Outlook for pharmaceutical stocks in 2024

Pharmaceutical industry's potential in volatile macro context

According to the Asian Development Outlook (ADO) Report published on April 11, the Asian Development Bank (ADB) said that Vietnam's economy is expected to grow 6 per cent in 2024 and 6.2 per cent in 2025 despite a challenging global environment. However, global geopolitical uncertainties and domestic economic structural constraints still have great impacts on this outlook.

Considered originally as a defensive group, the pharmaceutical industry in 2023 recorded positive business results despite many market fluctuations. At the start of 2024, while the macroeconomic context remains complicated, this industry is expected to make breakthroughs and contribute significantly to GDP growth.

The IQVIA organisation said that the Vietnamese pharmaceutical market is experiencing strong development, with a compound growth rate of about 10 per cent per year from 2020 to 2023. Growth rates rose dramatically during the outbreak of the pandemic, when people spent more on respiratory and immune product groups. Growth momentum slowed in 2023 when the pandemic ended. The scale of the entire pharmaceutical industry will reach $8.5 billion, an increase of 6 per cent compared to 2022.

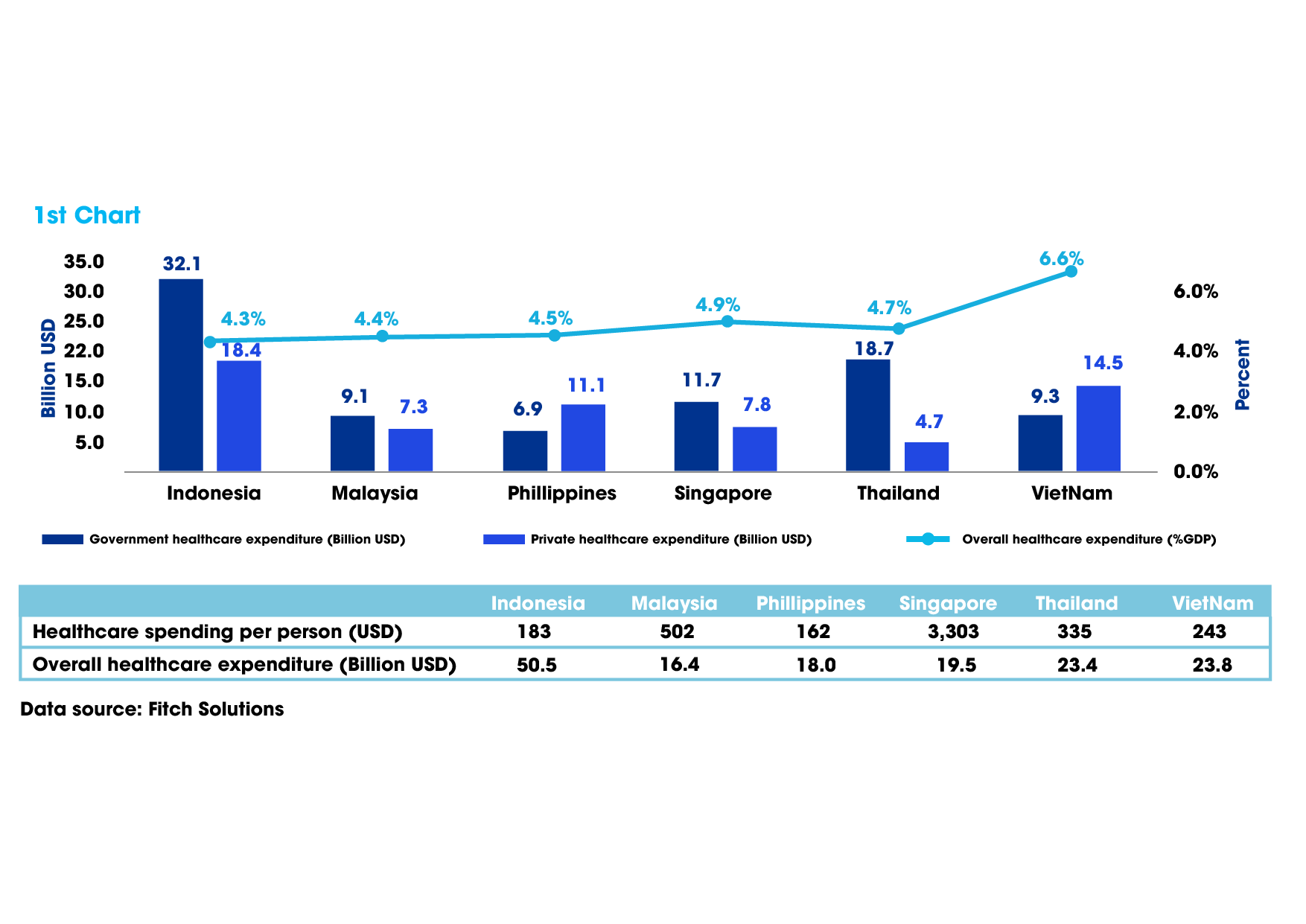

In addition, Vietnam has made remarkable achievements in domestic health insurance over the past two decades and is aiming for health insurance coverage with a participation rate of at least 95.15 per cent in 2025. With per capita healthcare costs expected to reach $402 by 2025, Vietnam is still less than the rates of regional countries, showing the growth potential of the pharmaceutical market.

|

Together with the goal of increasing health spending per citizen, pharmaceutical spending per capita in Vietnam reached $66 in 2021 and is expected to increase to $95 in 2025. A close relationship between the government and the medical/pharmaceutical industry will help narrow the gap between Vietnam and other ASEAN countries in pharmaceutical spending, realising the goal of increasing the domestic health insurance rate in Vietnam.

Main driving force behind industry breakthroughs

Although there are bright sides, the pharmaceutical industry also faces many challenges such as slow economic growth, supply chain disruptions during the pandemic, and huge costs for pharmaceutical research and development. Although Vietnam has more than 250 drug factories 228 of which meet WHO-GMP standards, there are only 16 companies that meet EU - GMP or PIC/S-GMP standards.

As a pioneer enterprise in the Vietnamese pharmaceutical industry, Imexpharm Pharmaceutical Joint Stock Company (Code: IMP) has continuously invested in production lines to improve production and business efficiency. Up to now, the company has three factory clusters meeting EU-GMP standards (IMP2, IMP3, IMP4) with 11 modern EU-GMP lines.

In addition, the IMP1 factory cluster stands out with the proportion of revenue in 2023, continuing to contribute the highest to the company's total revenue at 50 per cent. Meanwhile, the IMP3 factory contributes 32 per cent to total revenue by producing high-value injectable drugs, and IMP4, in its first year of operation, contributed VND80 billion ($3.15 million) to total revenue.

Focusing on investing in modern technology, Imexpharm is leading the market in the production and distribution of high-quality antibiotics. In 2023, according to VNReport, Imexpharm was also ranked in the top five prestigious Vietnamese pharmaceutical companies. In 2023, Imexpharm increased 11 more registration numbers for six products in Europe, including complex products such as Ampicillin/Sulbactam, bringing the total number of circulation licences in Europe to 27 for 11 types of products.

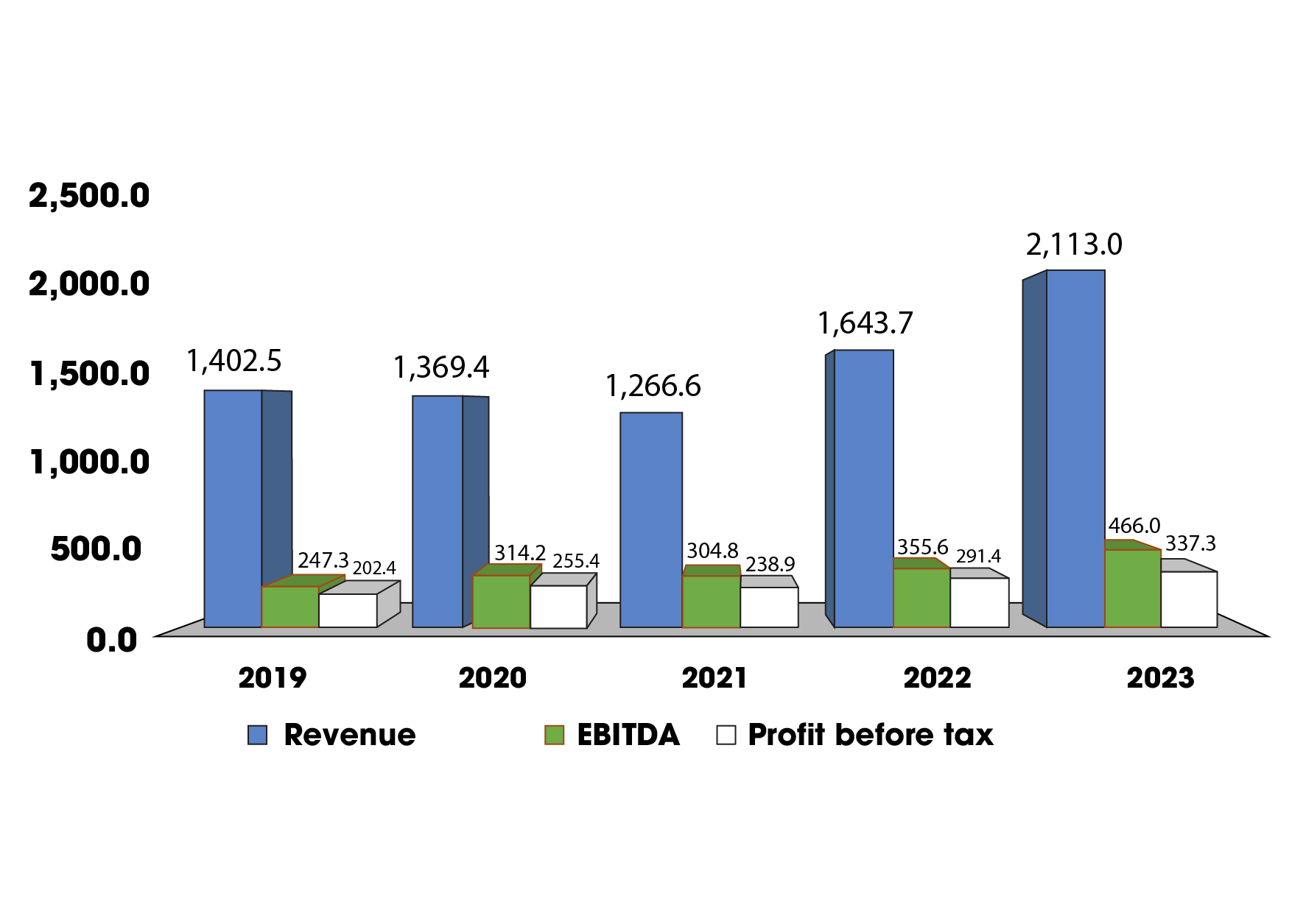

In the past five years (2019-2023), Imexpharm has maintained stable business results despite the complicated developments of the business environment. In 2023, net revenue reached VND1.99 trillion ($78.3 million), growing by 19 per cent compared to the overall industry growth of about 8 per cent. At the same time, pre-tax profit reached VND377.3 billion ($14.8 million), up 30 per cent and exceeding the plan by 8 per cent. Both revenue and profit achieved their highest growth rates ever.

|

| Imexpharm's business results in the 2019–2023 period (Unit: billion VND) |

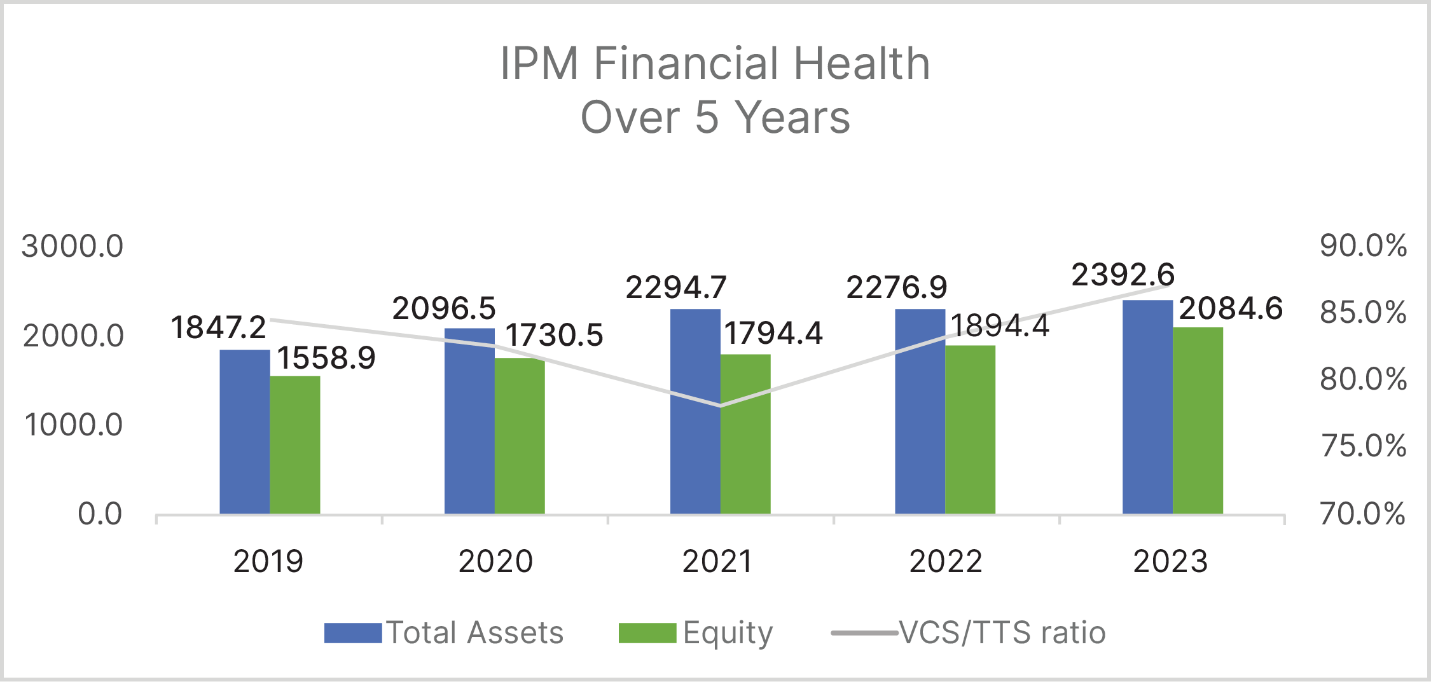

At the same time, the compound annual growth rate (CAGR) of pre-tax profit and after-tax profit in the 2019-2023 period was 13.6 per cent and 16.5 per cent, respectively. The CAGR of EBITDA over the past five years reached 17.5 per cent, while the CAGR of equity reached 7.5 per cent and the CAGR of total assets reached 6.7 per cent over the same period.

Besides maintaining high business results, Imexpharm's financial situation is also a bright spot, with the ratio of equity to total assets much higher than the average level of the pharmaceutical industry.

|

| Imexpharm's financial situation in the period 2019-2023 (Unit: Billion VND) |

High business efficiency and internal motivations are helping Imexpharm gain more confidence to reach its target of 24 per cent total revenue and 19 per cent net revenue increases in 2024. Particularly, with the participation of major shareholder SK Investment Vina III Pte Ltd, Imexpharm expects to receive significant support in management activities, research and development, and technology transfer, thereby perfecting the product lines of infusions and pills.

The EBITDA margin is expected to remain stable at 23 per cent. This will also allow Imexpharm to maintain the payment of abundant dividends of 20 per cent of charter capital in the next two years, including 10 per cent in cash and 10 per cent in shares.

It can be seen that the pharmaceutical industry in general and Imexpharm in particular have a lot of motivation to make a breakthrough in the future. Reports from securities companies say that owning a factory with EU-GMP standards is expected to bring great advantages to businesses in Vietnam.

Clearing up the industry's legal issues will also be an important catalyst for businesses' results. In addition, according to experts, investors should buy stocks in companies with a history of paying regular dividends, investing in modern technology, and researching new products.

| Imexpharm forges partnership with Genuone Sciences On February 23, Imexpharm JSC (IMP) officially announced the signing of a strategic cooperation agreement with Genuone Sciences Inc., one of the leading pharmaceutical companies from South Korea. |

| Imexpharm joins Vietnam's campaign to plant one billion trees Imexpharm Pharmaceutical JSC (IMP) teamed up with Nha Trang People's Committee to plant 500 trees along Ring Road 2 on March 18. |

| Imexpharm set growth record in 2023 Imexpharm Corporation (Imexpharm or IMP.VN), a pioneer in Vietnam’s pharmaceutical industry, announced its business results on March 27, for the fiscal year ending December 31, 2023. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version