Manufacturing output continues to rise amidst signs of slowing growth

|

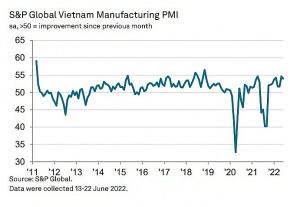

The S&P Global Vietnam Manufacturing Purchasing Managers' Index remained above the 50.0 point no-change mark for the tenth successive month in July, signalling a further strengthening of business conditions. That said, at 51.2 points – down from 54.0 points in June – the index signalled a less significant improvement.

New orders increased for the tenth month running, but the rate of expansion eased to its weakest point since April. Meanwhile, new export business rose solidly and at a faster pace than total new orders.

The continued growth of new orders encouraged manufacturers to keep expanding production in July. Output rose for the fourth successive month. However, the rate of expansion was only marginal and the softest in the current growth sequence amidst signs of lower demand, shipping difficulties, and pricing pressure.

There were signs, however, of price and supply pressures easing at the start of the third quarter.

In terms of prices, the rate of input cost inflation slowed sharply and was the weakest since October 2020 as the prices of some inputs fell on global markets. The latest rise was still above the series average due to higher costs for oil, gas, and freight.

Similarly, output prices continued to rise, but the rate of inflation slowed and was only modest.

| Economics director at S&P Global Market Intelligence Andrew Harker said, “The recent burst of growth in the Vietnamese manufacturing sector gave way to a more modest expansion in July, but firms were still able to secure greater volumes of new orders and increase output and employment accordingly." |

"Although there were some signs of demand softening, there were pleasing developments in terms of price and supply pressures. The rate of input cost inflation slowed sharply, while supply chains neared stabilisation. With these factors having provided serious headwinds for firms over a sustained period, signs of improvement should hopefully boost growth prospects," he added.

Suppliers' delivery times neared stabilisation as the rate of lead time lengthening reduced for the second month running to reach its weakest point in 22 months. Where delays continued, they were linked to issues with shipping and rising transportation costs.

Manufacturers continued to expand their workforce numbers in line with higher output requirements – the fourth month running in which this has been the case. The rate of job creation was solid despite slowing from the three-and-a-half-year high posted in June.

Meanwhile, backlogs of work were unchanged following a decrease in the previous month. As well as taking on extra staff, firms also expanded their purchasing activity in July due to rising new orders and efforts to build inventory reserves. Any attempts to accumulate stocks of purchases were in vain as preproduction inventories decreased at the sharpest pace in just over a year.

Stocks of finished goods also decreased, falling for the fifth month running and at a faster pace than in June. Some firms lowered inventories in response to slower new order growth, while others found it easier to dispatch products for export.

Manufacturers remain optimistic that production will increase over the coming 12 months.

| Vietnam’s economic growth accelerates on back of exports, manufacturing: Bloomberg Vietnam’s economic growth accelerated faster than expected in the second quarter of this year, as a recovery in exports and manufacturing helped offset risks from coronavirus outbreaks and rising oil prices, Bloomberg reported. |

| Manufacturing sector ends the first half of 2022 in good health The Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 54.0 points in June, down slightly from 54.7 points in May but still signalling a solid monthly improvement in the health of the sector. Business conditions have now strengthened in each of the past nine months, according to the latest PMI survey by S&P Global. |

| Vietnam’s process manufacturing attractive to foreign investors Vietnam’s process manufacturing sector has to date attracted 252 billion USD in foreign direct investment (FDI), accounting for nearly 60 percent of the total foreign capital poured into the Southeast Asian country. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version