KPMG assists businesses in tackling tax audit and inspection issues

|

| KPMG's "Supporting Tax Audit and Inspection in 2022" forum |

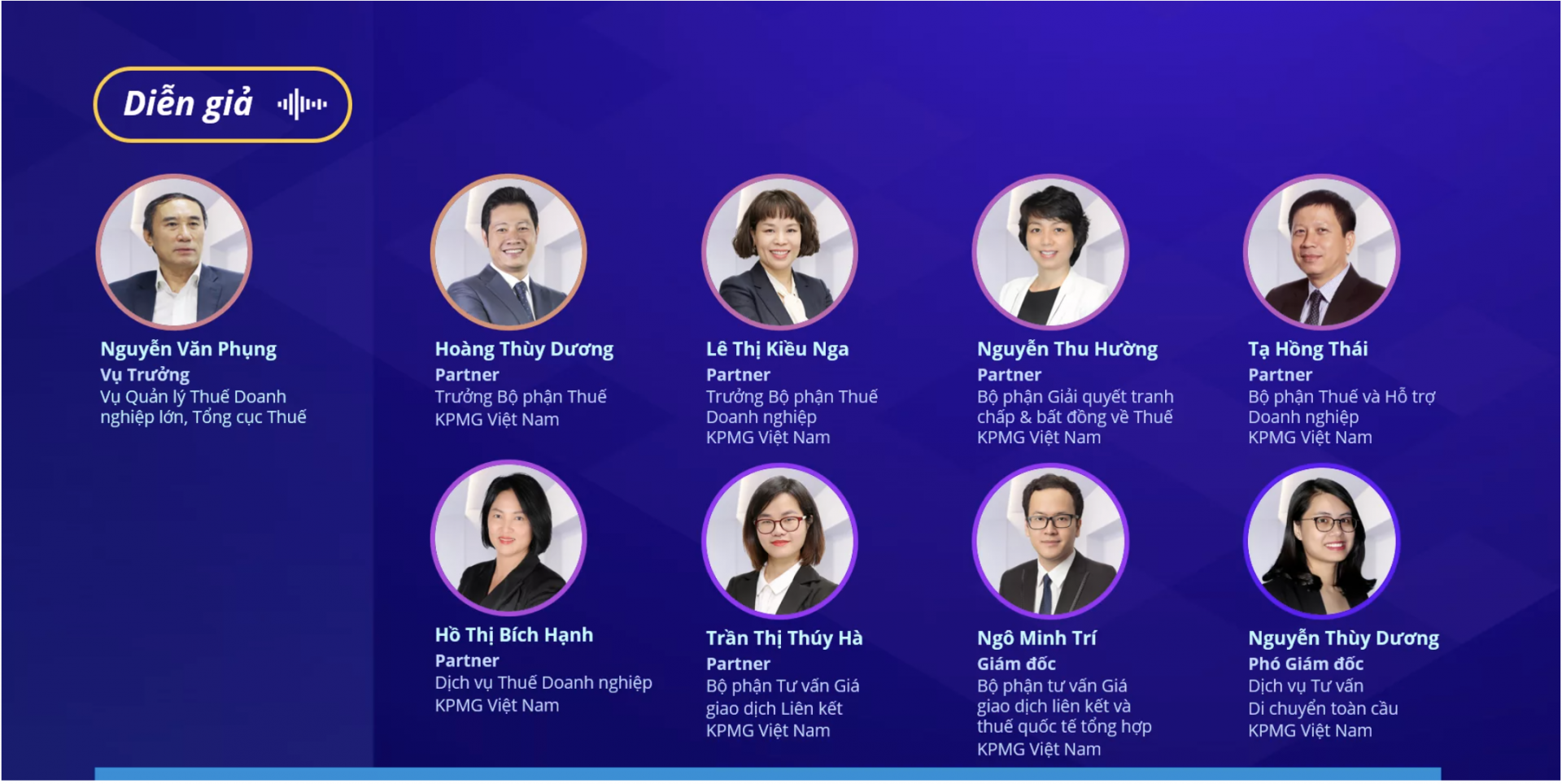

The forum Supporting Tax Audit and Inspection in 2022, organised by KPMG in Vietnam on April 14, saw the participation of more than 1500 representatives from businesses. At the forum, consultants and business representatives discussed difficulties and solutions for tax inspection and examination.

Hoang Thuy Duong, partner and head of Tax at KPMG in Vietnam, assessed that as businesses start to stabilise and restore production, it is time to prepare for the tax inspection and examination activities for 2022-2023. In addition to tax issues that existed before COVID-19, some new issues arose and needed to be viewed from a new perspective, especially as the tax law in Vietnam is revised in 2022 to suit the public’s needs, in accordance with international commitments.

Nguyen Van Phung, director of the Department of Large Enterprises at the General Department of Taxation, emphasised that tax authorities have switched to a new method of inspection and examination.

“The process will be off-site (electronic tax inspection) instead of at corporate headquarters. Data for the first three months of 2022 shows that over 5,000 inspections have taken place, most of which are off-site. State audit agencies, government inspectors, and tax agencies now tend to survey before issuing inspection decisions, especially with complicated cases,” Phung said.

Areas targeted for tax inspection and examination include issues of VAT refund and investment incentives, especially for expansions, transitions, and new projects. In particular, businesses that record losses will be under close scrutiny, especially those with foreign investment factors such as overseas parent companies or foreign partners.

Nguyen Thu Huong, partner and head of Tax Dispute Resolution at KPMG in Vietnam, added additional areas of tax inspection and examination in 2022 that tax authorities will focus on, including affiliate transactions, income from e-commerce activities, and payables to corporations and foreign parties.

According to Huong, to prepare for tax inspection and examination, enterprises should pay close attention to reviewing the tax compliance situation, assessing risks, and carefully preparing explanatory documents.

“Because of the pandemic, most businesses experienced difficulties in maintaining business operations, with revenues decreased as well as unusual expenses incurred. However, many tax inspection teams will be interested in further reasons for these losses, such as whether the company's documents are reasonable, whether they have applied the appropriate government support policies, or whether there are signs of policy abuse. Therefore, enterprises need to have complete data and records of both companies in Vietnam, suppliers, partners, and parent companies abroad to clearly demonstrate the factors that affected business results.” Huong noted.

KPMG in Vietnam's experts also provided many real-life examples of businesses that have been successfully consulted by KPMG in the process of tax inspection, especially related to issues in export VAT refund, expansion investment tax incentives, brand costs, and technology transfer costs, and so forth.

Le Thi Kieu Nga, partner and head of Tax & Corporate Services at KPMG in Vietnam, emphasised payments for administrative expenses.

"This is a sensitive concept and should not be used in transactions of related companies as it easily creates doubts for tax authorities. On the principle of market transactions, the proof for these expenses is also a point that enterprises should keep in mind when preparing explanatory documents," Nga said.

Nguyen Thuy Duong, partner at Global Migration Consulting Service at KPMG in Vietnam noted, “Enterprises should consider and classify the nature of COVID-19 expenses, relevant conditions to apply appropriate tax policies, and keep sufficient documents for tax inspection and examination purposes. For costs related to COVID-19 that are not mentioned in CV4110 and CV4102, businesses need to ask for more guidance from the General Department of Taxation and local tax departments.”

According to KPMG's experts, as the state budget revenues were affected by the pandemic, tax authorities will likely tighten inspection from 2022 onwards, with a focus on businesses with high tax risks.

Tran Thi Thuy Ha, Partner at General International Tax and Linked Transaction Price Advisory at KPMG in Vietnam pointed out some typical characteristics of high tax-risk businesses, such as continuous losses or low-profit margins, large fluctuations in profits over the years, and significant incurred costs with affiliates for internal services or for public copyrights and production technology. In particular, multinational corporations with a significant proportion of related parties are also in the category of high tax risk.

Ngo Minh Tri, director of General International Tax and Linked Transaction Pricing at KPMG in Vietnam, also recommended, "Businesses should maintain records for specific transactions related to the corporation's internal services or intangible assets."

The Q&A session received a lot of attention from participating businesses, followed by detailed responses from senior experts of KPMG in Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version