VinMart closes numerous stores to reach break even point sooner

|

| Masan to close numerous VinMart stores |

Last week, Masan occupied a conference with retail analysts on the potential of retail development after merging with Vincommerce. Accordingly, Masan Group will create a new legal entity this year, which is going to hold 83.74 per cent of VCM Services and Trading Development JSC (VCM) and 85.7 per cent of Masan Consumer Holdings.

Masan Group, parent company is holding 70 per cent of VCM, and the remaining belongs to Vingroup, and other investors, while the Government of Singapore Investment Corporation (GIC Private Limited) maintains their 16.26 per cent of VCM, which are taking the whole share of VinCommerce, owner of retail chain VinMart, VinMart+, and VinEco.

Masan has made a decision that VinCommerce, VinEco, and Masan Consumer would be separate companies, as well as support each other to raise their competitiveness in the retail market. VCM will be a partner of Masan Consumer, and Masan Consumer will be a vendor of this retailer.

Masan confirmed that the partnership with Vingroup would benefit both sides. Vingroup is a leader in the real estate and retail sectors, while Masan is the leading consumer goods producer with a great deal of experience in brand development and a pioneer in the fresh meat segment.

|

Optimising VinMart's operation

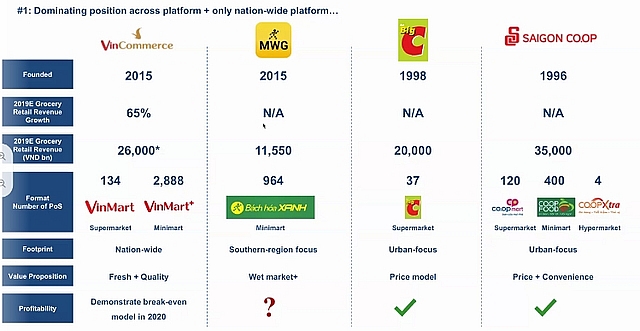

At present, VinCommerce operates 3,022 VinMart and VinMart+ supermarkets, with annual revenue growth at 65 per cent (last year). It is forecast to turn profit and reach the break even point in 2020.

A report of Masan showed that despite being established at the same time as Bach hoa Xanh of Thegioididong (Mobile World Investment Corporation), VinCommerce's revenue last year was VND26 trillion ($1.13 billion), twice as much as Bach hoa Xanh, but far below the VND35 trillion ($1.52 billion) of Saigon Co.op.

However, VinMart's monthly sales revenue per square metre in Hanoi last year was VND6.2 million ($269.57), an increase of 9 per cent compared, while it is VND8 million ($347.82) for VinMart+, doubling the performance of competition. Thus, this chain has been leading the capital's retail sector.

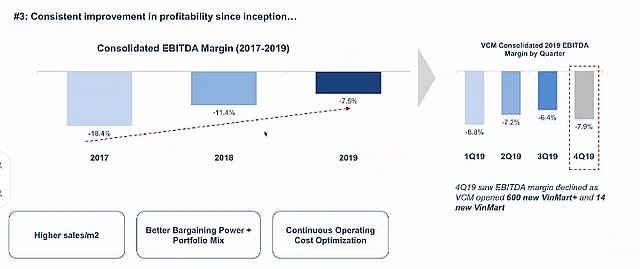

During the last year, the number of VinMart+ shops in provinces rose 2.5 times on-year, while big supermarket VinMart increased slowly. Particularly, in the fourth quarter of last year, as many as 600 VinMart+ stores and 14 VinMart supermarkets were launched, boosting the revenue of VinMart+ by 93 per cent and VinMart by 44 per cent.

Despite not turning profit yet, the profit margin of VinMart+ has improved remarkably over the last three years. This year, VinMart concentrates on improving its performance instead of massive expansion, and will close stores that are performing poorly. Additionally, it will open 10-30 VinMart supermarkets and 100-300 VinMart+ stores in Vincom trade centres of Tier 2 cities.

|

MeatDeli to capture 50 per cent market share in VinMart

Masan will raise the market share of its fresh meat in VinMart and VinMart+ from 30 per cent to 50 per cent this year and beyond, and VinEco's vegetables will rise to 40 per cent. Therefore, the sales of VinEco will triple this year from VND1.2 trillion ($52.17 million) to 3.2 trillion ($139.1 million), and that of MeatDeli to VND2.2 trillion ($95.6 million).

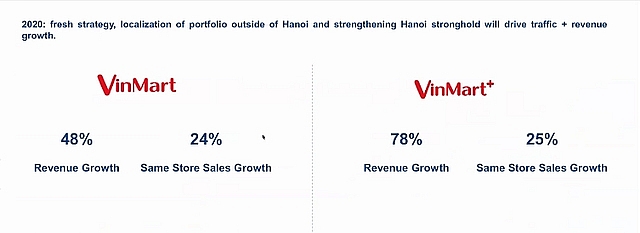

Masan set VinMart's revenue growth target at 48 per cent, and will increase the number of stores by 24 per cent, while the figures for VinMart+ are 78 and 25 per cent.

The total revenue of VinCommerce will reach VND42 trillion ($1.82 billion), up 61.5 per cent compared to last year, including VND17 trillion ($0.74 billion) generated by VinMart and VND25 trillion ($1.08 billion) by VinMart+. It is expected to reduce losses to 3 per cent of revenue only or break even wthis year, and Masan will pour around $15 million into improving its technology platform and digitalise management process.

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version