VIB's first-quarter profit up 18 per cent

VIB's first-quarter profit reached VND2.7 trillion ($114.93 million), maintaining the top business performance in the industry.

Among them, total operating income reached more than VND4.9 trillion ($208.57 million), an increase of more than 19 per cent. The bank maintained a highly effective net interest margin at 4.6 per cent amid fluctuations in both deposit and lending rates.

Well-controlled operating expenses helped the cost-of-revenue ratio drop significantly to only 32 per cent in the first quarter of 2023 compared to 35 per cent in the same period last year. As a result, the bank's pre-provision profit reached more than VND3.36 trillion ($143 million), up 26 per cent compared to Q1.

|

VIB's bad debt ratio temporarily increased from 1.79 per cent to 2.49 per cent at the end of March. The bank increased its risk provision to VND668 billion ($28.4 million) in the first quarter, an increase of nearly 70 per cent over the same period.

In the first quarter, VIB achieved nearly VND2.7 trillion ($114.9 million) in pre-tax profit. With this profit, the bank continued to maintain return on equity (ROE) at 30 per cent, the highest in the industry, for the fourth consecutive year.

Strong balance sheet

VIB's total assets reached more than VND357 trillion ($10.7 billion) at the end of March, up 4.2 per cent compared to the beginning of the year. At present, interest rates are still high amidst the dampened demand for housing, consumption, and investment. As a result, VIB's credit growth decreased slightly by 1.2 per cent. However, the bank maintained a strong business momentum in March, contributing to a positive growth outlook for the second quarter.

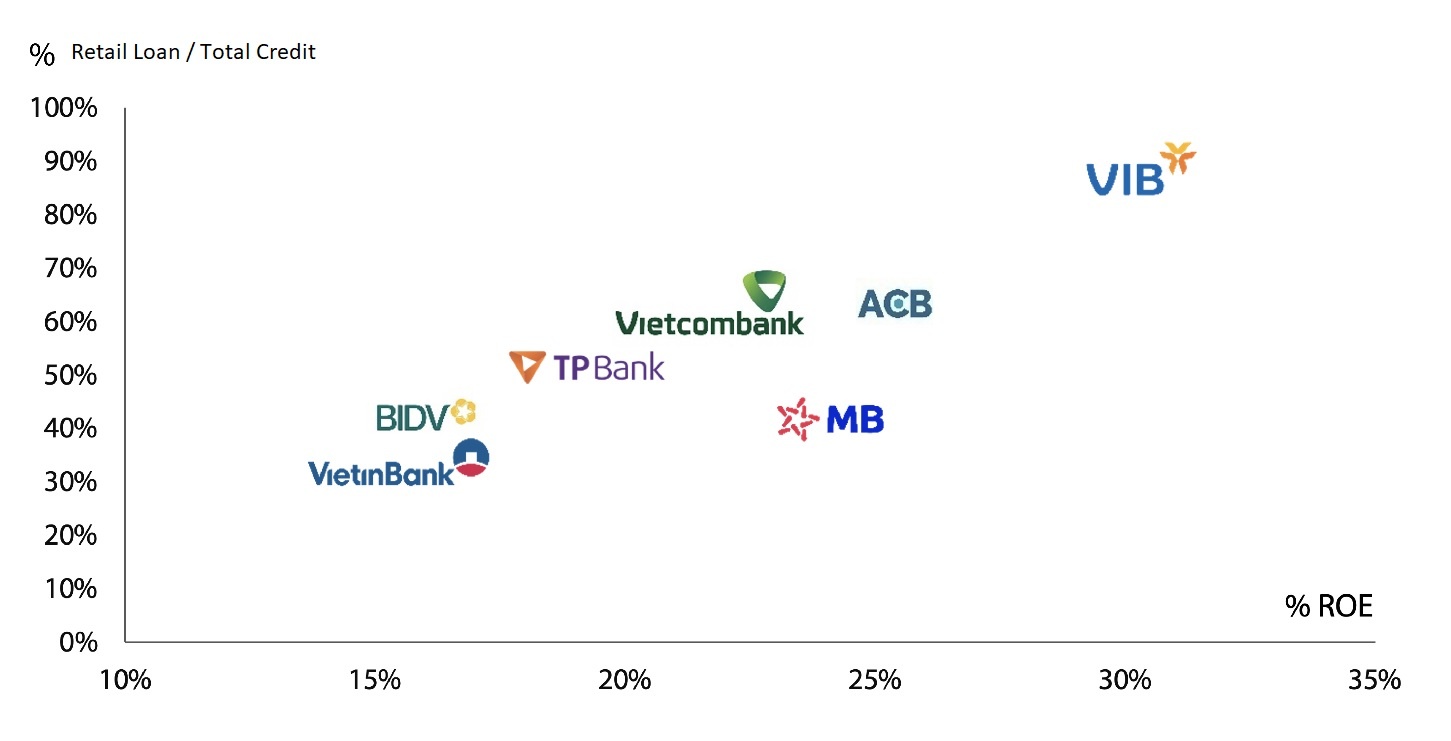

Currently, VIB is one of the banks with the lowest concentration of credit risk in the market. Its outstanding retail loans account for up to 90 per cent of the total loan portfolio. Of the total, over 90 per cent of loans are secured by collateral, mainly houses and residential land with full legality and good liquidity. VIB had the lowest investment balance in corporate bonds in the industry, about VND1.5 trillion ($63.8 million), equivalent to 0.6 per cent of the total credit balance. Most bonds are in the fields of manufacturing, trading, and consumption.

|

| The ratio of retail to total outstanding loans and ROE of banks in 2022 (Source: Fiinpro, financial statements of banks) |

By the end of March, VIB's mobilised capital had reached more than VND248 trillion ($10.5 billion), including customer deposits and valuable papers. In March, the International Finance Corporation (IFC) approved a five-year loan of $100 million for VIB. The agreement, expected to be signed in May, will help VIB increase disbursements to the housing sector. With this loan, VIB's overall credit limit from foreign organisations like the IFC topped $1.5 billion.

Safety indicators are optimally managed, with the loan-to-deposit ratio being 71.5 per cent and the short-term capital ratio for medium- and long-term loans being 28.3 per cent. The capital adequacy ratio under Basel II is managed at 12.3 per cent, while the Basel III net stable funding ratio is managed at 112 per cent.

In 2022, VIB also received the highest ratings from the State Bank of Vietnam (SBV) thanks to its efficient performance and safety in both quantitative and qualitative terms. VIB also used the methodology issued by the SBV to self-assess the results, which continued to be among the highest group. The official results will be announced by the SBV in 2023.

Dividend distribution

The bank's AGM approved the dividend payment plan at 35 per cent, including a 15 per cent cash dividend and a 20 per cent stock dividend. In early March, the bank completed the payment of a 10 per cent cash dividend. Currently, VIB is in the process of paying the remaining 5 per cent cash dividend and 20 per cent bonus shares to shareholders and 7.6 million bonus shares for employees.

Technology pioneer

|

With a consistent strategy of focusing on customers in the process of digitisation and digital transformation, VIB pioneered the application of many new technologies. The bank has also built value chains to give customers better experiences. In 2022, VIB recorded outstanding growth, with the number of digital banking transactions increasing by more than 100 per cent over the same period and reaching 93 per cent of transactions via digital channels.

The MyVIB Digital Banking application and technology solutions have received many awards and recognitions from prestigious organisations such as The Asset, The Banker, Global Finance Review, Mastercard, Visa, Amazon Web Services (AWS), and Microsoft.

In March, Microsoft's global website wrote that VIB was one of the first banks in the region to move to digital banking and achieve success in deploying a multi-cloud ecosystem. In early April, AWS invited VIB to make a speech about the importance of cloud computing and VIB's pioneering work in this area. VIB was the first customer of AWS in Vietnam in 2020 and has made an important contribution to laying the foundation for the practical application of cloud computing.

Currently, cloud computing is becoming a hot technology trend in Vietnamese banks. This trend is in line with the nation's IT development strategy, with a target of 60 per cent of bank customers using cloud computing services in the next few years.

With the highest retail concentration of 90 per cent in the market, VIB aims to invest in the digital transformation of all banking products and services. At the same time, the bank will focus on risk management to ensure safe, healthy, and transparent coefficients.

| VIB to announce dividend payment plans at its upcoming AGM After six years of implementing strong and extensive strategic transformation, Vietnam International Bank (VIB) has marked important milestones in its journey to becoming the leading retail bank in Vietnam. |

| VIB shareholders approve 35 per cent dividend payment Vietnam International Bank (VIB) held its 2023 AGM in Ho Chi Minh City today. The bank’s shareholders approved a plan to pay dividends at 35 per cent, including cash dividends and bonus shares. They also agreed on a pre-tax profit target of VND12.2 trillion ($517.5 million) for 2023. |

| VIB offers new-look credit cards Vietnam International Bank (VIB) has just announced a refreshed look for its Mastercard credit cards, with new features to optimise the benefits and meet the spending needs of cardholders. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version