Outlooks lowered as weaker trade hampers 2023 growth

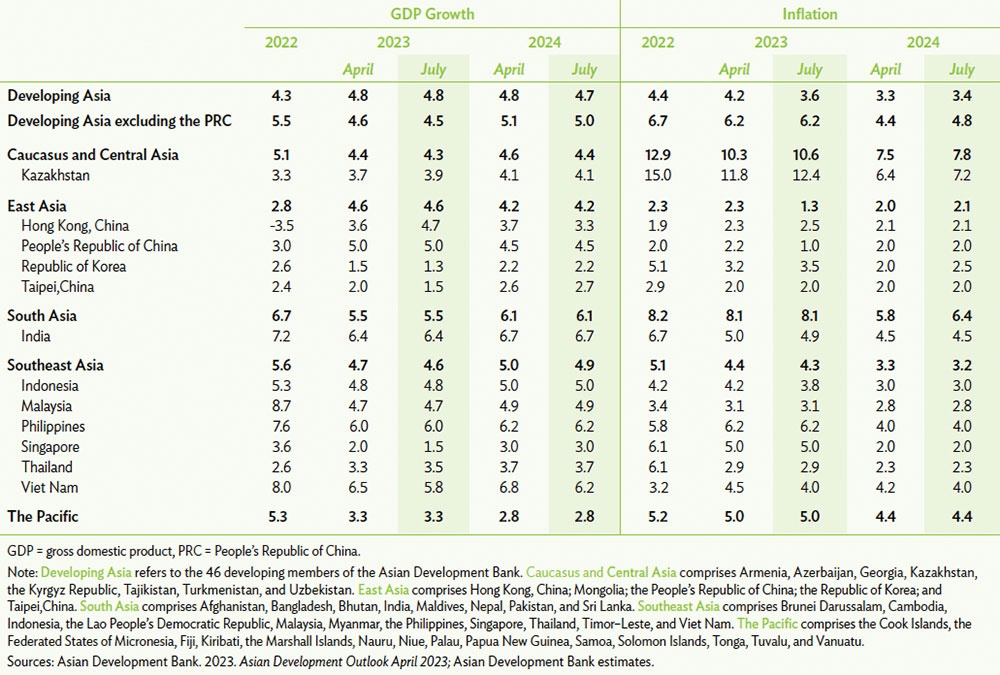

According to the Asian Development Bank’s (ADB) Asian Development Outlook released last week, the economic growth outlook for Southeast Asia has been lowered to 4.6 per cent this year and 4.9 per cent next year, compared with April estimates of 4.7 and 5 per cent, respectively.

The ADB also revised its growth forecast for Vietnam down from 6.5 to 5.8 per cent in 2023, and from 6.8 to 6.2 per cent in 2024.

Vietnam’s growth slowed from 6.5 per cent on-year in the first half of 2022 to 3.72 per cent a year later as external demand weakened and growth in manufacturing output slowed to only 0.4 per cent - the lowest half-year figure in a dozen years.

The ADB said that the Purchasing Managers Index has languished below 50 since March as weaker trade growth closed many businesses, notably in export-driven manufacturing. Industrial production was also hit by recent power outages in the north and trouble in the real estate sector. A credit crunch in response to the corporate bond market and bank exposure to elevated property risk has also squeezed construction.

“Weak external demand continued to put pressure on manufacturing and industrial production, while domestic conditions are expected to improve. Inflation is forecast to slow to 4 per cent in 2023 and 2024,” said ADB chief economist Albert Park.

Feeble domestic production and ongoing global risks have also prompted Fitch Solutions to revise Vietnam’s economic performance downwards this year.

“We expect Vietnam’s real GDP growth to slow sharply from 8 per cent in 2022 to 5.8 per cent in 2023,” Fitch Solutions said in its Vietnam country risk report released last week.

Prompted by economic difficulties, the International Monetary Fund has also lowered its 2023 prediction for Vietnam’s growth from 6.2 per cent in January to 4.7 per cent two weeks ago. This year’s rate will, however, also be among the highest in the Emerging and Developing Asia group of 30 economies.

The World Bank, however, has said thanks to its solid foundations, the economy has proven resilient through different crises. GDP growth is projected to ease to 6.3 per cent in 2023, down from 8 per cent in 2022, due to the moderation of domestic demand and exports.

“Vietnam’s economic growth is expected to rebound to 6.5 per cent in 2024 as domestic inflation could subside from 2024 onward. This will be further supported by the accelerating recovery of its main export markets such as the US, Eurozone, and China,” the World Bank said.

|

Maintaining goals

Figures from the Ministry of Industry and Trade showed that in the first half of this year, Vietnam’s export value sat at about $164.45 billion, down 12.1 per cent on-year – with domestic enterprises coming at $43.41 billion, down 11.9 per cent and accounting for 26.4 per cent of the economy’s total export turnover, and foreign-invested enterprises (including crude oil exports) hitting $121.04 billion, down 12.12 per cent and occupying 73.6 per cent of the total.

Many key export markets of Vietnam have also seen an on-year reduction in turnover in the first six months of this year, including China, down 2.2 per cent; the US, down 22.6 per cent; the EU, down 10.1 per cent; ASEAN, down 8.7 per cent; and South Korea, down 10.2 per cent.

Meanwhile, the General Statistics Office reported that as compared to the same period last year, the added value of the whole industrial sector declined 0.75 per cent in Q1 but rose to 1.65 per cent in Q2, leading to a rate of 0.44 per cent in H1.

In the first half of this year, the growth rate of the mining sector dropped 1.43 per cent on-year, while the manufacturing and processing sector – which creates 80 per cent of industrial growth – climbed 0.37 per cent on-year.

However, while steadfastly holding the economic growth target for 2023, the government has ordered the prime priority on boosting growth, with new solutions designed to fuel business performance.

Prime Minister Pham Minh Chinh has required authorities at all levels to “place the biggest priority on successfully achieving the set target of 6.5 per cent in economic growth this year.”

“We have no plan to revise the growth goal of 6.5 per cent for 2023. Despite lower-than-expected economic growth in the first six months, all efforts must be made to hit the set growth target for the entire year,” PM Chinh said. “To realise the growth goal, we must continue drastically supporting enterprises.”

On July 13, he issued a telegram to relevant authorities nationwide, asking them to urgently implement administrative reforms across the board.

Chinh ordered them to “publicise in a timely, sufficient, and accurate manner administrative procedures on the National Database on Administrative Procedures so that cadres, public servants, the public, and businesses can know, implement, and supervise the implementation.”

On a monthly basis, procedures that are newly issued, amended, supplemented, or annulled must be made clear and in full to ensure close control over the enactment and implementation of the procedures, PM Chinh stated.

Grand expectations

Senior economist Raymond Mallon told VIR that reaching the 2023 economic growth target would require a sharp turnaround in manufacturing and construction growth, improvements in service sector growth, and sustained agriculture growth.

He said that continued increases in public investment, and implementation of recent major policy initiatives in energy and tourism, should help to improve investor sentiment and stimulate further acceleration in economic growth.

“Further strong growth in accommodation and food services is very likely as international travel continues to recover, and recent visa reforms begin to impact. While some improvement in manufacturing growth is expected in the rest of the year, a return to higher trend growth rates may have to wait until 2024,” Mallon said.

According to business associations in Vietnam, although the government has made great efforts to reduce and simplify many administrative procedures, many regulations are still vexing businesses, investors, and individuals.

The Business Climate Index report, released two weeks ago by the European Chamber of Commerce in Vietnam, showed that the country continues to draw foreign investors, with 48 per cent of respondents expecting an increase in their company’s foreign direct investment in the country next quarter.

However, a total of 40 per cent of businesses expressed no plans for elevated investment, marking a 4 per cent increase from the previous index. Nevertheless, Vietnam remains firmly positioned among the top five investment destinations for over one-third of businesses, underscoring its enduring appeal.

Despite this, the report has highlighted the importance of improving the regulatory environment, developing infrastructure, and ensuring access to financing to enhance Vietnam’s attractiveness for funding from overseas.

It also emphasised that unclear regulations and onerous administrative procedures are the primary barriers hindering such investment, with over half of businesses citing them as the most significant regulatory obstacles impeding their operations.

| Historic support enters new phase for Japan and Vietnam Japan’s investment in Vietnam’s new sectors will expand thanks to a new scheme currently under discussion, expected to help increase bilateral trade. |

| Japanese cooperation focus stretching to new areas Early this month, Japan signed new loan agreements for Vietnam. Kubo Yoshitomo, senior representative at the Vietnam Office of the Japan International Cooperation Agency (JICA), talked with VIR’s Dat Nguyen about the overview of JICA’s cooperation in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version