MoMo dominates Vietnam's e-wallet market with 68 per cent share

|

In an exciting development in the digital landscape in Vietnam, Decision Lab, the exclusive partner of YouGov in the country, together with the Mobile Marketing Association Vietnam, recently released its Q1/2023 report titled The Connected Consumer.

The report reveals that the super app MoMo has risen to lead the e-wallet landscape in Vietnam, capturing an impressive 68 per cent market share of this fintech sector.

Following MoMo were Zalopay at 53 per cent, Viettelpay at 27 per cent, ShopeePay (Airpay) at 25 per cent, VNPay at 16 per cent, and Moca (Grabpay) at 7 per cent.

The Connected Consumer report focuses on the online habits of Vietnamese consumers, encompassing their usage of social media, entertainment platforms such as music, movies, and online videos, and online shopping.

A representative from MoMo attributed the success to the continuous efforts made by the company to improve its user interface and expand and enhance the features and utilities of its super app platform.

Alongside its commitment to cashless payments, MoMo has been at the forefront of providing investment, accumulation, and savings services, catering to the personal financial needs of the Vietnamese population.

A MoMo representative said, “As we enter Q2, we continue to make waves by introducing numerous new services and utilities. The company has recently become an integrated payment method on the online Apple Store. In early April, MoMo also partnered with YouTube Premium, enabling users to make payments through its platform in Vietnam.”

With approximately 31 million users, MoMo has solidified its position as a major player in the market. Meanwhile, ZaloPay is also expanding its ecosystem and user base, having reached approximately 11.5 million payment users in 2022.

Moreover, as Vietnam embraces the digital revolution, a fascinating trend has emerged with the rapid rise of QR-code based payments, e-wallets, and digital banking applications, igniting a cashless revolution across the nation.

Numerous users have voiced their preference for e-wallet payments, citing the alluring discounts and vouchers they receive as key factors.

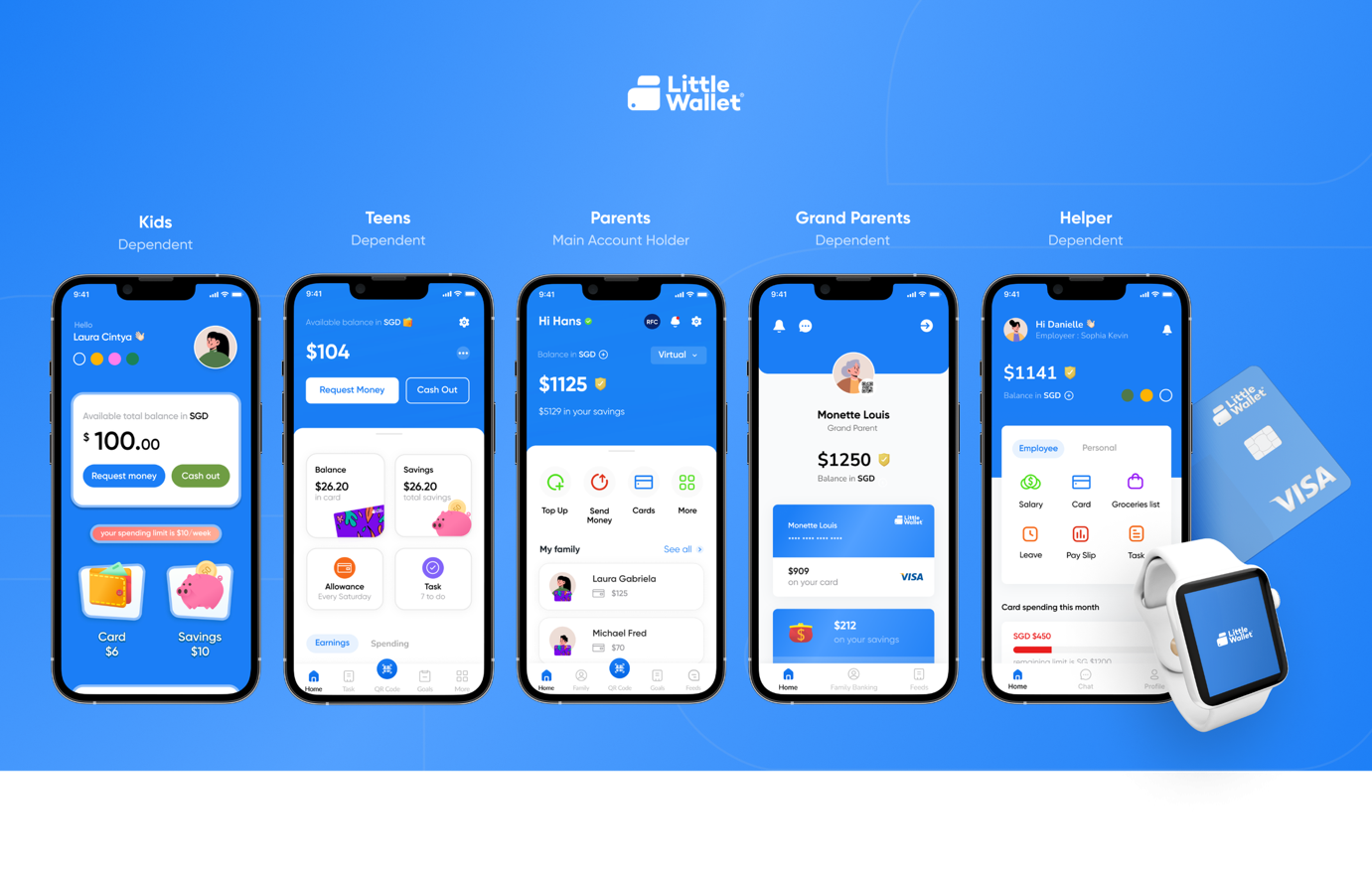

| Little Wallet secures pre-seed funding of $1.6 million Little Wallet, a fintech company headquartered in Singapore, has secured $1.6 million in pre-seed funding led by Tikaani Partners. |

| Visa and SmartPay to boost digital payment solutions for MSMEs Visa and SmartPay announced a partnership on May 17 that will empower micro, small, and medium-sized enterprises (MSMEs) with the essential tools that they need to compete in the burgeoning digital payment era. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Mobile Version

Mobile Version