Global sustainability reporting by KPMG shows improvement in Asia-Pacific

The KPMG Survey of Sustainability Reporting, which was first released in 1993, is produced every two years. This year's edition analyses sustainability and environment, social, and governance (ESG) reports from 5,800 organisations across 58 nations and jurisdictions.

According to the survey, sustainability reporting has increased consistently. About 96 per cent of the top 250 firms in the world, known as the G250, report on sustainability or ESG issues.

Meanwhile, the number of reports from the N100 (the top 100 companies in each country or jurisdiction analysed) has increased steadily. Around two-thirds of the N100 group of businesses issued sustainability reports ten years ago and this figure has now climbed to 79 per cent.

The Asia-Pacific region takes the lead in this field, with 89 per cent of its enterprises reporting on sustainability. The region is followed by Europe (82 per cent), the Americas (74 per cent), and the Middle East and Africa (56 per cent).

|

The survey results indicate that businesses throughout the world are increasingly realising that they can make a contribution to achieving climate goals. An astonishing 71 per cent of the N100 and 80 per cent of the G250 have established carbon reduction goals. It is encouraging to see that the majority of businesses understand they must cut their own emissions rather than rely on carbon credits.

The survey also identifies some areas where more rapid development is needed. Less than half of firms currently deem biodiversity loss as a risk, and only 64 per cent of G250 companies formally accept that climate change is a risk to their business.

According to Nguyen Chi Hieu, director of the ESG Advisory at KPMG Vietnam and Cambodia, this year’s report has also highlighted some further challenges the world’s major companies are facing in their reporting on ESG. Among the thousands of reports analysed, less than half of the world’s largest companies provided reporting on social components, despite increasing awareness of the link between the climate crisis and social inequality.

Hieu added, “At the same time, less than half of companies disclosed their governance risks. In addition, only a third of N100 companies have a dedicated member of their leadership team responsible for sustainability and less than a quarter link sustainability to compensation.”

The majority of ESG disclosures still focus on stories rather than disclosing quantitative or financial facts. He believes that businesses all around the world could do better in this area.

|

Commenting on Vietnam, ESG Sponsoring Partner for KPMG Vietnam & Cambodia John Ditty said, “Vietnam’s commitment to achieving net-zero carbon emissions by 2050 will require collaboration and action from players across the public and private sectors. The government needs to continue to make changes to the regulatory framework and corporations need to make voluntary commitments to support the government’s ambitions and drive sustainable values.”

In fact, the Vietnamese government is making progress with the disclosure standards for environmental performance. Data on social and environmental performance must be disclosed by public companies. However, Vietnam needs to encourage the disclosure of more essential quantitative ESG-related data in companies' sustainability reports, even though it is currently still optional for other organisations.

Additionally, there are growing calls for Vietnamese businesses to make net-zero promises and promptly take more significant action on carbon reduction in light of Vietnam's clear commitments at COP26.

For companies that have already started their decarbonisation strategy, it is more vital than ever to increase public awareness and visibility in their reporting.

Despite the fact that the majority of Vietnam's N100 companies have released sustainability reports, the survey's results show that there is a lack of compliance with established ESG reporting frameworks. It is encouraging that three-quarters of reporting companies have performed materiality assessments and are disclosing relevant information.

| KPMG exclusive #3: Transformative changes in mobility Vietnam has been grappling with heavy-impact mobility challenges, prompting employers to change focus. KPMG Vietnam’s recent Tax and Legal Institute highlighted the most critical trends affecting business in the years ahead. In the third of a series of four interviews on these findings, Andrea Godfrey, partner, head of Global Mobility Services of KPMG in Vietnam discusses with Tom Nguyen how mobility and employee expectations are changing for businesses in Vietnam. |

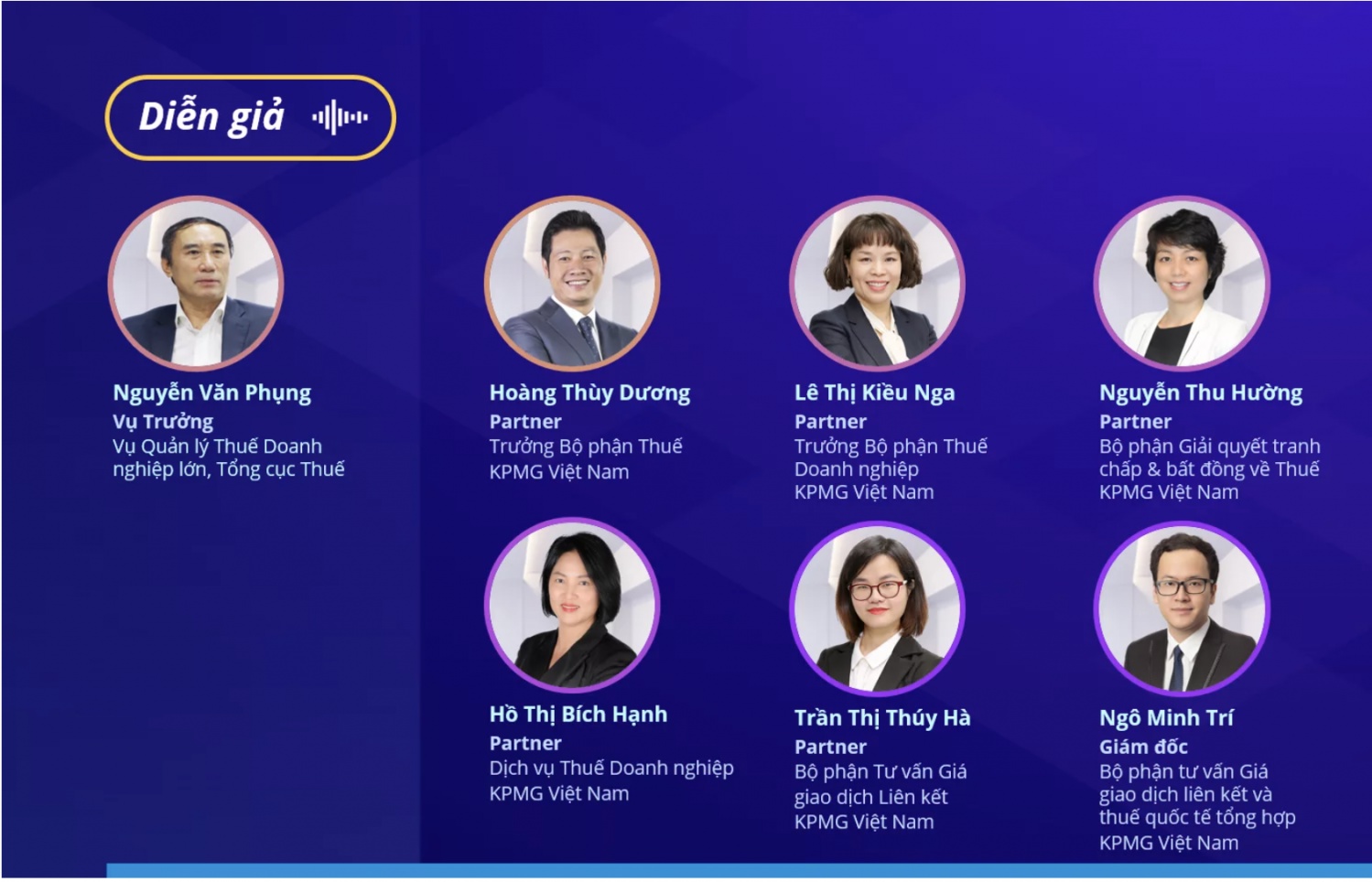

| KPMG assists businesses in tackling tax audit and inspection issues The changes in the current tax law and the tightening measures of tax inspection require businesses to review their tax compliance. KPMG in Vietnam launched the Tax & Legal 2022 programmes to support businesses in tax auditing and inspection in the 2022-2023 period. |

| KPMG releases first CFO report CFOs are more confident about the growth prospects of the country compared to those of the global economy, according to the latest Vietnam 2021-2022 CFO Survey by KPMG Vietnam. Additionally, 67 per cent of CFOs aspire to become a CEO, but only 10-12 per cent demonstrate current confidence and preparedness. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

- Bac Ai hydropower works stay on track despite holiday period (January 16, 2026 | 16:19)

- Fugro extends MoU with PTSC G&S to support offshore wind growth (January 14, 2026 | 15:59)

- Pacifico Energy starts commercial operations at Sunpro Wind Farm in Mekong Delta (January 12, 2026 | 14:01)

- Honda launches electric two-wheeler, expands charging infrastructure (January 12, 2026 | 14:00)

Tag:

Tag:

Mobile Version

Mobile Version