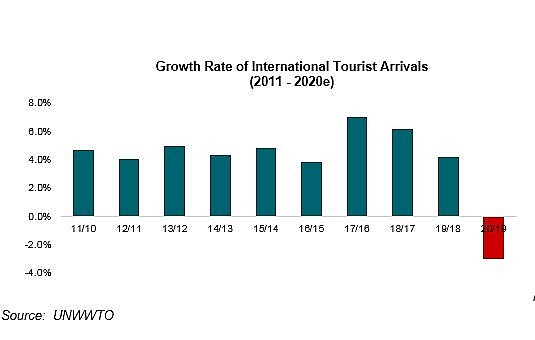

International arrivals drop after 10 consecutive years of growth due to COVID-19

|

| International tourists visiting Vietnam in the first days of COVID-19. Photo: Le Toan |

According to Mauro Gasparotti, director of Savills Hotels Asia-Pacific, following the evolution of the outbreak as well as corresponding controls and prevention measures, such as air traffic restrictions and country lockdowns, the decline is anticipated to be even greater than expected.

|

| This is the first time international arrival numbers are expected to drop after 10 consecutive years of growth |

“The initial drop in arrivals to Southeast Asian countries was primarily due to the high reliance on Chinese travellers, who were the first category to be impacted by the situation,” Gasparotti said.

The rapid spread of COVID-19 has caused significant damage to several industries worldwide, among which tourism is likely to be one of the hardest hit. The dramatic decline initially came from the drop in international travellers, starting with Chinese tourists and followed by a sharp decrease in local demand, which impacted hotels and restaurants, as well as meeting and event spaces.

On March 6, the United Nations World Tourism Organization (UNWTO) revised its 2020 prospects for international tourist arrivals to reflect a decline of 1 to 3 per cent, compared to the projected positive growth of 3 to 4 per cent before the outbreak.

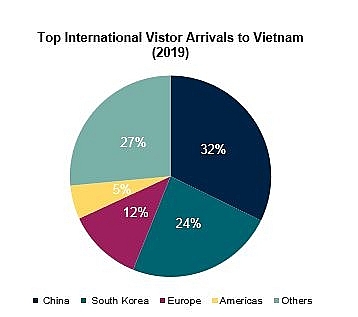

“Vietnam is facing the same situation, with China and Korea being the most significant tourism source markets, accounting for 56 per cent of international arrivals in Vietnam in 2019. In addition, in the past two weeks, the outbreak has worsened in Europe and the Americas, which together accounted for 17 per cent of tourist arrivals in Vietnam in 2019,” Gasparotti explained.

He added that the government has promptly restricted access for foreign visitors as a precautionary measure in order to contain the spread of the virus.

“This is a great help in minimising the exposure to potential sources of infection even if the entire tourism sector is impacted dramatically,” he commented.

|

| Vietnam is facing the same situation, with China and Korea representing the most significant tourism source markets, accounting for 56 per cent of international arrivals in Vietnam in 2019 |

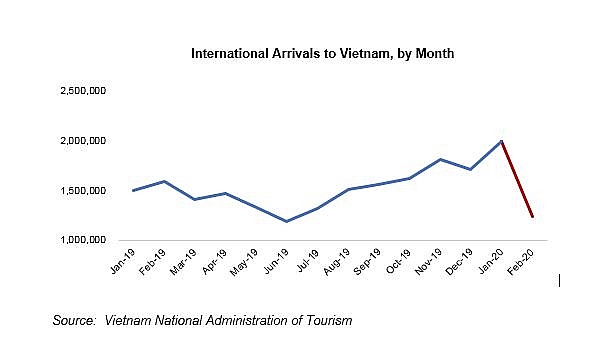

Vietnam, like everywhere else in the world, witnessed a significant reduction in tourist numbers during the first two months of the year.

Based on the latest report of the Vietnam National Administration of Tourism, the number of foreign visitors in February was down 37.7 per cent compared to the previous month and down 21.8 per cent over the same period in 2019. A further decline is expected in the coming months.

Gasparotti added that local demand has also been dramatically affected as many are now more hesitant to travel to airports, train and bus stations, or even restaurants and entertainment venues.

“Local demand largely depends on the ability of the Vietnamese government to contain the spread of the virus and ensure safety across the country. If the outbreak is well contained, local travellers will be the first category to recover,” he said.

|

According to STR, a global provider of data on hotel performance, all destinations across the Asia-Pacific reported significant drops in hotel occupancies in February compared to the same period in 2019 and Vietnam experienced one of the largest drops worldwide.

Gasparotti commented that based on recent data, Vietnam experienced an occupancy drop of approximately 26 per cent in February compared to the same period last year.

Central cities such as Ho Chi Minh City and Hanoi, despite the slowdown, were still able to manage their performance at an acceptable occupancy of 48 per cent in Ho Chi Minh City and even higher, at 60 per cent in Hanoi. However, due to the new ban on international travellers and rising concerns domestically, occupancy in the first three weeks of March dropped dramatically to a single digit in many destinations in Vietnam.

Among the coastal destinations, Danang and Hoi An are the most affected areas due to a strong reliance on foreign guests as well as a significant number of new hotel openings in 2019. Numerous properties have occupancy below 10 per cent and are considering temporary closures.

The situation is similar in Cam Ranh, albeit owing to Russian groups and local travellers, some properties in the area are still able to operate.

Phu Quoc’s occupancy was just below 40 per cent in February, an acceptable level, however, the upcoming suspension of new flights is likely to lead to a further large drop.

|

In March, the central cities received several cancellations, resulting in single-digit occupancy for Ho Chi Minh City and slightly higher levels for Hanoi as a result of existing corporate contracts with companies such as Samsung, providing some hotels with a stable base of business.

On a positive note, resorts that rely on local clientele and are reachable by car from large cities have been less affected and are still able to perform better than the market average.

Interestingly, by 21 March 2020, 145 hotels and resorts in Vietnam have voluntarily registered as quarantine areas for COVID-19, not only helping properties retain their operation during this period of low demand but also providing meaningful support to local authorities.

The Vietnamese hospitality industry has been affected and this will likely continue into the foreseeable future. However, whilst the expectation is that the entire year of 2020 will be impacted, as previously witnessed, at the first light of recovery, the hospitality industry is likely to see the fastest and strongest turnout when compared to other sectors.

Vietnam’s high reliance on local travellers (82.5 per cent of arrivals in 2019) and the Chinese and Korean markets could turn out to be an advantage, as these groups are expected to be some of the first who are able to travel again.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Manila becomes a new check-in destination for Vietnamese youth (December 11, 2025 | 18:07)

- Vietjet launches mega year-end ticket promotion (December 10, 2025 | 11:33)

- Dalat leads Vietnam’s 2025 search trends (December 09, 2025 | 13:44)

- Vietnam welcomes record wave of international visitors (December 09, 2025 | 13:43)

- Vietjet launches daily Manila flights to celebrate year-end festive peak season (December 05, 2025 | 13:47)

- The destinations powering Vietnam’s festive season travel demand (December 04, 2025 | 18:33)

- Vietnam named among the world’s most exciting winter destinations (December 04, 2025 | 15:10)

- Phu Tho emerges as northern Vietnam’s new tourism hub (December 01, 2025 | 17:00)

- Vietjet completes Airbus A320/A321 updates ahead of deadline (December 01, 2025 | 09:49)

- Vietjet resumes Con Dao flights from early December (November 28, 2025 | 15:24)

Tag:

Tag:

Mobile Version

Mobile Version