Soft global demand hits trade value

|

| Soft global demand hits trade value, illustration photo/ Source: Shutterstock |

According to the General Statistics Office (GSO), in the first nine months of this year, the Vietnamese economy’s total import turnover hit nearly $238 billion, down 13.8 per cent as compared to the same period last year. In which, $85.12 billion was from Vietnamese enterprises, down 11.8 per cent, and $152.87 billion came from foreign businesses, down 14.9 per cent.

Production inputs are estimated to reach $223.08 billion in the first nine months of this year, accounting for 93.7 per cent of total imports but dropped significantly by 14 per cent from $259.16 billion in the corresponding period last year.

It is calculated that as much as 70 per cent of Vietnam’s needed material inputs for domestic production must be imported currently, and the remaining 30 per cent are locally produced because the country’s supporting industries remained weak.

|

For example, so far this year, imports of assorted machinery and equipment have been worth around $101.5 billion; imports of materials came in at $107.7 billion; and imports of consumption-oriented products stood at $14.9 billion.

“Stagnant manufacturing has resulted in a significant reduction of imports of production inputs,” said the Asian Development Bank (ADB).

In the first nine months of the year, the added value of the industrial sector increased 1.65 per cent on-year, in which that of the manufacturing and processing sector expanded 1.98 per cent.

“Greater efforts must be made to soon revitalise industrial production, including the manufacturing and processing sector,” Prime Minister Pham Minh Chinh noted at a government meeting with ministries and localities on the issue in Hanoi. “Exports have also witnessed a 9-month decline, so more solutions must be applied to boost exports.”

According to the GSO, Vietnam’s nine-month total export turnover is estimated to reach $259.67 billion, down 8.2 per cent on-year. In September, the figure sits at an estimated $31.41 billion, down 4.1 per cent against August.

“Slow recovery in the global economy pulled down exports and imports. High interest rates in the US and Europe slowed down the recovery and reduced demand from major trade partners,” the ADB commented.

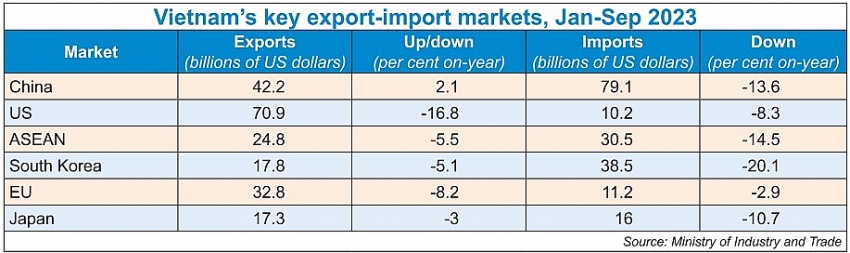

The declining demand was much more substantial in Vietnam’s key markets (see box). Export receipts in the period were down in many key items.

Specifically, shipments of mobile phones, computers, and electronic products, accounting for almost one-third of total exports, decreased by 15 per cent. Meanwhile, export of machinery and equipment, accounting for 12 per cent of total exports, fell by over 10 per cent.

According to the Ministry of Industry and Trade (MoIT), weak external demand, including from a subdued recovery in China, has hampered export-led manufacturing. The industrial production index narrowing down in the first nine months of 2023 has also resulted in increased closures of businesses.

On average, 15,000 firms closed monthly, and hundreds of thousands of workers were laid off. The growth of industry and construction in aggregate dropped to 2.41 per cent in the first nine months of 2023. Industry is forecast to grow at 7 per cent in 2023, and construction could pick up if major infrastructure projects can be implemented as planned, said the MoIT.

As imports declined faster than exports, the trade surplus widened, reaching $21.68 billion in the first nine months of this year – up far from only $6.9 billion in the corresponding period last year. Vietnamese firms have suffered from a trade deficit of $16.26 billion, and foreign businesses enjoyed a trade surplus of $37.94 billion, including crude oil exports.

“Weak global demand will dampen trade prospects for the rest of 2023 and 2024,” said the ADB. “Import and export growth are expected to return to a modest rate of 5 per cent this year and next year with the revival of external demand. Robust trade activity will help to maintain the current account balance in surplus this year, estimated at 3 per cent of GDP. As manufacturing activity is restored, pushing up imports for production inputs, the current account balance is projected to narrow to 2 per cent of GDP in 2024.”

Under a GSO Q3 survey on 50,000 manufacturing and processing businesses’ performance, more than 30 per cent of respondents said their performance in Q3 was better than in Q2.

| Vietnamese firms honoured at APEA 2023 Enterprise Asia is pleased to be honouring 65 remarkable business leaders and enterprises who have demonstrated unrivalled dedication to shaping a resurgent Asia at the Asia Pacific Enterprise Awards (APEA) 2023 on October 5. |

| Vietnam New Economy Forum 2023 attracts over 300 participants Over 300 representatives from international and domestic organisations and CEOs of Vietnamese enterprises participated in Vietnam New Economy Forum 2023 on October 6. |

| Vietnam leaps two places in Global Innovation Index in 2023 Vietnam has moved up two places in the Global Innovation Index (GII) in 2023, ranking 46th out of 132 countries and territories, according to a GII report released by the World Intellectual Property Organisation (WIPO). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version