AI can reshape Vietnam’s payment landscape

|

| Generative AI will lead to a transformational shift for businesses and consumers, creating a more seamless shopping and payment experience |

Visa's Vietnam Client Forum that was held in Hoi An from November 29 to 30 highlighted generative AI and embedded finance as the key payment trends in Vietnam.

Vietnam is in an excellent position to utilise AI to enhance the payment experience for both consumers and businesses, due to its status as the fastest-growing digital economy in Southeast Asia for the second year running. The country's digital economy is expected to continue growing at a compound annual growth rate of 20 per cent.

Generative AI is currently revolutionising numerous industries, including financial services, healthcare, and education. By improving services and productivity, it is transforming business growth strategies. This technology is also set to power many consumer experiences, such as embedded finance.

Embedded finance, which involves integrating payment options into non-financial platforms, is becoming an everyday part of Vietnamese consumers' lives. Whether booking a ride-share service or ordering takeaway food from an app, consumers are benefiting from more seamless customer journeys. Businesses can leverage embedded finance technology to develop integrated solution offerings, simplifying the payment process for merchants.

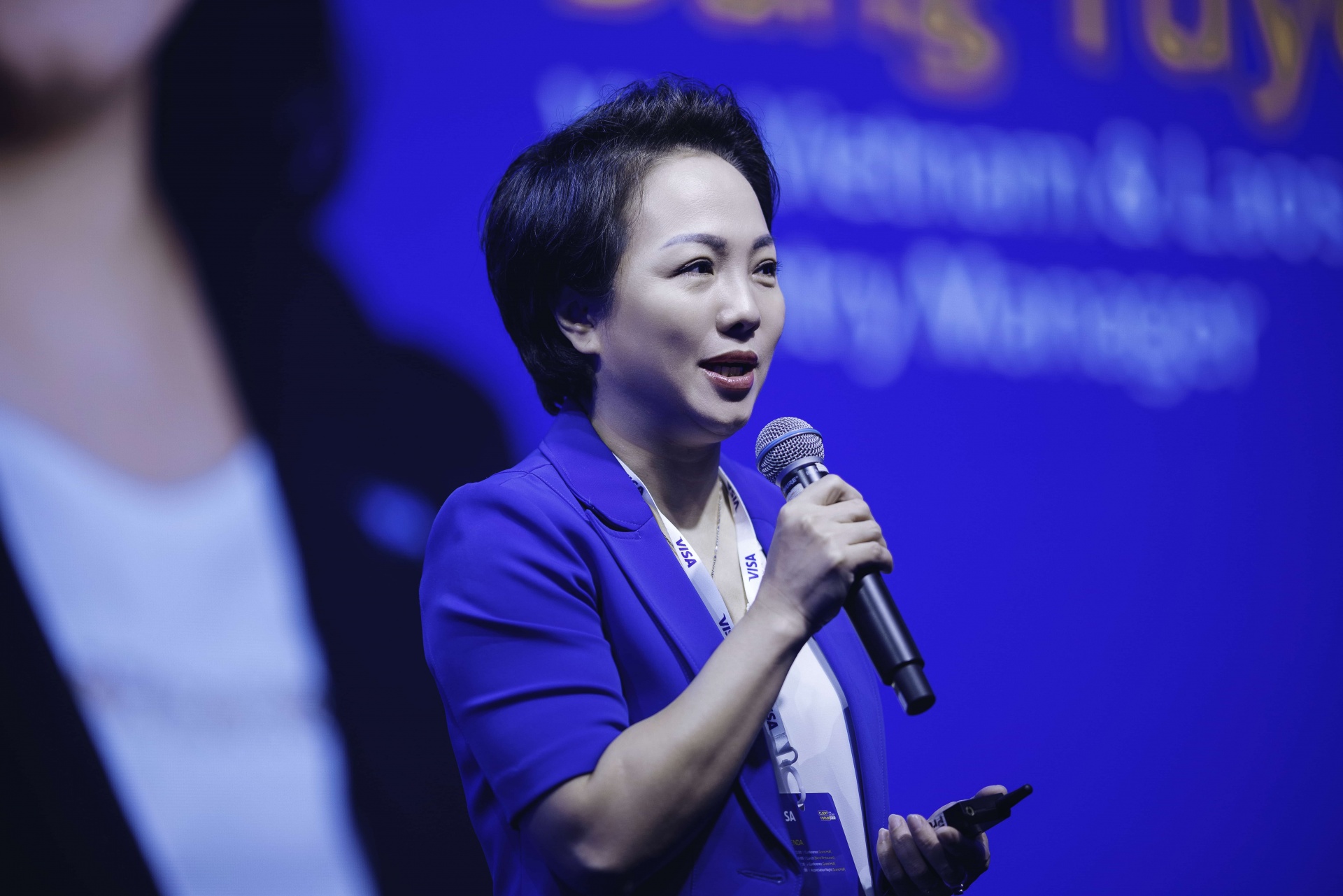

“At Visa, we recognise the tremendous potential of AI and embedded finance,” said Dung Dang, Visa country manager for Vietnam and Laos.

“We are working with our partners to facilitate increasingly frictionless and secure digital payments in Vietnam. As a trusted brand working with players in the payment ecosystem, Visa is well positioned to shape this space and innovate for the future,” added Dang.

|

Visa has been at the forefront of using AI for fraud and payment risk protection for over 30 years. It was the first network to deploy AI-based technology for risk and fraud management, pioneering the use of AI models for payment security. Visa Consulting & Analytics recently launched its new AI Advisory Practice, built to focus on empowering its clients with actionable insights and recommendations to harness the potential of AI, including generative versions.

“The AI revolution is here, and the payments sector is at the forefront of this transformation,” said Manideep Gupta, vice president of Visa Consulting & Analytics in Asia-Pacific.

“With the new AI Advisory practice, Visa is helping clients grow and redefining how they serve their customers through acquisition and engagement,” Gupta continued.

In the financial services industry, banks and financial institutions can navigate the competitive market landscape by using AI to acquire more customers, enhance customer engagement, and optimise operational excellence. AI facilitates quicker credit assessments for consumers and businesses, which is critical in enabling simpler and more reliable underwriting and collections.

The technology can also expedite fraud detection and protection, improve dispute management processes, and automate financial advisory services. This leads to a better user experience and allows the provision of intelligent financial services, such as hyper-personalised recommendations and offers.

Visa’s updated Security Roadmap for Vietnam, launched in April, provides the framework for securing the payment ecosystem in the country through collaborations with various partners. Visa uses AI and data-driven solutions to safeguard both online and physical transactions from potential threats. In October, Visa announced a US$100 million initiative to invest in companies that are focused on generative AI.

| Visa launches account updater to streamline payment experiences Visa has announced the expansion of Real Time Visa Account Updater (VAU) to selected markets in Asia Pacific, streamlining the payment experience for merchants and customers by providing cardholders with a single credential for life. |

| Visa accelerates support for smaller businesses On November 20, Visa and the Visa Foundation made announcements on their ongoing commitment to support small and micro-sized businesses across APEC and beyond. |

| Visa sponsors Base SaaS Day 2023 Visa, a world leader in digital payments, has become a strategic partner and sponsor of Base SaaS Day 2023, organised and hosted by Base, a leading Vietnamese business management platform. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- VIB hits $267.4 million in pre-tax profit over first nine months (October 29, 2025 | 12:12)

Tag:

Tag:

Mobile Version

Mobile Version