Bidiphar announces big plans for 2024

Pham Thi Thanh Huong, general director of Bidiphar, said that 2023 had been a positive year for the company in the context of economic uncertainties. Total pre-tax profit surpassed the annual target by 7 per cent, and although total revenue only reached 96 per cent of the yearly plan, it also rose 7 per cent from 2022.

|

| The Bidiphar shareholders meeting 2024 |

Last year, Bidiphar made its mark with the inauguration of a factory producing cancer drugs meeting GMP-EU standards, and started construction of a sterile drug factory with a total investment of VND840 billion ($35 million). Thanks to these impressive achievements, Bidiphar maintained its position in the top five most prestigious pharmaceutical enterprises in Vietnam.

For 2024, Bidiphar has set a charter capital target of VND936 billion ($39 million), an increase of 25 per cent; revenue of VND2 trillion ($83.33 million), an increase of 15 per cent; and a pre-tax profit of VND320 billion ($13.33 million). This year, in addition to continuing to invest in upgrading the factory and ongoing projects, Bidiphar will expand new investment in the OSD - Non Betalactam factory meeting EU-GMP/WHO-GMP standards with a total investment of VND870 billion ($36.25 million). The factory will produce non-betalactam solid oral medication with a capacity of 100 tonnes a year, and construction is expected to start in 2025 in Nhon Hoi Economic Zone.

The meeting also approved a plan to distribute profits in 2023 to shareholders in the form of shares at a rate of 25 per cent. After completing shares dividends, Bidiphar's charter capital will increase to about VND936 billion ($39 million).

Shareholders also approved a plan to issue shares under the selection scheme for employees. The number of shares issued will not exceed 1 per cent of the total number of shares outstanding at the time of issuance. These shares will be issued in 2025.

In addition, shareholders also adopted an offering of individual shares to investors with 23.3 million shares at the minimum offering price of VND50,000 ($2.08). This is expected to be carried out in 2024-2025. All proceeds from the issuance will be used to supplement capital for investment in the sterile medicine factory project and the OSD Non – Betalactam Factory in Nhon Hoi Economic Zone.

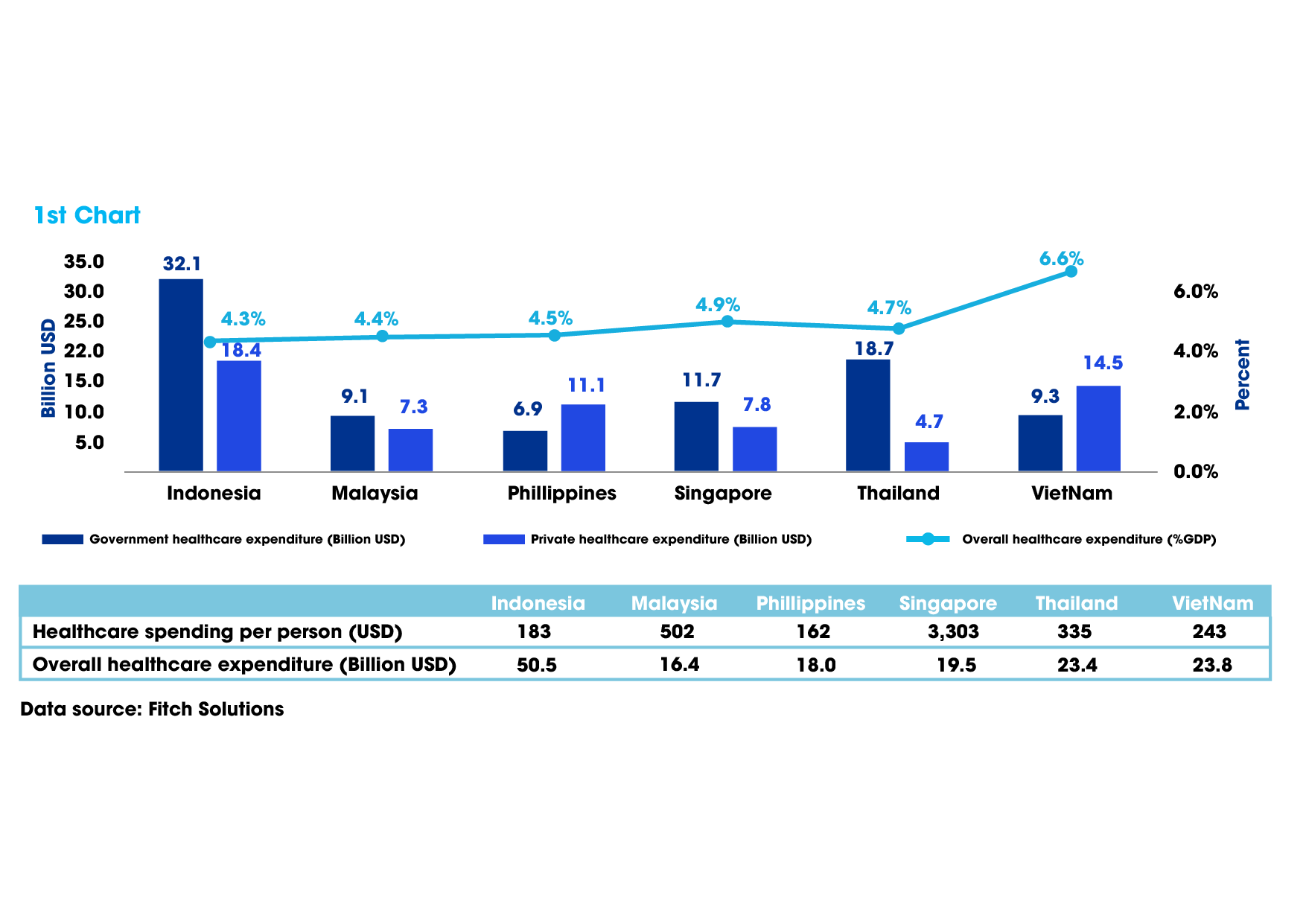

| Strong demand for high-quality drugs at reasonable prices As Vietnam experiences robust economic growth alongside a rapidly ageing population, the demand for pharmaceuticals and modern healthcare treatments has surged, with health expenditure in Vietnam witnessing an on-average growth rate of 11 per cent per year over the past decade. |

| Imexpharm set growth record in 2023 Imexpharm Corporation (Imexpharm or IMP.VN), a pioneer in Vietnam’s pharmaceutical industry, announced its business results on March 27, for the fiscal year ending December 31, 2023. |

| Outlook for pharmaceutical stocks in 2024 At a macro level in which there is still complexity, the pharmaceutical industry is expected to continue witnessing positive business results in 2024. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Healthcare Platform

- Hanoi intensifies airport monitoring amid Nipah disease risks

- Cosmetics rules set for overhaul under draft decree

- Policy obstacles being addressed in drug licensing and renewal

- Sanofi, Long Chau Pharmacy relaunch medicine blister pack collection initiative

- Takeda Vietnam awarded for ongoing support of Vietnam’s sustainability efforts

Related Contents

Latest News

More News

- The PAN Group acquires $56 million in after-tax profit in 2025 (February 03, 2026 | 13:06)

- Young entrepreneurs community to accelerate admin reform (February 03, 2026 | 13:04)

- Spring Fair 2026 launches national fair series (January 30, 2026 | 16:17)

- SnP celebrates 10th anniversary with new brand identity (January 30, 2026 | 14:41)

- Sci-tech sector sees January revenue growth of 23 per cent (January 30, 2026 | 11:20)

- Vietnam–Singapore partnership strengthens board leadership (January 30, 2026 | 11:02)

- DIGI-TEXX expands footprint with new hub in Ho Chi Minh City (January 30, 2026 | 09:04)

- Vietnamese spend $2.1 billion on food delivery apps in 2025 (January 29, 2026 | 15:14)

- Japan's NTT DATA signs agreement with CMC Global (January 29, 2026 | 15:03)

- Japfa Vietnam hosts annual customer conference (January 29, 2026 | 12:07)

Tag:

Tag:

Mobile Version

Mobile Version