Manufacturing sector ends the first half of 2022 in good health

|

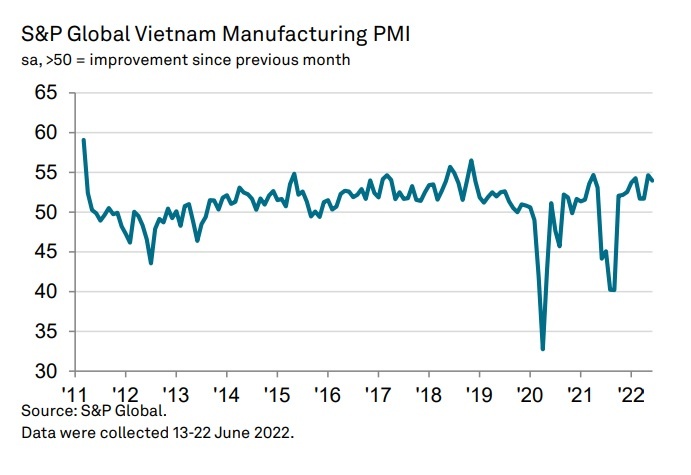

The Vietnamese manufacturing sector ended the first half of 2022 firmly in expansion mode as a lack of disruption from the pandemic supported demand and production.

Firms were also increasingly successful in efforts to hire additional staff, with the rate of job creation quickening to a new high.

Increased staffing capacity enabled firms to keep on top of workloads, with backlogs reduced for the second time in the past three months. Meanwhile, the shipping of finished items to customers meant that post-production inventories decreased again in June.

Further marked increases were seen in both output and new orders at the end of the second quarter, as relative market stability due to a lack of pandemic disruption enabled demand to grow.

Rates of expansion were particularly pronounced in the consumer goods category. Meanwhile, the growth of new export orders quickened to the fastest pace in four months, despite some reports that shipping difficulties had limited opportunities to export.

|

Input costs continued to rise sharply, with the rate of inflation quickening from that seen in May. A range of factors added to cost burdens, most notably higher gas and oil prices. Rising charges for shipping and freight and higher raw material prices were other factors.

Higher costs for energy and shipping, in particular, were behind a further increase in selling prices. The rate of inflation softened, but was still marked and well above the average since the data about inflation was collected in March 2011.

Continued supply-chain disruption was also a feature of the latest PMI survey, although lead times lengthened to a lesser extent than in May. Where delivery delays were reported, firms linked this to COVID-19 lockdowns in China, shipping issues, price rises, and material shortages.

A further solid rise in purchasing activity was registered in June as firms responded to higher new orders. These purchased inputs were often used to directly support production, meaning that stocks of purchases continued to fall slightly.

Manufacturers expect the pandemic to remain under control, leading to stable market conditions and increasing production over the next 12 months. More than half of all survey respondents – mostly manufacturers – predicted a rise in output, with confidence above the series average.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

- 14th National Party Congress’s opening: Great aspirations, steady steps (January 20, 2026 | 09:50)

- Opening remarks of 14th National Party Congress (January 20, 2026 | 09:44)

- First working day of 14th National Congress of Communist Party of Vietnam (January 19, 2026 | 08:54)

- Viettel starts construction of semiconductor chip production plant (January 16, 2026 | 21:30)

- Redefining Vietnam’s growth model for the era of innovation (January 16, 2026 | 16:40)

- Foreign sentiment towards Vietnam turns more positive (January 15, 2026 | 11:08)

- Vietnam ranks 38th in global AI adoption (January 14, 2026 | 16:01)

- European business confidence reaches highest in seven years (January 13, 2026 | 10:17)

- UOB lifts Vietnam growth outlook to 7.5 per cent for 2026 (January 10, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version