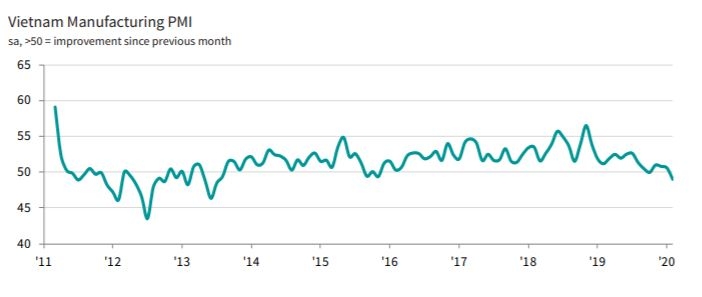

Vietnam manufacturing output slides at fastest rate since 2013: PMI

|

| Vietnam's PMI drops to a record low in February due to the impacts of the COVID-19 |

According to the latest Vietnam Manufacturing Purchasing Managers’ Index (PMI) survey, the coronavirus has severely impacted the Vietnamese manufacturing sector in February. Output contracted at the fastest pace for over six-and-a-half years, new orders fell for the first time since November 2015, and employee numbers dropped. Meanwhile, lower availability of Chinese goods put upward pressure on input prices and firms absorbed the additional costs amid an inability to increase output charges.

Looking forward, producers were optimistic of an upturn in output over the coming year, but the degree of positivity weakened. The PMI fell below the 50.0 no-change mark in February, signalling a deterioration in business conditions. The result represented the first decline for over four years. A key factor behind the deterioration in business conditions was a marked contraction in factory production during February. Panellists often noted that the COVID-19 had caused disruptions in output, which decreased at the quickest rate since June 2013. The virus also had a negative impact on demand in February.

|

| (Table 1) |

New orders fell for the first time since November 2015, which was partially driven by a reduction in new export sales. Some survey respondents mentioned weaker order flows from China when explaining the fall in international business. Softer demand conditions led manufacturing firms to cut their purchasing activity midway through the first quarter. The contraction was the first for over four years. The result was driven by declines in both the consumer and intermediate goods sub-sectors. Amid fears regarding the spread of coronavirus, employment in the Vietnamese manufacturing sector fell in February.

The decrease was the first for four months and the fastest for over six-and-a-half years. Investment goods were the only monitored sub-sector to register an increase in staff numbers. The coronavirus also adversely affected supply chains in the latest survey period. Vendor performance deteriorated to the greatest extent since June 2014. All three monitored sub-sectors saw slower delivery times. On the cost front, shortages of necessary inputs led to a rise in cost burdens during February. Some panellists mentioned difficulties in obtaining Chinese goods.

The rate of inflation was softer than that registered in January, however. Despite rising input costs, subdued demand led firms to cut average output prices. The decline was the first for three months and modest overall. Investment goods were the only monitored sub-sector to record higher charges. Finally, firms were optimistic towards the 12-month business outlook, supported by expectations for an improvement in demand. However, the degree of confidence weakened to the lowest in series history, dampened by fears of a prolonged impact from the COVID-19.

The Vietnam PMI is compiled by IHS Markit from responses to monthly questionnaires sent to purchasing managers in a panel of around 400 manufacturers. Cimigo market research have compiled the Vietnam PMI – manufacturing purchasing managers index since 2013.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version