SMEs face barriers to joining global supply chain

|

"Mechanical companies see many opportunities during the current spate of relocations from China to other countries, including Vietnam. However, we cannot take advantage of these opportunities due to a lack of capital and incentive mechanisms," said Dai.

According to Dai, to join the supply chain of global manufacturers, businesses in the supporting industries must meet at least two criteria, namely quality and cost. This requires them to offer high-quality products at competitive prices.

"Accessing or studying advanced technology from around the world is not a difficult problem for Vietnamese businesses, especially startups. But capital shortage is the biggest barrier because investing in modern technology takes a lot of money," he said, adding, "The small amounts of equity capital available to SMEs in Vietnam makes it difficult to invest in new technology, and there are too many barriers to getting a bank loan."

Mechanical manufacturers are recommending that the government research and implement more preferential policies for local suppliers such as tax exemption, lending-rate reductions, and simplification of procedures for loans from the state’s support funds.

"We propose that the government should assign focal points to monitor production chains and notify businesses of requirements for selecting component suppliers and supporting manufacturers so that SMEs can register to participate in the production chain. We also expect to have an organisation, which connects potential foreign-invested enterprises and foreign investors with domestic suppliers," explained Dai.

SMEs constitute the majority of the Vietnamese manufacturing sector and are largely responsible for supplying components and spare parts for the automotive and electronics industries.

"These suppliers are well aware of the regulations and requirements regarding quality and delivery times. However, producing components for high-tech products such as automobiles or aeroplanes is much more challenging. For the aviation industry, some Vietnamese companies can produce separate small components for lower-tier suppliers of Boeing, but it is highly technical to be a supplier for a global aviation corporation like Boeing," said deputy chairwoman and secretary general of the Vietnam Association of Supporting Industries Truong Thi Chi Binh.

Binh said that to become a link in the global aviation industry supply chain, countries need to have long-term preparation plans put in place, citing the example of India and Malaysia, who started building strategies for developing their aerospace industry 30 years ago.

| Vietnam’s semiconductor challenge and the potential within Amid the current restructuring of supply chains, perhaps no industry more so than the semiconductor industry exemplifies the lucrative opportunities and the complex dynamic between security and business. Having benefited to become a key element in supply chains across a number of industries, Vietnam has announced ambitious plans to do the same in the semiconductor industry. |

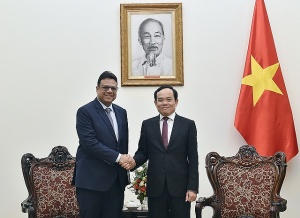

| P&G asked to help Vietnamese businesses join its supply chain Deputy Prime Minister Tran Luu Quang has asked Procter & Gamble (P&G) to expand its partnership and create the best conditions for Vietnamese businesses to join its supply chain. |

| Cainiao PAT Logistics Park welcomes warehousing partner Mixue Cainiao Group, the logistics arm of Chinese e-commerce giant Alibaba Group, welcomed food and beverage company Mixue to its PAT Logistics Park in Vietnam’s southern province of Long An on March 18. |

| Lam Research to build semiconductor factories and supply chain in Vietnam American chip-making technology provider Lam Research Corp. (NASDAQ: LRCX) is keen on building factories and developing a supply chain within Vietnam's semiconductor industry. |

| Logistic predictions in 2024 Le Khanh Lam, partner at RSM Vietnam, delves into changes in the logistics and commerce landscapes in 2024. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Agro-forestry and fisheries exports jump nearly 30 per cent in January (February 09, 2026 | 17:45)

- Canada trade minister to visit Vietnam and Singapore (February 09, 2026 | 17:37)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- Vietnam forest protection initiative launched (February 07, 2026 | 09:00)

- China buys $1.5bn of Vietnam farm produce in early 2026 (February 06, 2026 | 20:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

Tag:

Tag:

Mobile Version

Mobile Version