Prudential Vietnam and VIB enter bancassurance partnership

This partnership marks an important milestone in the bilateral cooperation, helping to set new standards for Vietnam’s bancassurance industry with outstanding changes.

Accordingly, this is the first bancassurance cooperation agreement that ensures the quality of consulting service and insurance contract service by setting a minimum ‘Persistency rate’ and gradually increasing to the ideal level.

This is the first bancassurance cooperation agreement with the establishment of a ‘Joint Customer Conduct Committee’ that will help to strengthen control over business activities, manage, monitor and take timely actions related to issues of standards of conduct with customers.

|

This is also the first bancassurance cooperation agreement with arranged proportion of distribution of product portfolios and customers.

Phuong Tien Minh, CEO of Prudential Vietnam said, “The Life Insurance market in Vietnam is still young with nearly 25 years of development, in which, bancassurance channel has only recorded strong growth from 2016 until now. This strong growth has allowed us to see the potential opportunities for improvement in product, service, and sales quality.

“We are proud to have a partner with the same vision as VIB. The extension until 2036 is not only a testament of our excellent relationship, but also a pioneering movement in bringing the local bancassurance industry to the next level, focusing on providing the best solutions to the right customer segments to achieve sustainable growth for both parties."

CEO of Vietnam International Bank (VIB) Han Ngoc Vu said, “With the vision of becoming the most innovative and customer-oriented bank in Vietnam, VIB has given top priority to offering comprehensive financial solutions to meet the increasing requirements of the Vietnamese people. In which, an important orientation is to provide customers with options in both hedging and ensuring a long-term and sustainable financial plan.”

“Distributing Prudential insurance products through banks is one of the options that we offer to our customers. A large international corporation with a leading reputation, Prudential is also a model enterprise that has a strong commitment to the Vietnamese market, leveraging good insurance products, transparent policies and processes and professional mechanisms' coordination.”

Vu said enhancing strategic cooperation with Prudential demonstrated the commitment of the two sides towards the sustainable development of the insurance market and opening up opportunities so that VIB could better serve customers, expand the retail business and affirm its goal of becoming a top retail bank.

Since its establishment, Vietnam's insurance industry has made positive contributions to the realisation of the country's socioeconomic development goals.

By the end of April 2023, the insurance businesses have invested back into the economy with an estimated amount of $30.8 billion. The insurance industry is expected to reach a scale of about 3 per cent of GDP by 2025.

In 2022, the entire life insurance industry already paid claims surpassing $1.82 billion, of which Prudential accounted for 25 per cent of total payments with nearly $417.3 million.

More than $69.5 million was paid for more than 150,000 cases with death benefit, total and permanent disability, critical illness and medical care, which increased 35 per cent compared to 2021.

From Prudential’s bancassurance channel alone, the number of claim cases and the claim pay-outs for customers rose 64 per cent and 69 per cent respectively compared to 2021, showing the protection needs of customers through banking is increasing every day.

When implementing the bancassurance model, VIB has focused on ensuring the capacities of consultants and supervising the quality of their consultations through specific processes and regulations based on guaranteeing the general principles.

To promptly answer customer inquiries and improve the quality of consultations, the bank has also extensively expedited after-sales activities such as making random calls, updating financial milestones and others.

From January 1, 2023, the two companies have coordinated to deploy calls from the insurance switchboard to all new bancassurance customers to check the quality of the consultations and reports on consultation quality have been made every month.

In the future, the two sides will team up to accelerate staff training, coaching and supervision, and communication activities so that local people will have more complete information about the characteristics of insurance products.

They will also continue to accompany customers to solve problems to bring the best possible experience to them, besides constantly improving service quality.

| Vietnam, Belgium promote partnership in seaport, logistics There are great opportunities for Belgian investors in the development of seaports in Vietnam, a country owning a coastline of over 3,200km, heard a conference held in Anvers city of Belgium on June 12. |

| Samsung Vietnam teams up with Shinhan Bank Vietnam on digital payments In a landmark move, Samsung Vietnam and Shinhan Bank Vietnam have joined hands, etching an MoU to revolutionise the digital payment arena in Vietnam on June 14. |

| EVS signs partnership with Siemens e-Mobility in Vietnam EVS and Siemens signed a cooperation agreement on April 12 in Ho Chi Minh City for EVS to become a Siemens Solution Partner in the e-Mobility segment. |

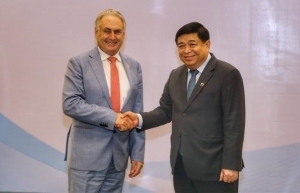

| Vietnam, Australia foster economic partnership The third Vietnam-Australia Economic Partnership Meeting was held in Hanoi on April 17 under the co-chair of Minister of Planning and Investment Nguyen Chi Dung and Australian Minister for Trade and Tourism Don Farrell. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- QBE Vietnam: 20-year journey of building trust and enabling resilience (November 20, 2025 | 14:25)

- Hanwha Life hosts training course in South Korea for Vietnamese fintech talents (November 20, 2025 | 09:51)

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

Tag:

Tag:

Mobile Version

Mobile Version