New renewable energy policy enters limelight

|

| Increased participation of the private sector will help push on development of renewable energy |

With its strong commitment to reducing CO2 emissions and with a healthy investment outlook, Vietnam has been deemed by industry insiders to be the most exciting renewable energy market in Southeast Asia. The country set a goal for installed solar capacity to 12 gigawatts, and to 6GW of wind capacity, by 2030 in alignment of the national Power Development Plan VII (PDP7) for the period of 2016 -2030 with a vision to 2030, but it will not stop there as targets to deploy total renewable power capacity is expected to increase in brand new power master plan (PDP8) for 2021-2030, with a vision towards 2045 .

Speaking at recent conference on sustainable renewable energy development, Deputy Minister of Industry and Trade Hoang Quoc Vuong remarked that rapid economic development has seen a surge in demand for energy, posing great challenges at a time when primary sources like coal, oil, and gas are exhausted in the context that many coal-fired projects under PDP7 are behind schedule.

“In this context, making use of endless natural resources, especially wind and solar power, to generate electricity for socio-economic development and reduce pressure on the national electricity system and many other benefits is one of the most important trends and solutions today,” said Vuong.

Global energy research and consultancy group Wood Mackenzie also praised Vietnam as the new leader in Southeast Asia’s solar photovoltaic (PV) market, noting the nation’s solar PV installation made up close to half of the region's total capacity last year.

Positive movements

With high growth over recent times, the Vietnamese solar market is hotter than ever thanks to the feed-in tariff (FiT) of 9.35 US cents per kilowatt-hour (kWh) for solar projects as set by 2017’s Decree No.11/2017/QD-TTg on mechanisms for encouraging development of solar power, when both foreign and local investors are registered and large-scale projects are connected to the grid.

According to recent data by state-run Electricity of Vietnam (EVN), solar generation in the first quarter of 2020 surged by 28 times to 2.3 billion kilowatt-hours on year; among that, 91 solar farms with total capacity of 4,550 megawatts connected the grid.

“This is an impressive achievement that validates the government’s step-by-step approach to market development and the ability of domestic and international developers to mobilise capital for scalable renewable energy portfolios,” remarked Michiel Vriens, energy analyst from the Institute for Energy Economics and Financial Analysis. “It also highlights the ability of modular renewable projects to deliver much-needed capacity more rapidly than large-scale baseload fossil fuel projects that require large expenditures on associated infrastructure.”

Meanwhile, wind industry analysts GWEC Market Intelligence noted that Vietnam had a cumulative installed wind power capacity of over 487MW by the end of 2019, making it the second-largest wind market in Southeast Asia. Due to strong flows of foreign and domestic investors into Vietnam’s wind sector, the market is predicted to install approximately 4GW of additional capacity by 2025, with at least 1GW offshore.

Currently, UK-based Enterprize Energy is planning to develop the $11 billion Thang Long Offshore Wind Power Project with total capacity of 3,400MW. If approved, the project will be the largest offshore wind power project not only in Vietnam, but also in Southeast Asia, with success providing a large amount of clean electricity for the country’s power mix.

On top of these targets, the government also raised the FiT for both onshore and offshore wind in September 2018, in order to spur market activity and balance out the high risks within emerging markets, specifically power purchase agreement bankability.

Under that, the new FiT is 8.5 US cents per kWh for wind power projects on the mainland and 9.8 US cents per kWh for offshore projects. The rates are applied to wind power plants connecting to the national grid and beginning generation before November 1, 2021.

However, the Ministry of Industry and Trade recently asked the government to extend the period of fixed FiT for wind power project to the end of 2023 instead of November next year in order to avoid delays hit by the global health crisis.

“In order to ensure energy transfer and harmonise the interests of parties, the business community and localities need to enhance dialogue, information sharing, and solutions to remove bottlenecks for the development of renewable energy in Vietnam,” Vuong emphasised.

Vietnam’s electricity sector requires new investments of about $10 billion annually frontloaded through 2030, higher than the average of $8 billion for the period 2011-2015, according to the World Bank. Meanwhile, the envisaged expansion of the gas sector calls for an accumulated investment of around $20 billion between 2015 and 2035.

|

Attracting the private sector

Vietnam has enacted its strategic orientations for energy development for the next decade and beyond, encouraging more in the private sector to make the next step for future development and ensuring energy security to meet new demand.

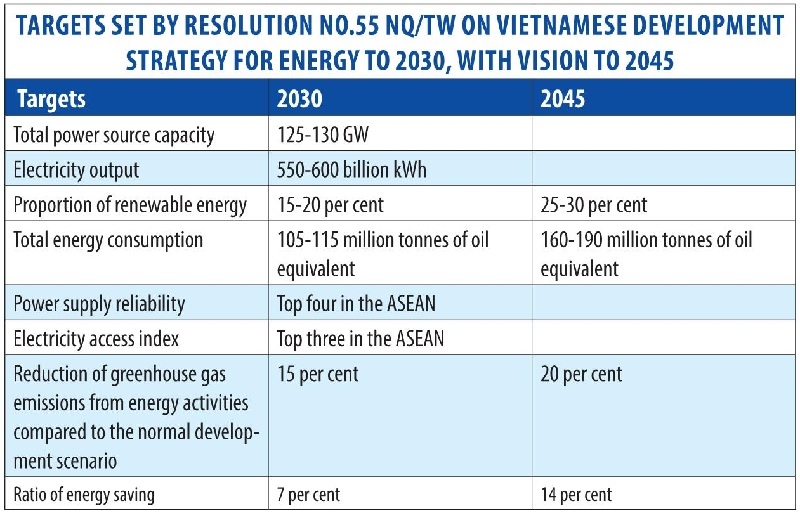

Under February’s Resolution No.55 NQ/TW on the Vietnamese energy development strategy for the next 10 years and with a vision to 2045, targets have been set for sufficient and stable supply energy with reasonable prices as well as for accelerating development of a comprehensive, competitive, and transparent energy market with diversified ownership and business models.

Sector experts said that the participation of the private sector will create competition for the market. Deeper private participation in the energy sector not only ensures greater security for the nation’s energy security, but also creates a transparent environment, and they are willing to invest as long as projects are well-structured and bankable.

Nguyen Tam Tien is general director of locally-invested Trung Nam Group – the first group allowed by the government and the People’s Committee of the south-central province of Ninh Thuan to invest in a 500 kilovolt transformer and transmission station. Tien said Resolution 55 was helping to remove unreasonable barriers to private investment in transmission, therefore making businesses excited as renewable energy bottlenecks are removed.

Tien explained that benefits have been made available to all side through the private implementation of the transmission station project, especially in the context of poor power transmission infrastructure which has also hampered development of renewable power. The state and the provinces also do not have to spend money to invest in lines. “The private sector needs good incentives to incorporate a proper risk-sharing mechanism among all parties, as well as a transparent and stable regulatory environment,” he suggested.

Meanwhile, more international enterprises are waiting for Vietnam’s direct power purchase agreement (DPPA) mechanism. In May the Vietnamese government introduced a mechanism which allows renewable energy producers to sell and deliver electricity directly to corporate customers. For the first time ever, the private sector could see more chances for investment into the national electricity transmission system.

Resolution 55 places high priority on fast and sustainable energy development, aiming to increase the share of renewable energy sources in total primary energy production to 15-20 per cent by 2030, and 25-30 per cent by 2045. More mechanisms and policies will be developed to encourage investment and establish a suitable fossil fuel reduction plan.

Vietnam’s renewable sector growth is expected to develop to the next level and take shape for the next round of market opportunities as targets are set for PDP8, in which the main issues will be how grid development is designed to support the growth of renewables, and how PPAs and new storage options will be factored into the plan.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Towards Sustainability

- $100 million initiative launched to protect forests and boost rural incomes

- Decree opens incentives for green urban development

- European expertise to boost Vietnam’s sustainable logistics push

- Living with water: from policy to practice of the 'sponge cities' concept

- From climate pressure to new urban mindsets

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version