Specific guidance crucial for success of nation’s power plan

|

| Major groups are developing onshore and offshore energy ventures that would get a helping hand with further policy detail, photo Le Toan |

The Ministry of Industry and Trade has been consulting on the draft plan for implementation of the Power Development Plan VIII (PDP8) since it was announced in May. The plan aims to achieve energy security for Vietnam, progressing on its climate change commitments towards the middle of this century, and to export 5,000-10,000MW of power by 2030.

Under the plan, offshore wind power projects will be distributed regionally. Localities will decide on specific sizes and locations based on key factors, including electricity production costs, capacity to release capacity of the grid, and transmission costs. Onshore and nearshore wind power will be distributed by region/province.

Nguyen Viet Dung, vice chairman of the board at Halcom Vietnam JSC, said businesses were waiting for specific implementation instructions. “The longer this work lasts, the more difficult it is for investors, affecting finance and capital turnover,” Dung said.

One of Vietnam’s top industrial conglomerates, T&T Group, said that there were currently no criteria or definitions of onshore, nearshore, and offshore projects.

Currently, the PDP8 combines onshore and nearshore wind power into one type of project, while their characteristics are not the same in terms of investment environment, installation cost, and the levelled cost of electricity and operating.

“We look forward to specific solutions to realise the PDP8 as there is not much time left from now to 2030,” said Nguyen Thi Thanh Binh, deputy general director of T&T Group.

T&T’s strategic goal in the next 10 years is to focus on investing in low-carbon renewable energy projects with a total capacity of 12-15GW, accounting for nearly 10 per cent of the total power capacity of Vietnam

Bui Van Thinh, chairman of the Binh Thuan Wind and Solar Power Association, said that investors in the energy sector are eagerly waiting for specific solutions in the implementation of the PDP8, especially policies to prevent electricity shortages.

“Investors are very impatient as the master plan has been issued, but the specific plan, including the issue of electricity selling price, is not clear. If the policy is stable and beneficial to all parties, investors will definitely pour in capital,” Thinh said.

Unclear implementation

Regarding the PDP8 target of 6GW of offshore wind by 2030, Stuart Livesey, CEO of Copenhagen Offshore Partners, suggested pilot projects that mix 500MW and 1GW installations. State-owned enterprises and experienced private companies could play leading roles in these pilots, and the remaining 3GW could be developed through competitive auctions.

The company is developing the La Gan offshore wind farm with an estimated capacity of nearly 3.5GW off the coast of the south-central province of Binh Thuan.

“We recommend for a two-stage selection process. Each stage will be coordinated by a single ministry; however, these ministries need to ensure they are aware of the processes being undertaken to allow visibility as to how and when a developer will be able to complete both stages,” he said.

He explained that the first stage process is exclusive survey rights. The Ministry of Natural Resources and Environment granted developers three years of exclusive survey rights on the seabed area with the potential to extend.

“It might be beneficial to include obligations for timely implementation, such as initiating surveys within the first 12 months, and a requirement to submit a summary report of data collection,” Livesey said.

He also highlighted the necessity of pilot project investors and of certainty around revenue, investment, and returns. This includes having functional power purchase agreements in place without second-round negotiation of financial submissions. Guarantees on grid capacity and availability, regulatory transparency and fairness, and sufficient time to build infrastructure were also raised.

Similar to offshore wind power is liquefied natural gas. To reach the target set of 22,400MW of liquefied natural gas power by 2030 is a huge challenge. Currently, investors want to have a committed rate of contract power output at the desired level to match the ability to raise capital for project implementation and recover investment costs.

Financing gap

In the comments to finalise the draft for the PDP8, the Ministry of Planning and Investment (MPI) emphasised that the plan needs to clarify details on the objectives, investment phases, capital, and resource mobilisation.

“The draft plan lacks policies to draw in investment capital, including green capital from foreign financial institutions to promote the development of power projects using renewable energy and green energy,” the MPI noted.

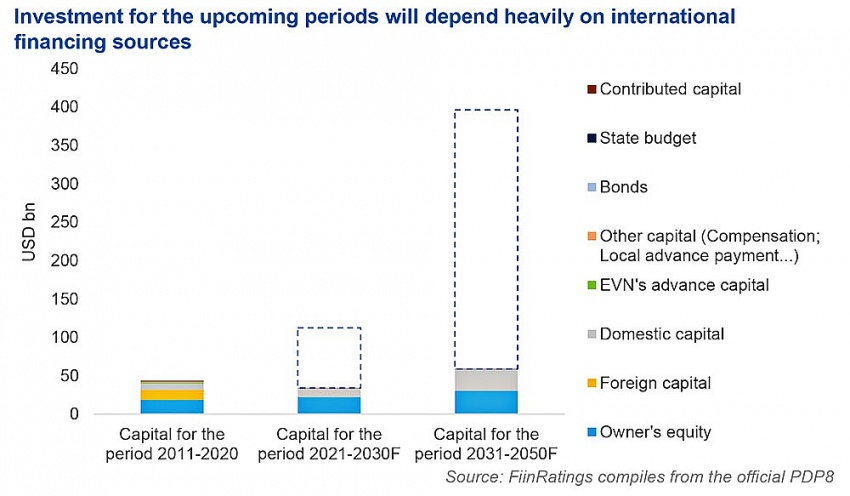

The estimated total in terms of development of power sources and transmission before 2030 is expected to be around $134.7 billion, and for 2031-2050, the figure is $399-523 billion.

Meanwhile, Dung from Halcom said that although foreign investors were interested in incentives when participating in investment in green technology and energy, green credit policy has no specific guidance.

“From the reality of accessing capital from foreign banks when implementing projects with partners, green credit has preferential interest rates, but the difficulty for enterprises is meeting conditions on the environment, society, and sustainable development,” Dung said.

A June report on the bankability of renewable energy projects stemming from the PDP8 by FiinRatings and Indochine Counsel noted that the green finance market in Vietnam was relatively new, with considerable growth potential. Thus, much work is still needed, including enhancing market awareness, facilitating the market, and establishing a robust verification system so as to prevent greenwashing.

“Given the mismatch between asset and funding duration, there is a concern that project developers may need help to secure long-term financing on favourable terms. We expect that this financing gap will depend significantly on attracting foreign direct and indirect investment, and corporate bonds, with a specific emphasis on green bonds,” the report said.

“Given the PDP8’s scale and scope, there must be other long-term funding sources, including the domestic corporate bond market, international debt markets, and the stock market,” said Tung Anh Nguyen, author of the report.

|

| Powering Vietnam’s green growth with new power plan Vietnam’s recently approved energy policy serves as a pivotal element in its journey towards achieving net-zero emissions by 2050, with the power sector shouldering the responsibility of eliminating approximately two-thirds of the country’s total greenhouse gas emissions. Philipp Munzinger, director of the German Development’s Agency’s Energy Support Programme, gave his viewpoints on the plan and suggestions to help Vietnam realise its ambitions. |

| Nation sticks to its guns over economic growth goals Steadily holding the economic growth target for 2023, the government has set a prime priority on boosting growth, with brand new solutions ordered to fuel enterprise performance. |

| Power plan shapes development direction The future demand, fuel supply, power generation sources, and the regulatory framework are four major elements in in Vietnam’s Power Development Plan VIII that should be carefully elaborated and taken into account in Vietnam’s energy transition process. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

Tag:

Tag:

Mobile Version

Mobile Version