Power of collaboration driving the ESG agenda

|

| Nguyen Thi Cat Tuong - Head of ESG Research Dynam Capital |

Investor networks have focused on critical environmental issues such as climate change, plastic waste, and governance as a cross-cutting theme to ensure that considerations of ESG issues are embedded in top-down governance arrangements.

In Vietnam, business-led coalitions to promote sustainable development, good governance practices and address certain environmental issues have been growing in recent years. Over the past seven years, the Vietnam Chamber of Commerce and Industry has effectively promoted responsible production and ESG practices among the business community in Vietnam through the Corporate Sustainability Index, which yearly selects the top 100 sustainable companies in Vietnam based on 130 indicators.

Foreign-invested enterprises (FIEs) in Vietnam determine that ESG is not really a new thing or a “nice-to-do” just for marketing and branding, but it does reflect what is defined as good business. FIEs are largely more progressive than Vietnamese companies in adopting ESG practices and driving their sustainability agenda, partly due to their global commitments, partly due to the obligations from their headquarters countries in Europe and the United States that have stricter ESG regulations.

However, in recent years, we are seeing more and more Vietnamese companies make great leaps forward in their ESG performance – Vinamilk, PNJ, Vicostone, Century Synthetic Fiber Corporation, and Novaland to name a few. The progress of these companies can be seen clearly through their annual/sustainability reports.

The Vietnam Institute of Directors (VIOD), established in 2018, is a professional organisation which promotes corporate governance standards and best practices in the Vietnamese corporate sector. With technical support from the International Finance Corporation and the Swiss State Secretariat for Economic Affairs, the VIOD aims to advance board professionalism, promote business ethics and transparency, create a pool of independent directors, and build a network to connect corporate leaders and stakeholders and help companies gain investor confidence.

Governed by a board of directors comprised of various private sector representatives, the VIOD has close collaboration with and is supported by the State Securities Commission of Vietnam (SSC) and Vietnam’s stock exchanges under the Vietnam Corporate Governance Initiative. With the support of the SSC, the VIOD represented Vietnam to participate in the 2021 ASEAN Corporate Governance Scorecard. The organisation has also held numerous director training programmes and networking events for chairmen and CEOs from Vietnamese companies to discuss corporate governance and company culture.

Packaging Recycling Organisation Vietnam is another business-led coalition established by leading foreign and domestic companies having high prestige in consumer goods, packaging, retail, and import industries with the mission to drive the circular economy model for packaging in Vietnam, thereby contributing to reducing plastic waste in Vietnam, especially from single-use packaging.

The organisation expanded to 19 members by the end of 2021 with various ongoing pilot projects, showing strong commitment from these companies in working to address the plastic waste issue, despite being competitors in the market.

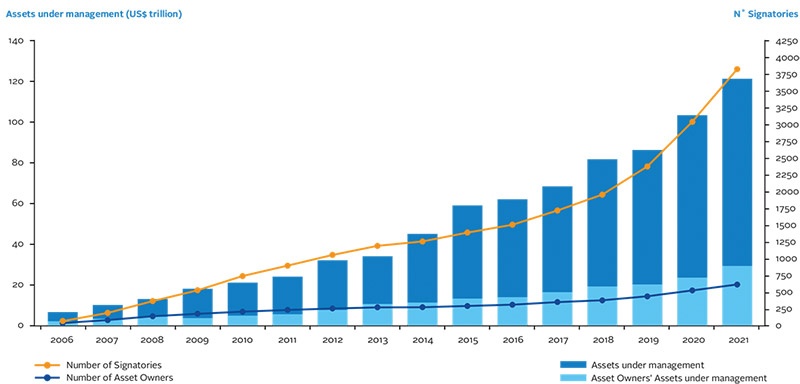

On a global scale, according to the PRI Annual Report 2021, some 97 per cent of asset owner and investment manager signatories reported that they incorporate ESG factors into their listed equity investments, while 86 per cent reported doing so across other asset classes. Over 2021-2024, ESG incorporation and stewardship remain the PRI’s major focus of work.

The organisation has collaborated with other investor networks to form the Investor Agenda – the largest global collaboration to mobilise the broader investment community to act on the climate crisis and advocate collectively for public policies that accelerate the investor transition to a net-zero emissions economy.

The 2021 Global Investor Statements to Governments on the climate crisis, signed by 733 investors with over $52 trillion in assets under management, was showcased a week before COP26 and had real outcomes in terms of increased climate risk disclosure mandates and increasingly ambitious Nationally Determined Contributions.

|

| PRI Growth 2006-2021 (Source:UNPRI) |

As the business sector is facing many common ESG challenges, albeit at different levels, business coalitions and networks become important sharing platforms where investors and companies can contribute their experiences, learn from each other and, most importantly, collaborate effectively to address the challenges, whether it is COVID-19, climate change, plastic pollution, or human rights. And effective collaboration requires an action plan that can drive results and impacts, not merely a conversation.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

Tag:

Tag:

Mobile Version

Mobile Version