying the digital government ecosystem for all provinces and cities as well as a digital health ecosystem for nearly 2,000 hospitals, and accessing and providing services via online channels for more than 50,000 small- and medium-sized enterprises.

VNPT also has a policy of converting invoices to electronic invoice from cash registers to meet the requirements of the Ministry of Finance and General Department of Taxation. It standardises mobile subscribers’ information in line with the National Population Database, according to the regulations of the Ministry of Information and Communications.

Similarly, Vietnamobile Telecommunications JSC saw first-quarter revenue of $6.57 million, down 69 per cent on the same period last year.

| Made by FPT digital platforms win Make in Vietnam Digital Award 2020 AkaBot and FPT.AI developed by FPT Group have won the “Make in Vietnam” Digital Award 2020 for excellent digital platforms and products announced at the national forum on the development of Vietnamese digital technology enterprises. |

| GIB Global Investment Digital Bank to bid for digital banking licence in Vietnam Leading Hong Kong-based investment bank GIB Global Investment Digital Bank announced intentions to enter the digital banking space in Vietnam by teaming up with Vimo and local payments providers. |

| Financial wellness and digital money management apps to ignite digital banking Financial wellness and digital money management apps are potential future sparks for igniting Vietnam’s race for digital dominance in the retail banking sector. |

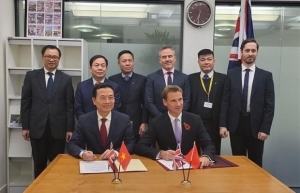

| Vietnam, UK enhance cooperation in digital economy, digital transformation Vietnamese Minister of Information and Communications Nguyen Manh Hung and the UK’s Parliamentary Under Secretary of State at the Department for Digital, Culture, Media and Sport Chris Philp signed a Letter of Intent on cooperation in digital economy and digital transformation on November 1 (London time). |

| BAV - MB Digital Hub: Top-notch digital banking experience for Banking Academy students Military Commercial Joint Stock Bank (MB) inaugurated and handed over the “Digital Hub” project at the Banking Academy of Vietnam (BAV) in November, a crucial part of MB Digital Hub's synchoronous ecosystem to offer tremendously favourable conditions for students experiencing first-class digital banking services. |

| NEU-MB Digital Hub aspires to facilitate digital banking experiences for students MB Bank and the National Economics University (NEU) jointly launched the NEU-MB Digital Hub on the morning of March 30. The fresh space seeks to equip NEU students with avantgarde digital banking services from MB. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Digital Transformation

- Dassault Systèmes and Nvidia to build platform powering virtual twins

- Sci-tech sector sees January revenue growth of 23 per cent

- Advanced semiconductor testing and packaging plant to become operational in 2027

- BIM and ISO 19650 seen as key to improving project efficiency

- Viettel starts construction of semiconductor chip production plant

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version