VIB hits $267.4 million in pre-tax profit over first nine months

Credit and deposit growth reached 15 per cent and 11 per cent respectively. Asset quality continues to improve, with risk management remaining strong and at an optimal level.

As of September 30, VIB ’s total assets had reached over VND543 billion ($20.6 billion), up 10 per cent compared to the beginning of the year. Outstanding credit was nearly VND373 trillion ($14.2 billion), an increase of 15 per cent year-to-date, with reached balanced contributions from the bank's three main business segments: retail banking, corporate banking, and institutional banking.

In retail banking, VIB continues to selectively expand lending, focusing on core products such as home loans, auto loans, business loans, and credit cards, targeting high-quality customers with well-secured and fully compliant assets. In the corporate and institutional banking segments, VIB has accelerated growth in working capital loans, production and business loans, and project financing for reputable enterprises with strong financial capacity and sustainable growth potential.

Customer deposits recorded growth of more than 11 per cent, reaching nearly VND308 trillion ($11.7 billion). Current account savings account (CASA) balances and Super Interest accounts rose by 39 per cent compared to the beginning of the year, reflecting the effectiveness of VIB's strategy to optimise idle funds. In the third quarter of 2025, VIB launched a combined solution integrating the Super Account and the Smart Card cash-back payment card under the theme “Leading the Profitability Trend”.

This represents an innovative step in cash flow management, enabling customers to maximise the value of both their idle funds and daily spending, with a combined benefit of up to 9.3 per cent. This “Smart Duo” marks a major milestone in transforming Vietnamese consumer mindsets on how to fully leverage the earning potential of every unit of capital.

|

Asset quality continued to show significant improvement in the third quarter, with the nonperforming loan ratio declining to 2.45 per cent, down 0.23 percentage points compared to the end of the first quarter. This reflects the effectiveness of VIB's prudent credit policies and its focus on high-quality customers. VIB's loan portfolio remains well-balanced, with over 73 per cent of total outstanding loans in the retail and small- and medium-sized enterprise segments.

Of these, more than 90 per cent of retail loans are secured by fully legal real estate assets, mainly located in major urban areas. Meanwhile, 27 per cent of the credit portfolio is allocated to the corporate and institutional banking segments, focusing mainly on leading enterprises across sectors, including foreign-invested firms, state-owned enterprises, and top private companies.

In the third quarter, the bank issued a 14 per cent stock dividend and completed a total dividend payment of 21 per cent in cash and shares, as approved at the 2025 AGM. Key safety and risk management indicators remain at optimal levels. The Capital Adequacy Ratio under Basel II reached 12.4 per cent (regulation: above 8 per cent); the Loan-to-Deposit Ratio stood at 79 per cent (regulation: below 85 per cent); the ratio of short-term funding used for medium- and long-term loans was 27 per cent (regulation: below 30 per cent); and the Net Stable Funding Ratio under Basel III reached 107 per cent (Basel III standard: above 100 per cent).

Nine-month profit up 7 per cent, driving revenue diversification

At the end of the first nine months of 2025, VIB recorded total operating income of over VND14.7 trillion ($558.3 million) and pre-tax profit exceeding VND7.04 trillion ($267.4 million), up 7 per cent on-year. Net interest income reached nearly VND11.9 trillion ($451.9 million), continuing to be the main contributor as the bank expanded lending across all customer segments with competitive interest rates, focusing on high-quality clients with well-secured assets. In line with the government's directive to support credit access, VIB maintains lending rates at reasonable levels, contributing to economic recovery. The net interest margin stood at 3.2 per cent, ensuring a balance between profitability and asset quality.

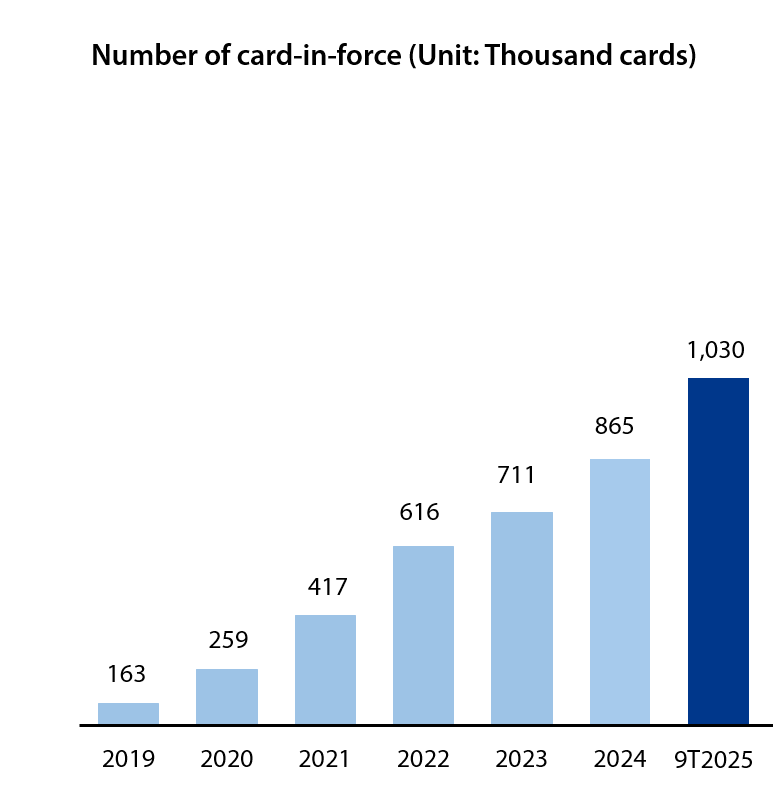

Non-interest income made a strong contribution, accounting for over 19 per cent of total operating income, mainly driven by fees and service activities. As of September 30, VIB's credit cards in circulation had surpassed one million, with total spending in the first nine months reaching over VND104 trillion ($3.95 billion), up 15 per cent on-year. In addition, newly launched digital banking services – such as bill payments, international transfers, tuition, and insurance payments – together with tailored solution packages and services for corporate clients, also contributed significantly to the bank's fee and service income.

|

| Chart: Number of card-in-force at VIB from 2019 to 9M25 |

Operating expenses totalled approximately VND5.46 trillion ($207.4 million), remaining largely unchanged on-year thanks to the coordinated implementation of process optimisation measures and effective cost management. Meanwhile, credit risk provisioning in the first nine months declined by 31 per cent compared to the same period last year, reflecting the prudent provisioning set aside in previous quarters and the improved quality of the bank's assets.

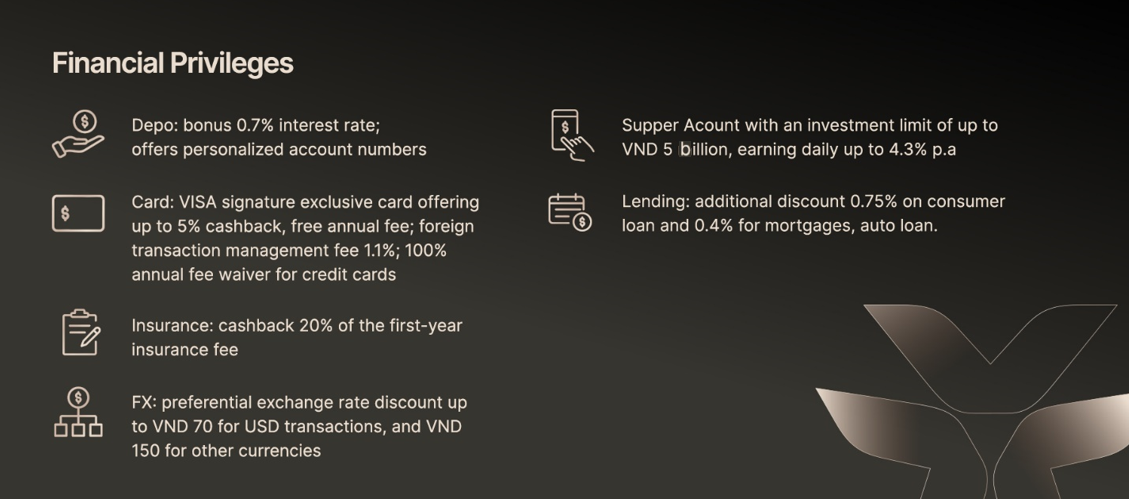

In response to the trend of customers seeking comprehensive financial solutions rather than standalone products, VIB officially launched Privilege Banking – a priority customer service programme, marking a new milestone in its journey of supporting clients in creating, building, and growing their wealth.

With the positioning “Value is measured not only by assets but by experience”, Privilege Banking introduces a comprehensive privileged ecosystem, combining financial benefits, lifestyle perks, and premium services, reaffirming VIB's emerging position in Vietnam's priority banking segment.

|

Also in the third quarter, VIB was honoured by the international card organisation Visa with three prizes at the 2025 Visa Vietnam Customer Conference. These awards recognised VIB's outstanding efforts in technological innovation, transaction volume growth, and corporate card development.

The three award categories were: Digital Pioneer – Leading the deployment of new digital solutions in Vietnam with the PayFlex feature; Payment Volume Growth – Exceptional growth in card transaction volume, achieving a 100 per cent increase; and Supply Chain Payment & Commercial Card Innovation 2025 – Pioneering in supply chain payments and corporate card innovation with the VIB Business Card.

The positive results in the first nine months of the year further affirm VIB's sound strategic direction in enhancing operational efficiency, managing risks, and accelerating digitalisation. With a solid financial foundation, high-quality credit portfolio, and an increasingly comprehensive digital ecosystem, VIB is well-positioned to accelerate in the fourth quarter, aiming to achieve its 2025 targets and continue delivering sustainable value to customers, shareholders, and the Vietnamese economy.

| VIB launches market-leading high cashback international debit card suite VIB has launched a suite of debit cards offering up to 5 per cent cashback with no minimum spending requirement. |

| VIB marks 29 years of innovation for millions of customers VIB celebrated its 29th anniversary on September 18, marking a journey of aspirations to create smart financial solutions with a deep understanding of customer needs, and improving the financial experience for Vietnamese users. |

| VIB unveils Smart Duo to maximize savings and spending returns VIB has introduced Smart Duo, a combined savings and spending solution designed to maximize returns on idle cash and daily expenses. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- UOB Vietnam elevates retail banking experience with enhanced credit card suite (October 24, 2025 | 09:50)

Tag:

Tag:

Mobile Version

Mobile Version