KPMG releases first CFO report

KPMG has recently conducted a CFO survey for C-levels and finance leaders to bring a holistic and in-depth understanding of current and future expectations for finance and the role of CFOs in organisations in Vietnam.

|

| KPMG releases first CFO report |

The survey comprises 69 respondents – CFOs and finance directors (68 per cent), chief officers and directors of other functions (13 per cent), presidents and CEOs (3 per cent), and other business leaders (14 per cent) – working in various industries, such as manufacturing, consumer goods, financial services, and others.

The study shows that 80 per cent of CFOs and business leaders are optimistic about the prospects of businesses and industries in Vietnam in the post-pandemic era, and more than 90 per cent of executives from publicly listed companies share this sentiment.

73 per cent of C-levels believe the role of CFO will witness a significant transformation in the next 3-5 years in terms of technology, business model, and operations.

In addition, 65 per cent of business leaders state that developing the capabilities of finance and accounting departments is a foremost priority in the upcoming years, with necessary skills in the future including cyber security, data analytics, IT and process automation, and strategic development.

Luu Bao Lien, partner at Financial Management Consulting, KPMG Vietnam & Cambodia, said that “The finance function of the future is no longer just about accounting and processing numbers, it is about understanding the numbers and translating their implications into business decisions. Investments in planning and analytical tools that are underpinned by technology have now become the priority of organisations to transcend finance’s transactional role.”

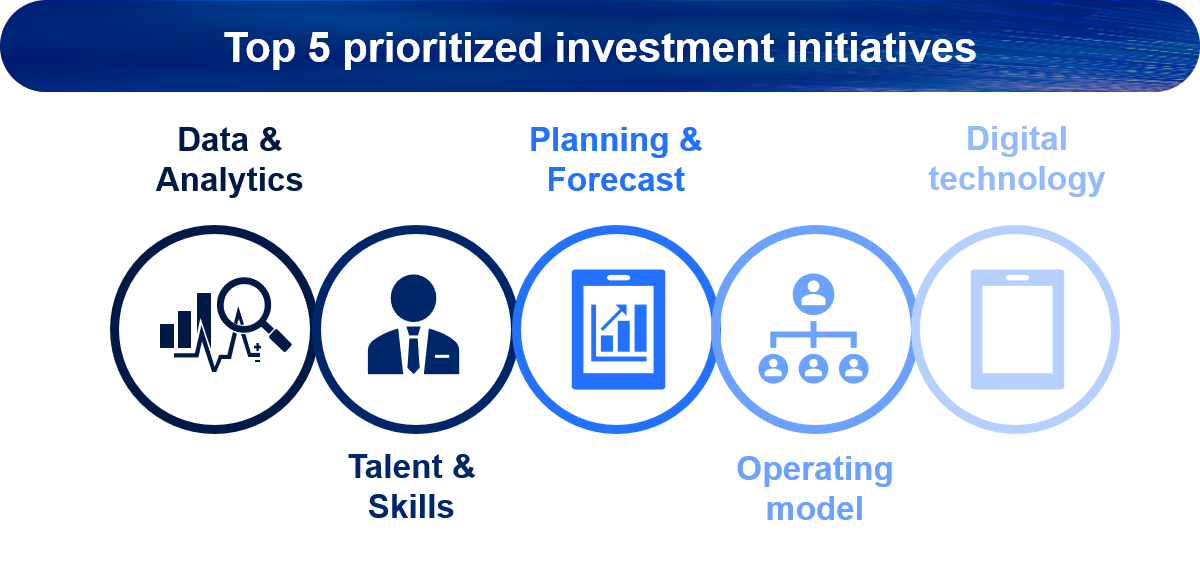

Data analytics (52 per cent) and planning and forecast accuracy (39 per cent) are among the highest-ranking priorities for investment, yet 40-50 per cent of the five most prioritised investments fail to achieve a success rate above 50 per cent.

There is an opportunity to drastically enhance efficiency by increasing the centralisation of finance functions. The average percentage of the total cost of finance departments in Vietnam has reached 4.1 per cent, while the figure in Asia-Pacific is only 1.2 per cent.

Partner and head of Business Transformations at KPMG Vietnam and Cambodia, Lam Thi Ngoc Hao assessed, “Our survey revealed that the average personnel cost for the finance function in Vietnam is only one-fifth of that in ASPAC. However, the total finance function costs of Vietnamese companies (including personnel and technology costs) are, on average, three times higher than their peer enterprises in ASPAC are paying for each dollar of revenue. Clearly, investments in technology have proven to be highly cost-effective, helping ASPAC business leaders save a huge amount on human resources.”

Financial services are the most confident of the three main industries in KPMG’s poll findings. At least 33 per cent are very confident in national, industrial, and organisational performance.

The sentiments of those in the manufacturing and consumer goods industries are quite comparable, with around 50 per cent of replies expressing a reasonable degree of confidence.

CFOs and business leaders in Vietnam focus on areas that provide insights into business performance and support forward-thinking strategies such as data and analytics (52 per cent) and planning and forecasting (39 per cent). Digital technology (30 per cent), is another important field that companies look to invest in.

However, there are still challenges to investing in finance functions in Vietnamese companies, with 40-50 per cent of investments in the top priorities seeing a success rate below 50 per cent. Finance operating model optimisation has the lowest overall success rate.

Vietnam's companies have a significantly lower rate of finance staff productivity than the average for the Asia-Pacific region, while Asia-Pacific businesses have a higher average personnel cost ($6,350) to perform finance functions per month than those in Vietnam ($1,323).

In terms of career prospects, the survey showed that 67 per cent of CFOs expressed their ambition to become the CEO of their companies in the future, but only 10-12 per cent showed instant confidence and readiness for the role.

53 per cent of the CFOs who plan to become CEOs believe that they will be ready within five years, while 25 per cent believe that their preparations will take 5-10 years.

The capabilities of CFOs are directly proportional to the sustainable development of a business, with 97 per cent of respondents taking action to facilitate experience accumulation and capability development.

Read KPMG's full report here

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Mobile Version

Mobile Version