MBBank App makes it into the “Top Apps of 2021” by Apple Store

While the presence of international brands like Facebook, YouTube, TikTok, and Gmail does not come as a surprise, a "Made in Vietnam" apps like App MBBank piques people's interest. What is so intriguing about the MBBank App?

Multi-compartment wallet

MB is the first Vietnamese bank to provide consumers several account numbers – akin to "a wallet with many compartments" – immediately on the MBBank App. App users may quickly create a gorgeous account number, a phone number account, a date of birth account, or a quartet account, based on their preference.

Notably, the MBBank App is the only financial app to appear in Vietnam's Top Apps of 2021 on iOS.

|

| MB is the pioneer to facilitate multi banking accounts for customers, similar to a “multi-compartment wallet” on MBBank App |

Customers may now make transfers with their unique account numbers, which are easy to remember and convenient, rather than memorising a long series of digits (like the old 13-number accounts). This successful approach has helped reduce consumer uncertainty while transferring money.

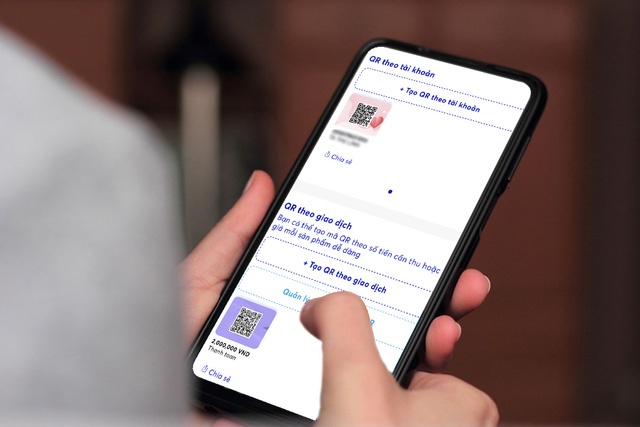

Getting a "2-in-1" deal in VietQR code

MB quickly added a quick payment mechanism using the VietQR code into the MBBank application. Payment transactions are completed in a fraction of a second using VietQR code, eliminating the need to input the payee's data such as account number, account name, beneficiary bank, and so on, as with traditional money transfers. Users may also customise the mascot and colour of VietQR payment.

|

| VietQR comes in handy for business owners, shippers, and customers |

The QR payment feature can be especially useful for small and medium-sized enterprises owners, delivery shippers, and consumers. Customers or shippers just need to scan the QR code to process the transfer order immediately. Sellers will also receive the funds quickly and without incurring any further fees. MB has increased the QR code payment limit to VND500 million($21,740), making this service extremely convenient for both buyers and sellers.

With digital mindset in its DNA, MB has recently enhanced the capability of this cashless payment method, allowing business owners to actively settle with VietQR in addition to providing a smooth payment experience. Specifically, the business owners may use the MBBank App to generate a transaction QR code with the due amount of the goods, product content, and beneficiary account, making inventory and settlement easier. Furthermore, the MBBank App also incorporates personal computers, permitting customers to easily calculate while shopping.

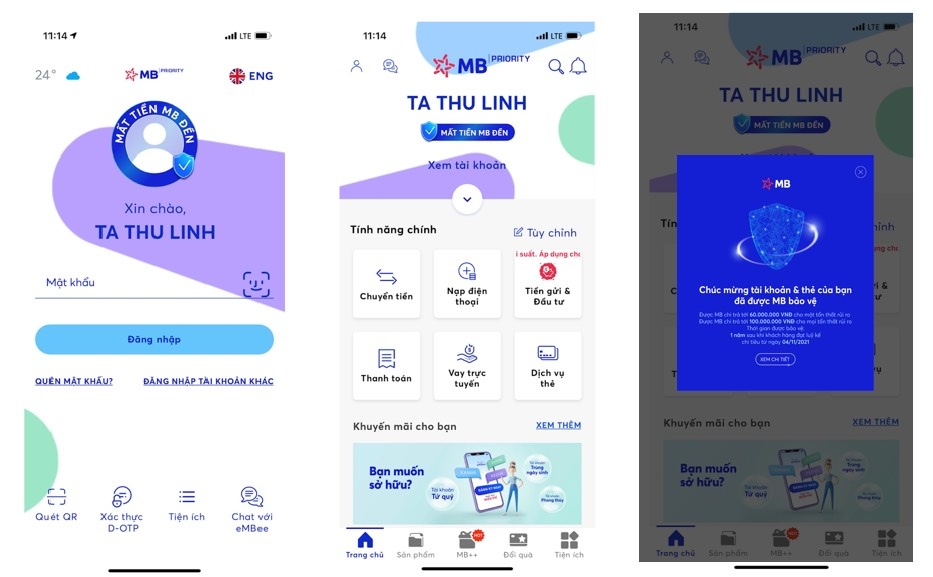

"Fear of losing money? MB will compensate": Available only at MB

Customers were drawn to the slogan "Fear of losing money? MB will compensate" that appeared recently on the MBBank App.

Particularly, MB is the first bank in Vietnam to provide clients up to VND100 million ($4,350) in compensation in case of falling victim to fraud while making online payments with MB's account and international payment card. Those who spend more than VND10 million ($435) on debit and foreign credit cards between November 4, 2021 and November 4, 2022 will be alerted to activate this special protection mode for a one-year period.

|

| MB is the first and only bank offering compensation to customers in case of fraudulent online payments |

Understanding users’ psychology and pioneering in offering exceptional financial product experiences, particularly on digital platforms, is the path MB defined to achieve the aim of "leading in digitalisation”.

MB continues to assert its superior quality and advanced technology as the sole banking app on the list of Top Apps of 2021 on the iOS operating system in Vietnam, thereby contributing to a cashless society.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- VIB hits $267.4 million in pre-tax profit over first nine months (October 29, 2025 | 12:12)

Tag:

Tag:

Mobile Version

Mobile Version