Soft momentum likely for Q3: UOB

|

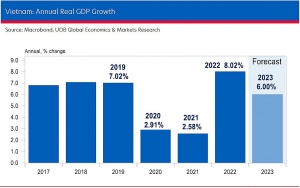

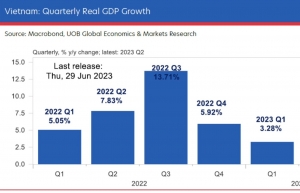

According to the latest report of UOB, after starting off the year at a sluggish pace, with real GDP growth in Q1 decelerating to 3.28 per cent on-year, from 5.92 per cent in the previous quarter, growth momentum in Vietnam remained lethargic, largely due to weak external demand coupled with an underperforming manufacturing sector.

As a result, economic growth in Q2 expanded just 4.14 per cent on-year, for a cumulative growth rate of 3.72 per cent on-year in H1, well below the official growth target of 6.5 per cent.

In terms of sectoral performance, manufacturing (including construction), which accounts for about 34 per cent share of the economy, managed to gain about 1.1 per cent on-year in Q2 with a positive contribution in H1.

Meanwhile, the services sector (43 per cent share) managed to cushion some of the weaknesses from the external sector, rising 6.1 per cent on-year in Q2 following the 6.6 per cent on-year run in Q1. The services sector contributed 2.7 percentage points, or more than 60 per cent of the headline growth in H1.

The UOB report said that looking beyond these tepid performances, the outlook for the remainder of the year is likely to be challenging as the latest data releases do not inspire much confidence.

Vietnam’s purchasing manager’s index (PMI) returned to an above-50 reading in August 2023 after five straight months of contraction (below 50) and the lowest reading (45.3 in May) since September 2021, being the worst performer in Asia at that time. Vietnam’s PMI has been underperforming the overall ASEAN PMI for 12 straight months.

Vietnam’s exports have contracted in 9 out of the last 10 months (August reported -8.5 per cent on-year), while imports saw 10 straight losses (August reported -5.8 per cent).

Poor external demand is reflected in Vietnam’s exports to the US -- its largest market that accounts for 28 per cent of total exports-- which has declined in 9 months of the past 10.

In contrast to the externally driven sector, domestic demand is relatively encouraging. Retail sales continued to perform well over the past year, with total retail trade reporting a 10 per cent on-year gain in August 2023, supported by double-digit increases in travel-related spending and activities.

Visitor arrivals have accelerated through the year, with overall inbound tourists of more than 7.8 million in August, which means that by end-2023, arrivals could recover to at least two-thirds of the levels recorded in 2019.

|

Nonetheless, with the services sector offsetting only part of the weaknesses in exports and manufacturing sectors, GDP growth in Q3 is likely to be underwhelming.

UOB maintains the full-year growth forecasts of 5.2 per cent for 2023 and 6 per cent for 2024, pencilling a projected 5.6 per cent on-year growth in and 7.6 per cent for Q4.

This implies about 6.6 per cent growth in H2. In contrast, to meet the official forecast of 6.5 per cent for 2023, the pace of expansion in H2 would have to average more than 9.2 per cent on-year, a huge hurdle in the current circumstances.

External risk factors to watch include Russia-Ukraine conflict and its impact on energy, food, and commodity prices; global supply chain shifts and disruptions; and the pace of China’s economic recovery.

On the inflation front, both the headline and core measures of Vietnam’s consumer price index (CPI) have trended below the official target of 4.5 per cent.

However, the two-month rebound in the headline CPI after a six-month downtrend suggests that the price pressures remain a concern, especially with the recent spikes in crude oil prices.

Vietnam’s headline inflation came in around 3.1 per cent on-year, higher than the 2.6 per cent in the same period in 2022. For the full year, UOB sees upside risks to Vietnam’s inflation trajectory.

| UOB trim GDP growth forecast for Vietnam The strong rebound seen in 2022 is unlikely to be sustainable, with overall growth momentum likely to moderate further in 2023. As a result, UOB has lowered Vietnam’s full-year GDP growth forecast for 2023 to 6 per cent from an earlier call of 6.6 per cent. |

| Full-year GDP growth projection of Vietnam to 5.2 per cent: UOB United Overseas Bank (UOB) has just revised its full-year growth projection down to 5.2 per cent in view of the challenges ahead, particularly for the fourth quarter of 2023 with its high base (in value terms) a year earlier. |

| Vietnam’s fiscal policy can perform a stronger role High interest rates elsewhere have led to consumption and export issues. Suan Teck Kin, head of Research at UOB, shared with VIR’s Nhue Man his prospects on Vietnam’s development and its monetary policies to face to the impact of activity involving China and the United States. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Mobile Version

Mobile Version