HSBC: Local businesses cash in on international trade

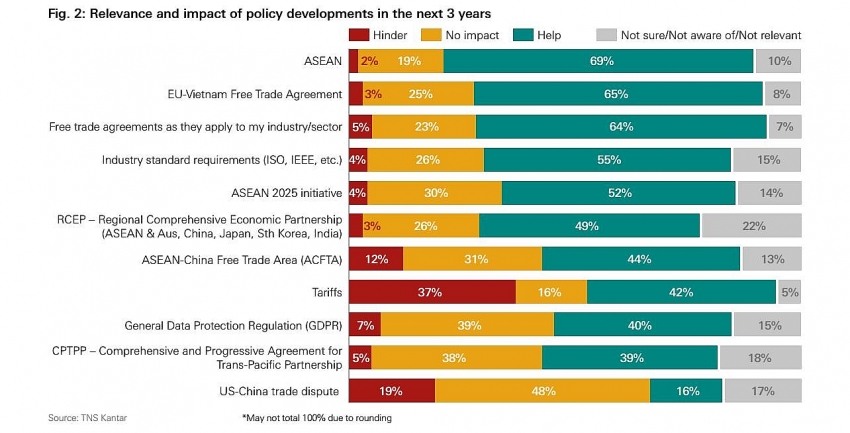

HSBC’s latest report entitled ‘Navigator: Now, next and how for business,’ which polled over 8,500 businesses across 34 markets, finds that the majority of Vietnamese respondents are positive about the partnerships established with key trading partners, with 69 per cent believing that ASEAN membership will help their business in the next three years. Similarly, 65 per cent of Vietnamese firms believe the forthcoming European Union-Vietnam Free Trade Agreement will have a positive impact on their business in the near future. The two sides agreed on a final text for the trade agreement earlier in June.

|

Vietnamese businesses are also looking beyond these agreements for growth. Over a quarter of businesses are eyeing opportunities in Japan, while 23 per cent are looking to expand into China, and a fifth are considering South Korea.

“We are seeing an increasing demand from clients, particularly those in the manufacturing and energy sectors, looking to expand their operations. These ambitions are supported by sustainable local economic growth and interest from overseas firms looking to move here. Optimism from Vietnamese businesses has never been stronger,” said Winfield Wong, head of Wholesale Banking at HSBC Vietnam.

|

In an effort to raise standards and boost competitiveness, 45 per cent of Vietnamese respondents said up-skilling their workforce is a key focus for investment while 43 per cent of firms stated they are placing a greater emphasis on productivity and skills development. Meanwhile, around 8 out of 10 companies in Vietnam are using data to optimise their performance, compared with 75 per cent globally.

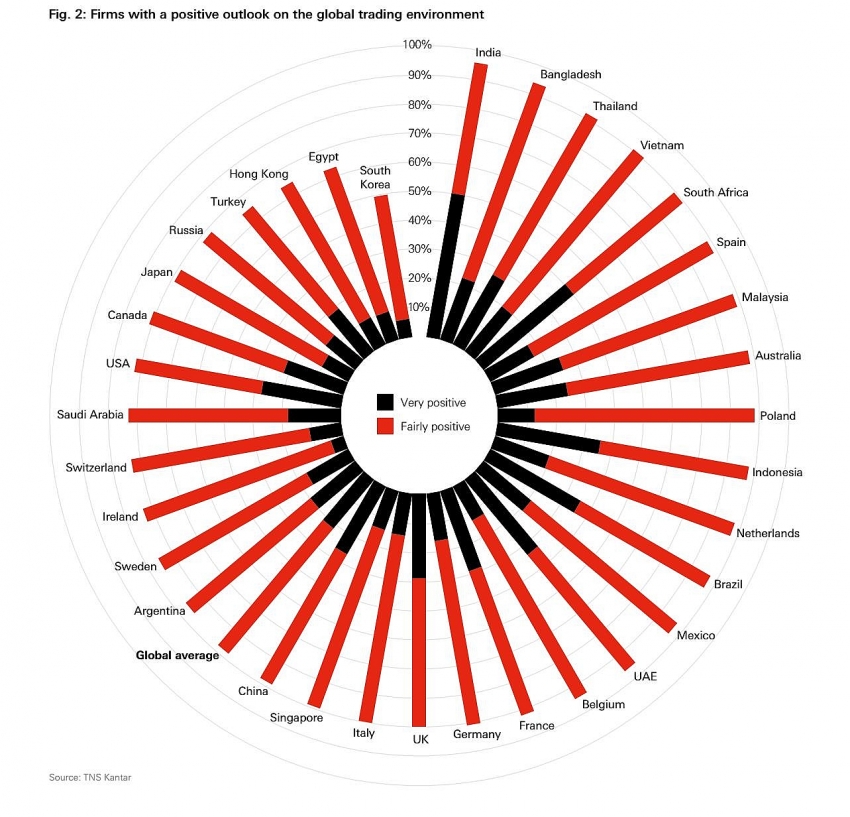

The survey also sees 91 per cent of Vietnamese respondents, compared with 75 per cent globally, believing the outlook for trade is favourable in spite of geopolitical factors that are curbing enthusiasm elsewhere. They cite a favourable economic environment, decreasing costs of shipping, logistics, and storage, and an increasing demand for their products as the top three drivers of trade growth.

This bullishness is also reflected in the confidence of Vietnamese firms, with 91 per cent believing that they will succeed in the current environment, compared to 81 per cent of businesses globally. Consumer confidence, commodity prices, and global economic growth are the top factors for their own positive outlook.

On a global level, respondents are upbeat about their prospects – encouraged by customer demand and favourable economic conditions – yet many are revising their strategies for fear that protectionist policies will have a negative impact on international trade.

“Vietnamese businesses’ optimism reflects an economy that’s been one of Asia’s star performers in growth speed,” said Wong. “They are optimistic as they consider themselves well-positioned thanks to a strong domestic economy, confidence in the global economy, as well as far-reaching trade deals and burgeoning trade relations with major markets.”

|

Despite the overall optimistic outlook on trade opportunities, four out of five Vietnamese firms (78 per cent) did concur that foreign governments are becoming more protectionist – this is considerably higher than the global benchmark (63 per cent) and an 11-percentage point increase from HSBC’s last Navigator survey conducted in late 2017.

In fact, HSBC’s Navigator survey shows that more than half of the companies (51 per cent) globally expect that free trade agreements, where they apply to their country and industry, will benefit them over the next three years.

FTAs are particularly popular in emerging markets, with 60 per cent of firms saying they will have a positive impact, compared to 45 per cent of firms in developed markets.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

Mobile Version

Mobile Version