Coffee shop chains increase presence

|

After only five months presence in Vietnam, last month Thai coffee chain Café Amazon announced its plan to open even more stores nationwide this year. A representative of the chain said that Vietnam is still a highlight for investment, even amid the global health crisis.

At present, Café Amazon has five outlets, two in Ho Chi Minh City and three inside stores of the Go! Supermarket chain in Tien Giang, Ben Tre, and Tra Vinh provinces. Xuan Nguyen, marketing officer at Café Amazon, said that his firm has plans to expand outlets across the country, with Ho Chi Minh City and surrounding cities and provinces as priority locations, but specific figures were not revealed.

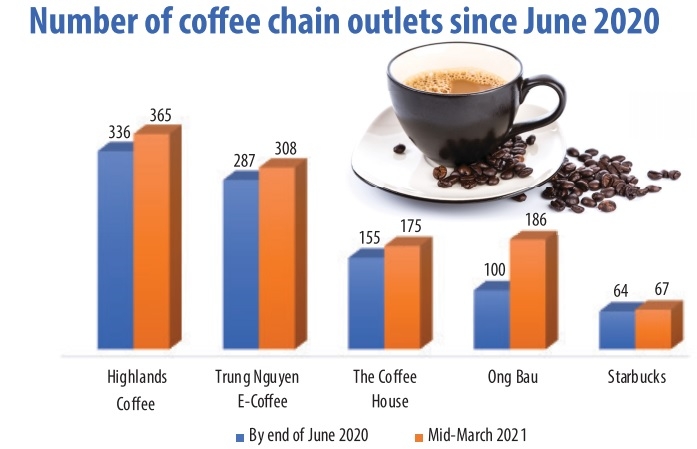

Meanwhile, Starbucks is also promoting the opening of new stores in Vietnam after more than a year of delayed plans due to the pandemic. Since the beginning of 2020, Starbucks has just opened six new stores, bringing the total number of stores in Vietnam to 68.

Patricia Marques, general director of Starbucks Vietnam, said that the purchasing power of domestic consumers recovers quickly after each peak of the pandemic. Therefore, brands do not necessarily have to wait for foreign tourists and experts to return, but can attract new domestic visitors to compensate.

“Starbucks Vietnam has chosen to open new stores in densely populated areas, instead of sticking to central business districts with expensive space rents, as a new business strategy this year,” Marques said, adding that Starbucks will continue to increase its presence with new stores in Hanoi, Danang, Ho Chi Minh City, and three more in Nha Trang this year.

The expansion of foreign coffee chains with strengths in brands, capital, techniques, and professional management processes also stimulates the rise of domestic coffee brands. The race between domestic and international beverage brands is gradually becoming more interesting with the expansion in the market share for Vietnamese brands such as Ong Bau, Trung Nguyen, The Coffee House, Phuc Long, and others.

“Three years are enough for domestic players to occupy the top position or accept to give up their position to foreign coffee chains,” said Dinh Anh Huan, chairman of The Coffee House.

CBRE Vietnam statistics for Q4 of 2020 show that the number of coffee chains is still growing by more than 10 per cent and that this is the only segment in the food and beverage industry that has achieved positive growth during the pandemic thus far.

Domestic coffee shops accelerate

Despite restructuring its Board of Directors, The Coffee House also announced further expansion this year. By the end of Q1, the chain had more than 176 stores nationwide. Under its plan, it will open at least 50 new stores by the end of 2021 and an ambitious 1,000 stores by 2025.

Tea house Phuc Long also expressed its goal to increase coverage, confirming that it would open more stores nationwide, giving priority to the central areas of Ho Chi Minh City, Dalat, Vung Tau, Nha Trang, and Danang. The only criterion this brand set is that there are no Phuc Long stores opened within a 2km radius of each other.

Franchise systems such as Trung Nguyen E-Coffee and Ong Bau have even higher opening rates.

In addition to the parallel development of Trung Nguyen Legend stores operated by the group itself, 16 new Trung Nguyen E-Coffee stores have opened since the beginning of 2021. Through concession, Trung Nguyen has now nearly 1,000 stores in Vietnam and will continue to expand its presence in all localities until reaching more than 3,000 stores nationwide.

Meanwhile, Ong Bau’s coffee chain reached more than 100 locations nationwide as of October 2020. An Ong Bau representative said that the brand is working with partners with the goal of opening many more outlets into next year.

Although the race to expand stores is still fierce, coffee chains make small profit following aggressive expansion strategies.

According to the business data platform Statista, in 2019, Highlands Coffee recorded VND84 billion ($3.6 million) in earnings before tax while Starbucks earned VND52 billion ($2.26 million) before tax. Meanwhile, local chains recorded tens of billions of VND in earnings but still incurred losses. The Coffee House had a loss of VND81 billion ($3.52 million) in 2019 while Trung Nguyen lost VND50 billion ($2.17 million) in the same year. The COVID-19 pandemic has seemingly not helped matters in this regard.

Thus, it seems that not profit but expansion is the goal of both domestic and foreign coffee chains at the moment to capture market share before it reaches saturation, and also pave the way for different business directions, such as private brand export.

Strengthening local brands

According to Euromonitor International, the market for specialty coffee and tea shops in Vietnam is worth more than $1 billion. Popular chains like Highlands Coffee, Starbucks, The Coffee House, Phuc Long, and Trung Ngyen account for less than 20 per cent of the market.

While foreign brands dominate the high-end arena, domestic coffee chains are dominating the mid-range and low-price segments.

According to marketing and branding experts, domestic coffee businesses have the advantage in terms of brands and number of stores. Although it is not impossible that financially strong foreign enterprises will acquire domestic chains, Nguyen Dinh Tung, chairman and general director of Vina T&T Group, which owns The Bunny coffee chain, believes that competition will promote the market’s development and consumers are the ultimate beneficiaries.

Even if foreign players buy all the famous Vietnamese coffee chains, they cannot dominate the market, as new chains are expected to open.

It is common among most local coffee brands like The Coffee House, Trung Nguyen, and Ong Bau to produce their own branded coffee products. While Trung Nguyen owns a large growing area in the Central Highlands’ Buon Ma Thuot with its ecosystem even including a coffee village, museum, and coffee shops, Ong Bau also has an 800-hectare coffee farm.

The Coffee House also owns Cau Dat farm, renowned for being on land best suited for growing Arabica coffee beans in Vietnam – which is also the homeland of the famous Dalat coffee line of the Starbucks brand.

Despite these advantages, annual coffee consumption must be large enough to sustain the chains’ operating costs. Therefore, these chains are continuously expanding and thus trying to increase the annual coffee consumption.

“We want to export Vietnamese branded coffee. To do that, we must be strong and well-known in Vietnam,” said Huan of The Coffee House.

Along with the retail business, many of the players in the coffee and beverages market have ambitions to become representatives for Vietnamese coffee.

Meanwhile, Trung Nguyen focuses on investing and expanding in international markets in more than 80 countries and territories, especially key markets such as China, the United States, South Korea, Russia, and Europe.

In the Asian market, Trung Nguyen Legend achieved a growth rate of nearly 200 per cent, covering supermarkets, trade centres, convenience store chains, e-commerce channels, and pharmacy systems.

In China, Trung Nguyen coffee products are being sold in nearly 30,000 supermarkets and convenience stores and are available on leading e-commerce sites such as Alibaba, Taobao, Tmall, and Yihaodian. In the US, Trung Nguyen’s G7 products were presented at the Costco retail supermarket chain in 2019 with nearly 800 sale locations.

However, the export path is not only meant for large coffee brands but also for the rookies who, although not yet capable enough to expand the number of stores, still want to position themselves in the market with quality and their stories behind the coffee.

Duy Ho, CEO of The Married Beans, said that in the 10 years since inception the company has welcomed many foreign delegations to visit and enjoy the typical Lac Duong Arabica coffee cups in Dalat.

However, his brand does not focus on expanding stores but on giving customers the best experience with its products and the process of making them.

Currently, 30 per cent of 150-tonnes coffee production produced by The Married Beans is supplied to coffee shop chains and large hotels in Vietnam, with the remainder exported to Europe, Japan, and other markets.

“I don’t have the pressure to compete with big coffee brands but just want to give customers a new experience of Vietnamese coffee with products that are increasingly perfect in terms of process and quality,” said Duy.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version