VIB launches market-leading high cashback international debit card suite

|

This marks a new turning point in the card market, transforming the debit card – once primarily associated with cash withdrawals or basic transactions – into a smart spending tool that helps customers optimise benefits directly from their current accounts and through every daily transaction.

Tuong Nguyen, deputy CEO of VIB, shared, "Consumers today are shifting towards a new spending trend, balancing lifestyle and experiences with effective personal financial management to achieve greater goals. The launch of this debit card suite further affirms VIB's strategy of leading card trends. Going beyond basic payment functions, VIB's debit card lines offer outstanding cashback value, a wide range of options tailored to different customer segments, and easy accessibility. By maximising benefits for customers right on their own current accounts, we aim to pioneer the new consumer spending trend."

Elevating the payment card experience

While the market is heavily focused on credit cards or QR code payments, debit cards receive relatively little attention and are often limited to cash management and ATM withdrawals, resulting in limited customer options in this segment. With the vision of "Leading card trends", VIB not only strengthens its position in the credit card sector but also elevates the debit card segment by launching a completely new suite of products that cater to the diverse needs of all customer segments.

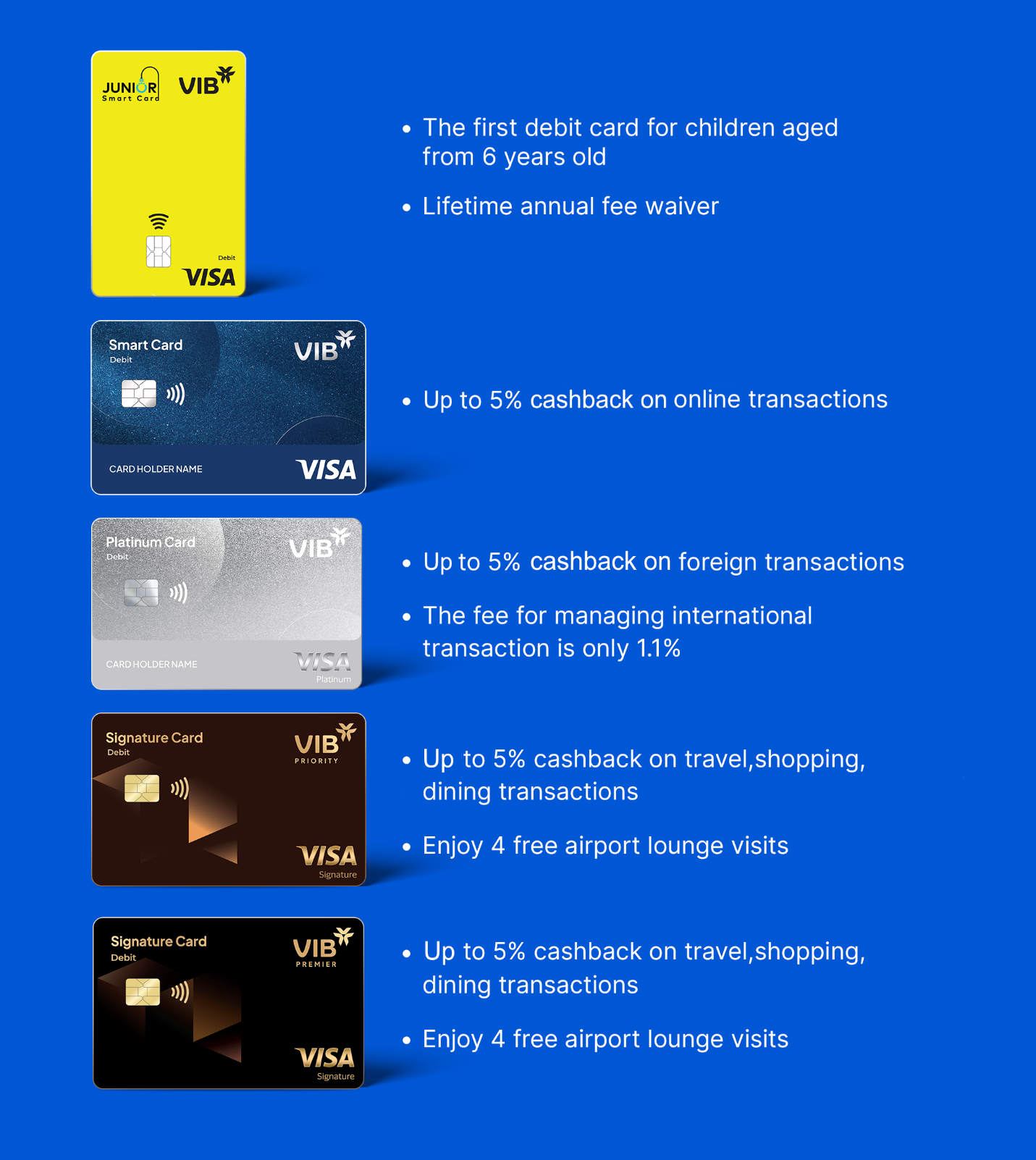

Smart Card – offers up to 5 per cent cashback on online shopping, along with the privilege of issuing unlimited supplementary cards linked to various payment platforms.

Junior Smart Card – the first debit card in the market that allows children from the age of six to own a card.

Platinum Card – provides up to 5 per cent cashback on international transactions, plus two complimentary airport lounge visits, with unlimited additional visits based on spending volume.

Premier Signature and Priority Signature Cards – premium cards designed for priority banking customers, offering exceptional privileges including up to 5 per cent cashback on dining, travel, and shopping, four complimentary airport lounge visits per year, and unlimited additional visits based on spending volume.

Each card line is tailored to specific spending needs and lifestyle preferences across different customer segments, helping users optimise benefits directly from their current accounts, without requiring income verification or complicated registration procedures.

|

Exclusive privileges with VIB debit cards

With five distinct card lines, VIB's debit card suite serves as a modern spending solution for all customer segments, from children and active young users to affluent clients, offering a host of breakthrough advantages.

Credit card-equivalent privileges: Market-leading cashback of up to 5 per cent, complimentary airport lounge access, and other premium benefits, all without the need for income verification or credit approval.

Competitive and flexible cashback mechanism: While many debit cards on the market require a minimum spending threshold to unlock rewards for future transactions, VIB's new debit cards tie cashback benefits directly to the customer's current account balance. The higher the balance, the higher the cashback rate – up to 5 per cent. Every transaction, no matter how small, qualifies for cashback, with earnings of up to VND900,000 ($34.1) per month (equivalent to VND10.8 million ($409.22) per year), delivering real, daily financial value.

Synergistic privileges: Through an integrated spending management model, customers can easily combine benefits from various VIB products and services, For example, pairing with the Super Account, which generates returns of up to 4.3 per cent per annum even for one-day deposits, effectively transforming the current account into a dual-benefit financial centre.

Advanced payment technology integration: All VIB debit cards are equipped with cutting-edge payment technologies, allowing users to make seamless contactless transactions via Apple Pay, Google Wallet, Samsung Pay, Garmin, or fast QR code payments.

The missing piece completing VIB's personalised financial ecosystem

The launch of the new debit card suite is not merely the introduction of another convenient product, but rather a crucial component in VIB's personalised financial ecosystem. It enables customers to maximise their benefits by leveraging a unified ecosystem, instead of relying solely on individual accounts or standalone cards.

For younger customers who have yet to meet credit card eligibility criteria – or those who currently have no need for a credit card – the debit card serves as an ideal entry point to the VIB ecosystem. It offers market-leading cashback benefits with no minimum spending requirement, and is highly versatile thanks to its compatibility with popular e-wallets and international payment gateways, something QR code payments cannot provide.

For existing payment cardholders, VIB offers upgrade programmes and the opportunity to open a credit card, giving customers the added flexibility of “spend now, pay later” with interest-free periods of up to 55–57 days, as well as the option to convert large transactions into instalment payments directly on the card.

|

By flexibly combining debit cards with credit cards, the Super Account, and other financial products such as Super Cash, a 100 per cent online unsecured personal loan of up to VND1 billion ($37,892), customers can easily balance spending, manage cash flow intelligently, and fully leverage the exclusive privileges offered within VIB's financial ecosystem.

With a fully digital card issuance process available via the MyVIB or Max Powered by VIB digital banking apps, customers can obtain a virtual card and start spending within just five minutes of registration.

To celebrate the launch, VIB is rolling out an attractive promotion: first-year annual fee wafted for all new customers meeting a minimum spending of just VND1 million ($37.89), along with an opportunity to open a complimentary VIB Cashback credit card, doubling the benefits for users.

Open your card now to experience and enjoy these exclusive offers.

| VIB sees strong first half performance with profit exceeding $190 million Vietnam International Bank (VIB) continues to show steady momentum in 2025, driven by strong credit growth and a focus on asset quality. |

| VIB sets new benchmark with one million credit cards Vietnam International Bank (VIB) has achieved the milestone of one million credit cards, strengthening the market leading position and setting new industry benchmarks. |

| iDepo VIB offers attractive interest rates and flexible transferability VIB has updated its iDepo account service, a smart accumulation solution for short-term deposit needs, offering interest rates up to 6.2 per cent and a feature that preserves accumulated interest when early withdrawal is required. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- VIB hits $267.4 million in pre-tax profit over first nine months (October 29, 2025 | 12:12)

Tag:

Tag:

Mobile Version

Mobile Version