Little Wallet secures pre-seed funding of $1.6 million

|

The company's primary focus is to promote smart-money habits and improve financial wellbeing for entire families. This is particularly important in Southeast Asia (SEA), where financial literacy rates are among the lowest in the world, according to the S&P Global FinLit Survey.

Cyrus Daruwala, managing director of Global Financial Services at IDC cited, “Traditional banks do a great job tailoring their services towards financially established adults, but none have done well building services for families and younger pre-collegiate consumers. These digital natives are a part of the multi-billion-dollar addressable market. Contrary to belief, most customers often stay with their first bank, so it is important to introduce them to banking while they are young.”

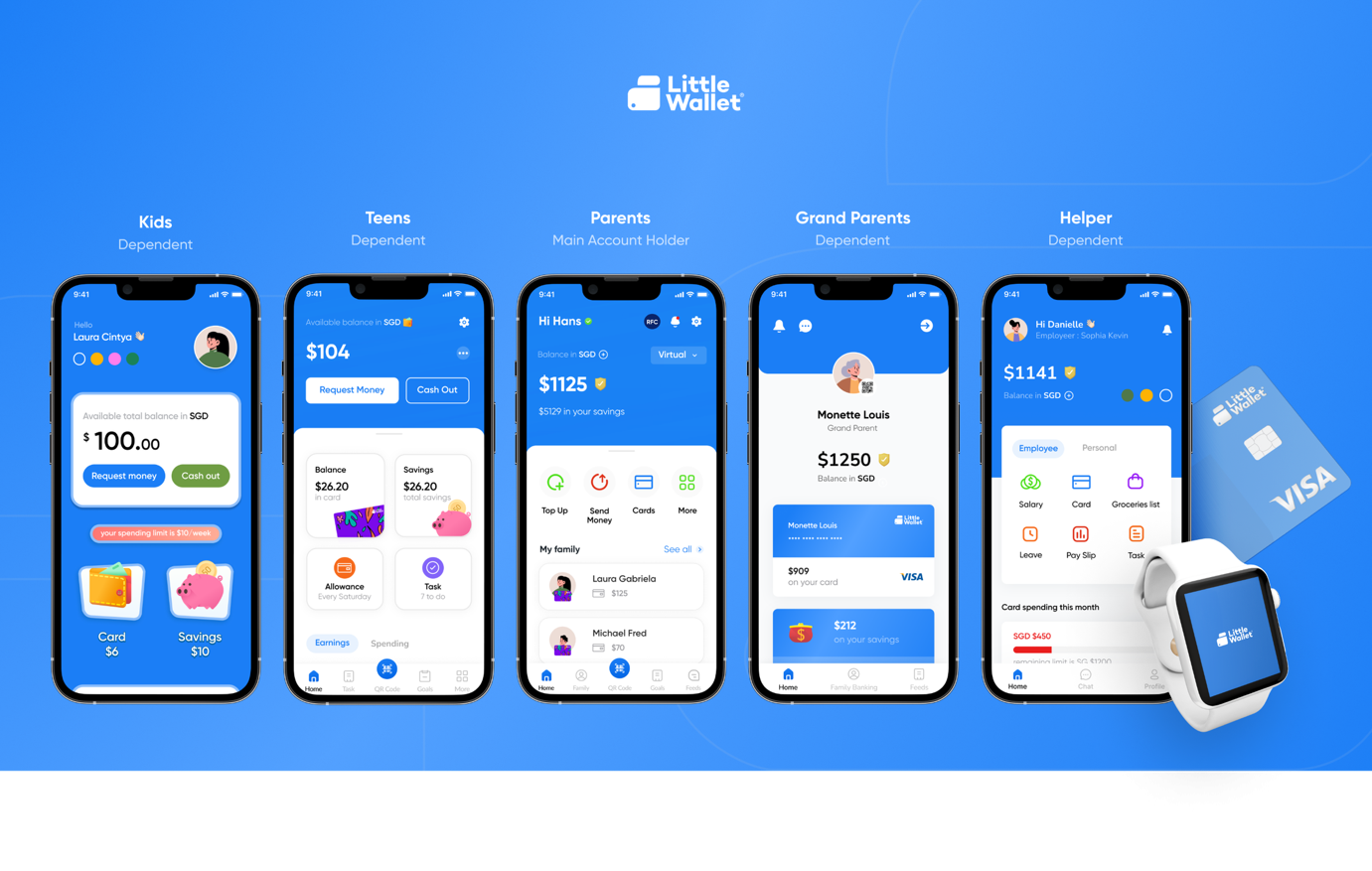

Little Wallet is pioneering the concept of family banking in Southeast Asia, which has not been introduced in the region before. The company's founder Rahul Sharma and co-founder Phoebe Tran, both INSEAD global executive MBA classmates, have developed an all-in-one money management platform designed for families.

It offers a comprehensive suite of services focused on earning, saving, budgeting, spending, and giving. It comes equipped with a debit card, a companion app, a wearable device for tap and pay transactions, and an educational resource for teaching critical financial skills to younger people.

Little Wallet aims to differentiate itself from traditional banking brands by creating a gamified, youthful, and modern brand image that appeals to users aged 13-18 and even as young as 6-12 years old. Little Wallet seeks to strike a balance between being super cool and appealing to younger users, while also being a reliable and accessible resource for financial education.

Sharma said, “Our customers' data safety and security is our utmost priority. Our top focus is to embrace zero personal data knowledge, implement strong encryption techniques, adhere to industry standards, carefully select our technology partners, regularly test and monitor our security measures, and educate our customers on best security practices.”

Tran added, “We recognise the opportunity in SEA and plan to invest our first round of funding in scaling up our operations, engineering teams, marketing, and strategic partnerships. With partners like Visa in place, we are prepared for big launches in selected SEA markets.”

| Banks jump into the e-wallet business More and more banks are entering the e-wallet business as they see huge growth potential in the wake of the Government’s plan to reduce cash payments to below 10 per cent of all transactions by 2020. |

| Winners to take it all in e-wallet race An economic expert has said e-wallet firms are breaking out promotions to try and win large chunks of the high potential market in Vietnam. |

| Little Wallet aims to enhance financial literacy among children Little Wallet, a Singapore-based fintech, with the mission to promote financial literacy among children, has signed a partnership with Visa. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

- Dassault Systèmes and Nvidia to build platform powering virtual twins (February 04, 2026 | 08:00)

- The PAN Group acquires $56 million in after-tax profit in 2025 (February 03, 2026 | 13:06)

- Young entrepreneurs community to accelerate admin reform (February 03, 2026 | 13:04)

- Spring Fair 2026 launches national fair series (January 30, 2026 | 16:17)

- SnP celebrates 10th anniversary with new brand identity (January 30, 2026 | 14:41)

Mobile Version

Mobile Version