Full-year GDP growth projection of Vietnam to 5.2 per cent: UOB

|

With growth in the first half of this year (1H/2023) coming in well below target, it would be a tall order for the bank to achieve its initial projection of 6 per cent, UOB reported.

It stated, "While domestic sectors have performed well, particularly with recent positive policy measures including cuts to benchmark interest rates and VAT, these are not sufficient. Manufacturing and external trade will also need to return fully to contribute to stronger growth."

The outlook presents a challenge for UOB, particularly in the fourth quarter (4Q/2023), as the bank reported strong earnings for the same period last year. Therefore, 3Q/2023 will be key, as these are the months that traditionally see a ramping up of production and exports ahead of the year-end festive demand in developed markets.

UOB noted, "As such, downside risks remain, especially if exports and manufacturing fail to see any significant improvements in the months ahead and will put our projection for 3Q23 of 7 per cent growth on-year, and our full-year forecast of 5.2 per cent growth in jeopardy."

The official growth forecast of 6.5 per cent is likely to slip further away given the outcome in 1H/2023. In its latest country review for Vietnam completed at the end of June, the International Monetary Fund pegged Vietnam’s growth projection at 5.8 per cent.

|

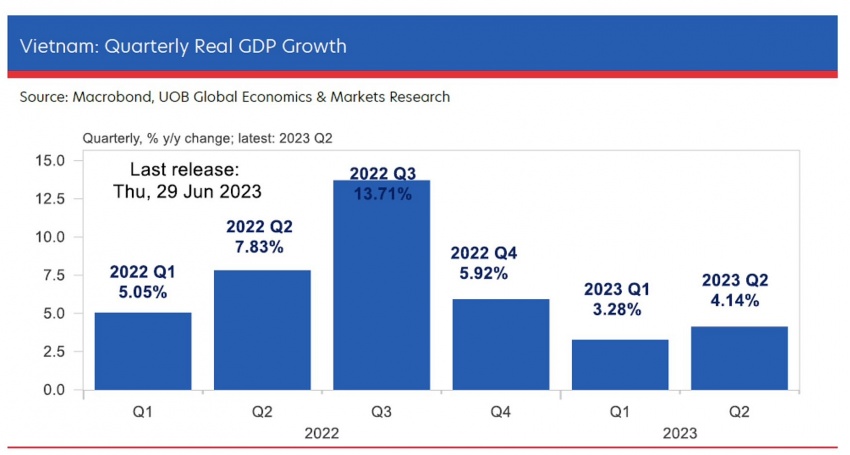

Data released by the General Statistics Office last week showed Vietnam’s real GDP growth rate in 2Q/2023 picked up its pace to 4.14 per cent on-year from a downwardly revised 3.28 per cent on-year in 1Q/2023. The outcome was ahead of the consensus forecast of 3.8 per cent but fell short of the call of 5.9 per cent.

As has been the case since earlier this year, the main cause for the tepid performance continued to be weakness in manufacturing and external demand. All in, the first half of 2023 saw Vietnam’s economy expand by 3.72 per cent on-year, well below the 6.46 per cent pace in 1H/2022 and the official growth target of 6.5 per cent.

In terms of sectoral performance, manufacturing (including construction), which accounts for about a 34 per cent share of the economy, managed to gain about 1.1 per cent on-year and contribute positively in 1H/2023 after dipping into its first contraction since 3Q/2021.

Meanwhile, the services sector (43 per cent share) managed to cushion some of the losses from the external sector, rising 6.1 per cent on-year in 2Q/2023 and extending the 6.6 per cent on-year run in 1Q/2023. The services sector contributed 2.7 percentage points, or more than 60 per cent of the headline growth in 1H/2023.

Economists have said that the main cause for the manufacturing sector’s poor performance was mainly weak external demand, which has been the case since early 2023 and covered key exporting economies in Asia as policy tightening in developed markets squeezes demand. This was further compounded by the ongoing US-China friction, which weighed on supply chain activities.

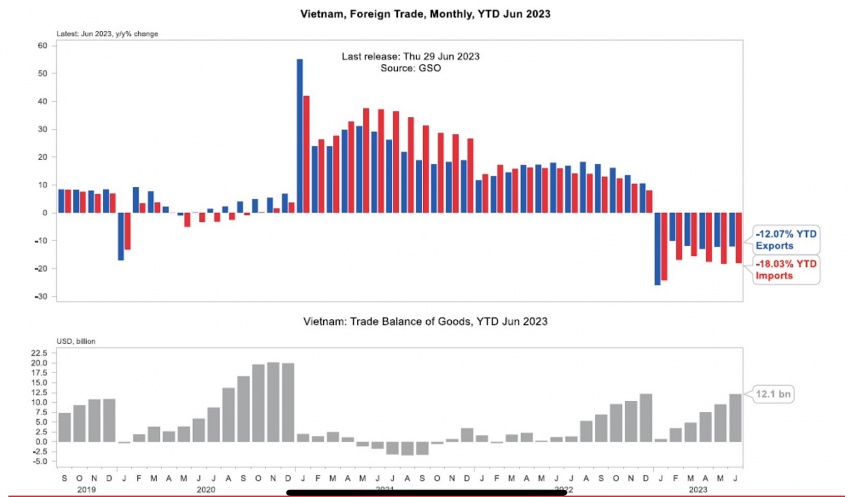

Exports in 2Q/2023 fell by 14.2 per cent on-year, while imports fell by 22.3 per cent. This is an extension from 1Q/2023 saw exports contracting by 11.9 per cent on-year and imports declining. In the first half of this year, exports have declined by more than 12 per cent on-year, and there has not been a month of gains since the end of 2022.

The statistics office also reported that the country’s main exports earners, smartphones, fell by 27.1 per cent on-year in 2Q/2023 to 39.8 million units, while garment output fell by 2.9 per cent and footwear output edged down by 4.1 per cent during the quarter.

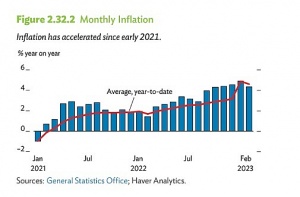

On the domestic front, retail sales of goods and services in the first half of this year rose by 10.9 per cent on-year, while average consumer prices in the period rose by 3.29 per cent. The pace of inflation has eased despite strong domestic demand.

The consumer price index decelerated further, to 2.4 per cent on-year in 2Q/2023 from 4.18 per cent on-year in 1Q/2023, coming in below the government’s target of 4.5 per cent.

Core inflation (which excludes food, energy, and other public services prices) edged down to 4.48 per cent on-year in 2Q/2023 from 5.01 per cent on-year in 1Q/2023, providing room for the central bank to ease its policy stance in the first half.

In view of the soft economic momentum, the State Bank of Vietnam (SBV) had been more aggressive than anticipated, cutting its refinancing rate an accumulative 150 basis points by June to 4.5 per cent.

UOB had expected cuts of 100 based points in the first half of 2023. With these actions, the SBV has shifted towards a more accommodative stance, and further rate easing will be likely in 3Q/2023.

Weak exports that could potentially spill over into domestic demand, the US Fed’s rate pause in June, possible rate reductions in 2024, and confidence from a steady VND exchange rate despite the previous rounds of rate reductions have bolstered the prospect of further rate cuts in Vietnam this year.

"As such, we factor in another 100 basis point rate reduction in 3Q/2023 before the SBV pauses to assess the effects," UOB noted in its report.

| ADB sets moderate 2023 growth outlook for Vietnam After a strong performance last year, the Vietnamese economy can expect moderate growth of 6.5 per cent this year, followed by a slight improvement to 6.8 per cent in 2024, according to a recent economic publication from the Asian Development Bank (ADB). |

| OECD forecasts Vietnam's GDP growth at 6.5 per cent The Organisation for Economic Cooperation and Development (OECD) expects Vietnam's economy to grow steadily, with GDP at 6.5 per cent in 2023 and 6.6 per cent in 2024. |

| Vietnam's GDP growth slows in Q1 ahead of expected recovery Vietnam's Q1 GDP growth slowed to 3.3 per cent due to a number of factors, including weak exports. However, a recovery is anticipated as interest rates decline and the government implements measures to stimulate economic growth. |

| MPI highlights two GDP growth scenarios for H2 The Ministry of Planning and Investment (MPI) updated two scenarios in the second half of 2023 for Vietnam to strive for GDP growth of 6-6.5 per cent for the whole year, at the government's monthly meeting on July 4. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- 14th National Party Congress expected to shape Vietnam’s path to 2045 (January 17, 2026 | 16:00)

- CVFA chief highlights role of 14th National Party Congress (January 17, 2026 | 15:54)

- Tablets to replace paper at 14th Party Congress (January 16, 2026 | 21:27)

- Hanoi to display firework to celebrate the 14th National Party Congress (January 16, 2026 | 21:21)

- Vietnam, UN strengthen cooperation in digital technology, AI (January 16, 2026 | 16:48)

- VN-Index could reach 2,040 points in 2026 (January 16, 2026 | 16:41)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- ASML signals long-term commitment to Vietnam (January 16, 2026 | 12:00)

- Ho Chi Minh City starts construction of four key infrastructure projects (January 15, 2026 | 17:22)

- ASEAN Digital Ministers' Meeting opens in Hanoi (January 15, 2026 | 15:33)

Mobile Version

Mobile Version