How Vietnam can stay competitive in a changing global trade environment

Vietnam has made tremendous economic progress in the 21st century. Real domestic output per capita has more than tripled since 2000, a rate of growth surpassed only by China in the East Asia and Pacific region. Labour productivity growth per worker was also fastest in the region, albeit from a relatively low starting point. And, Vietnam has made significant headway toward achieving the Sustainable Development Goals by 2030, including most of the targets related to poverty reduction, health and education.

|

| Ramla Khalidi, UNDP resident representative in Vietnam |

With these achievements, Vietnam is on course to achieve the government’s target of “upper middle-income status by 2030”. More challenging will be reaching the goal of “high-income status by 2045.” To achieve that, it requires posting growth rates of 6 per cent or more consistently, over the next twenty years. Based on past performance, this appears to be within reach. But it is important to bear in mind that global trends indicate that as countries get richer, growth rates tend to slow down.

Low-income countries can grow fast as they replace traditional technologies with modern production methods, often imported from abroad. Fewer of these opportunities are available to middle-income countries. If we examine growth rate trends in Indonesia, Malaysia and Thailand, we note that they have slowed since the 1990s, even if we discount the COVID-19 pandemic years (2020-2021).

Nevertheless, with forward-looking policies and a stable global economy, Vietnam is well-placed to make an historic transition to high-income status within one generation. How can this be achieved? To answer this question, we have to start from a clear understanding of the foundations of Vietnam’s past successes.

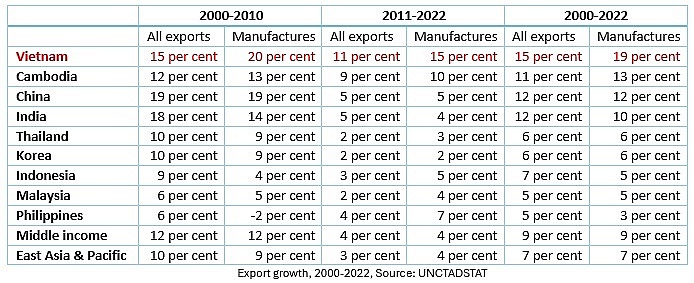

Vietnam is an outward-oriented country that has sustained high rates of growth through deep integration into East Asia production networks, especially in manufacturing (see UNDP, “Export Competitiveness and the Evolution of Vietnamese Trade, 2023). Since 2000, Vietnam has posted the fastest growth of exports in the region, achieving a remarkable average annual increase of 15 per cent in US dollar terms. This is faster than China (12 per cent) and more than twice as fast as Thailand, Indonesia and Malaysia.

| “With forward looking policies and a stable global economy, Vietnam is well placed to make an historic transition to high-income status within one generation." |

A closer look at the statistics reveals two important differences between Vietnam and its regional peers. The first is that Vietnam managed to sustain rapid export growth after the Global Financial Crisis of 2008-2009, while most middle-income countries experienced a sharp slowdown in export growth from 2010 as global economic recovery stalled in the face of fiscal austerity measures in high-income countries and rising protectionist sentiment.

The government negotiated regional and bilateral trade and investment deals to increase the country’s attractiveness as a production base, and also stepped-up investment in essential infrastructure to power logistics costs. Mounting tensions between the United States and China enhanced Vietnam’s appeal to foreign investors looking to diversify their export platforms (see Table).

The second difference between Vietnam and other middle-income countries is the exceptionally high rate of growth of manufactured exports, especially after 2010. Over the past two decades, Vietnam has emerged as a manufacturing powerhouse, posting growth rates far higher than China, India and the ASEAN neighbors. Moreover, these rates were broadly sustained in the aftermath of the financial crisis.

|

Will Vietnam be able to sustain such high rates of growth of manufactured exports to power growth over the next two decades? The medium-term answer is yes. Net foreign direct investment topped $20 billion for the first time in 2023, two-thirds of which was directed to manufacturing. Exports of mobile phones and computing equipment grew particularly rapidly over the past decade, but more traditional exports like footwear and furniture also recorded impressive gains. These trends look likely to continue, carrying the country through the next socioeconomic Development Plan 2026-2030.

The long-term answer is more complicated. While none of us can predict the future, there are four reasons to expect that the current development model will not, in itself, be enough to sustain growth after 2030.

Firstly, Vietnamese manufacturing remains heavily concentrated in labour-intensive, low value-added assembly operations. If foreign firms are mainly attracted to Vietnam to reduce labour costs, they will look elsewhere when the supply of underemployed labour falls and wages start to rise. The supply of workers willing to take on low-skilled manufacturing jobs will contract over time due to demographic factors, urbanisation and rising expectations among educated youth.

Secondly, automation of assembly operations could reduce incentives for manufacturers to relocate to Vietnam. No one has yet figured out how to build a robot that can sew a shirt faster and more cheaply than a skilled machine operator. Thousands of workers are still needed to assemble consumer electronics and sports shoes. However, advances in AI, robotics and 3D printing have transformed assembly of automobiles, electrical components, machines and a wide range of other industries. Automated assembly would allow manufacturers to locate factories closer to consumers, reducing shipping times and costs, and increasing scope for production personalisation.

Thirdly, as awareness of the environmental impact of manufacturing increases among foreign governments and consumers, the link between carbon emissions and access to international markets will grow stronger. The European Union’s Carbon Border Adjustment Mechanism is an early example, but it will not be the last. Environmental protectionism is meant to level the playing field between domestic companies, which are subject to strict limits on carbon emissions, and exporters. Countries that require a long adjustment period from fossil fuels to renewable energy may find that their exports are subject to tariffs and other penalties.

Fourthly, Vietnamese firms have not yet succeeded in penetrating the supply chains of multinational enterprises operating in the countries. The most recent statistics published by the Organization for Economic Cooperation and Development (OECD) indicate that the import-intensity of exports meaning the share of imported goods and services in exports is considerably higher in Vietnam (51 per cent) than in Malaysia and Thailand (35 per cent), India (20 per cent) and Indonesia (15 per cent). Moreover, the import-intensity of Vietnamese exports Vietnam has risen steadily since 2000, while remaining relatively constant or declining in comparator countries. These figures suggest that technological spillover effects and demand linkages between foreign and domestic firms have not materialised as expected. Vietnamese manufacturing is still largely stuck in low value-added operations, which are sensitive to labour costs.

These factors, and others, suggest that Vietnam will not be able to rely exclusively on labour-intensive activities for much longer. Like Japan, South Korea, Taiwan and China, Vietnam will need to learn how to compete in higher value-added segments of industry and related services.

As the experience of successful East Asian countries has shown, developing national technological capabilities is a crucial factor. However, public spending on higher education and research is still low in Vietnam. The World Bank estimates that in 2019 Vietnam spent 0.27 per cent of GDP on higher education, compared to 1.12 per cent in China, 0.95 per cent in Malaysia, and 0.6 per cent in Thailand. Similarly, Vietnam allocated 0.4 per cent of GDP to research and development, less than China (2.4 per cent), Malaysia (1 per cent) and Thailand (1.3 per cent). While spending is not always the best indicator of capacity, Vietnam also scores poorly on research outputs.

According to the journal Nature, the top-ranked Vietnamese university published 10 international studies in the sciences over the period May 2023 to April 2024, leaving the country without an institution able to break into the top 1,000 in the world. By way of comparison, the top institution in Singapore published more than one thousand papers in international journals over the same period.

The transition to renewable energy will be costly and difficult, but also presents Vietnam with opportunities to develop new industries. This opens the way for nimble companies to learn new technologies and secure a foothold in an expanding market. There will be many examples in aviation, digitalisation, construction, and agriculture. Rising demand for energy efficiency, circular technologies will stimulate investment in the industries of the future.

Seizing these opportunities will require better coordination between policymakers, businesses, universities and communities. Much has been written about the role of national innovation systems in helping countries compete in emerging industries. Vietnam’s National Strategy for Science, Technology and Innovation Development has established targets for research and business development. However, closer collaboration is needed among government agencies, businesses and universities to strengthen linkages between policy, research and market opportunities.

| “Vietnam will need to learn how to compete in higher value-added segments of industry and related services.” |

Vietnam could also do more to mobilise the capabilities and expertise of Vietnamese scientists and other professional working in international universities and multinational corporations. Some domestic firms have taken the lead with recruitment teams set up to identify candidates with specific skills and expertise needed to help them compete in global markets. Universities could learn from this experience by recruiting Vietnamese scientists with a strong international track record to fast-track the modernisation of Vietnamese universities and research institutes.

Looking ahead, Vietnam has a unique opportunity to build on its past achievements and attain high-income status. To stay competitive, the country must transition to higher value-added industries and invest in innovation. By implementing forward-looking policies and fostering stronger collaboration between government, businesses, and academia, Vietnam can continue to prosper in an increasingly complex global economy.

| The priority steps required for successful JETP mobilisation I commend the Ministry of Natural Resources and Environment and other key ministries for the second consultation on the draft resource mobilisation plan (RMP) of the Just Energy Transition Partnership (JETP). Over the past two months, the draft has improved significantly, benefitting from about 500 comments from concerned partners. |

| Support exists for climate battle Delegates at the COP28 climate summit in December 2023 agreed on some new and far-reaching commitments. Ramla Khalidi, resident representative in Vietnam of the United Nations Development Programme, writes about the implications of the event for the country. |

| The keys to a just energy and coal-fired transition The Just Energy Transition Partnership (JETP) is a centrepiece of Vietnam’s commitment to achieve net-zero greenhouse gas emissions by 2050. Agreed between Vietnam and members of the International Partners Group (IPG) in 2022, the JETP aims to support the transition to green energy by providing funding in the form of grants, low-interest loans and investments from both the public and private sectors. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Siam Cement Group announces 2025 results amid global headwinds (February 11, 2026 | 11:44)

- Rising consumption and travel fuel ‘Tet season’ stocks (February 11, 2026 | 11:43)

- Education as strategic capital: why Dwight School Hanoi represents a long-term investment in Vietnam’s future (February 10, 2026 | 19:00)

- Green logistics–the vital link in the global energy transition (February 09, 2026 | 19:35)

- Wages and Lunar New Year bonuses on the rise (February 09, 2026 | 17:47)

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

Tag:

Tag:

Mobile Version

Mobile Version