April downturn in Vietnamese manufacturing sector intensifies

|

| Vietnam's manufacturing output continued to plunge for the third consecutive month, hitting a new low |

Record falls were seen in output, new orders, employment, and purchasing amid company shutdowns and the cancellation of orders. Meanwhile, business sentiment turned negative for the first time since the survey began.

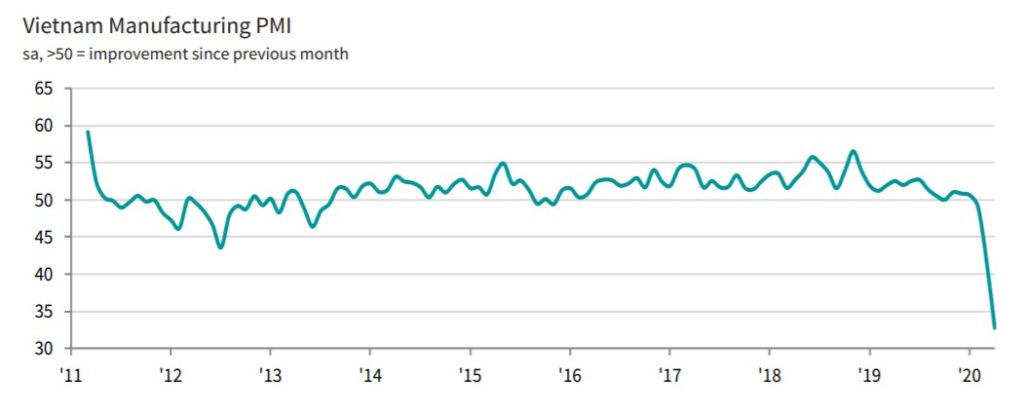

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) posted 32.7 points in April, well down against the 41.9 mark in March, which itself had signalled a record monthly deterioration in the health of the sector. Business conditions have now worsened in each of the past three months.

The impact of COVID-19 was most keenly felt with respect to manufacturing production and new orders. Both fell severely during April amid order cancellations and company closures. The decline in overall new business was outpaced by that seen for new export orders, reflecting the effects of the virus in markets all around the world. Approximately two-thirds of respondents signalled that output decreased during the month. As such, declines were registered across each of the three broad sectors covered by the survey, led by intermediate goods firms.

A lack of new orders fed through to a steep reduction in backlogs of work. Lower workloads led manufacturers to reduce staffing levels, while there were also some reports of employees having resigned. The resulting decrease in employment was the sharpest on record, the second month running in which a new low has been registered.

Purchasing activity also decreased at a substantial pace, linked to lower new orders, a reduction in production requirements, and company closures. As a result, stocks of purchases declined sharply. Stocks of finished goods also fell, albeit to a lesser extent than in March.

Meanwhile, difficulties in obtaining imported goods, material shortages, and issues with travelling meant that suppliers’ delivery times lengthened to the greatest extent since the survey began in March 2011.

Input prices decreased for the first time in 16 months during April, and at a marked pace that was the fastest since September 2015. Panellists linked the fall in input costs to a lack of demand for inputs and lower oil prices. With input costs falling, manufacturers continued to lower their output prices, extending the current sequence of decline to three months.

The latest reduction was sharp and the joint-fastest in the survey’s history, equal with that seen in June 2012. For the first time in the series, firms were pessimistic regarding the outlook for production over the coming year. Sentiment dropped amid fears that the impact of the COVID-19 pandemic could last for a prolonged period. Around 40 per cent of respondents signalled a negative outlook in April.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version