Developing smart healthcare systems

|

Just a few days ago, SaVi Pharmaceutical JSC (SaVipharm) broke ground for a high-tech research and development centre in Ho Chi Minh City. Costing VND200 billion ($8.7 million), the facility aims to study, approach, and transfer new and high-tech products while co-operating with domestic and international research and development (R&D) centres.

In addition, SaVipharm’s oral solid dosage factory will be invested with advanced equipment to ensure that the centre’s research is quickly put into commercial production. SaVipharm has recently received an EU-GMP certificate for the factory.

The R&D centre project is part of the company’s strategic goals for development in the 2020-2025 period in which it will prioritise investment in human resources training, sci-tech, and R&D activities.

GIANTS IN RACE

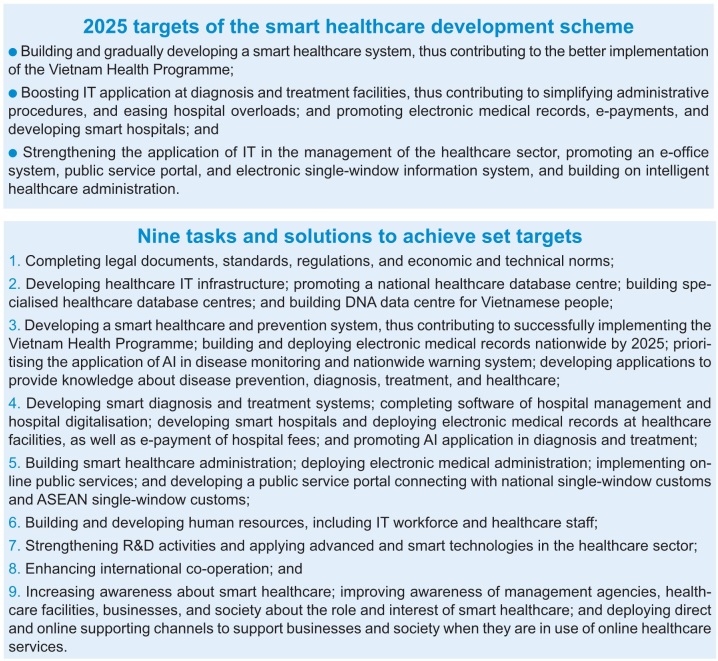

SaVipharm’s move is aligned with the Ministry of Health’s (MoH) scheme on development of IT and smart healthcare for 2019-2025 in line with the Politburo’s Resolution No.52-NQ/TW from last September on a number of guidelines and policies to proactively participate in Industry 4.0. The MoH has become the first ministry to approve such a scheme.

Under the scheme, one of the key tasks is to strengthen R&D activities and the application of smart technologies in manufacturing and hospitals among others, while enhancing international co-operation.

In this view, other domestic pharma giants such as Hau Giang Pharmaceutical JSC (DHG), Domesco Medical Import Export JSC, Imexpharm Pharmaceutical JSC (IMP), and Traphaco JSC have so far been taking bold actions to prepare for the sector’s upcoming changes and possible technology boom.

Traphaco, the country’s second-largest publicly-traded drugmaker, is boosting sci-tech application in production, together with developing the ethical drugs (ETC) channel, seeking partners and production of franchised products, expanding the distribution network.

“We are completing procedures for technology transfer with South Korean partner Daewoong for its strategic products at a new factory located in the northern province of Hung Yen,” said Vu Thi Thuan, chairwoman of Traphaco. “We also now have Mirae Assets as an indirect investor which helps us with opportunities to work with capable partners in technology transfer to shorten R&D, and the manufacturing of new high-quality products, thus enabling us to meet the requirements to join the ETC channel.”

At present, State Capital Investment Corporation, Magbi Fund Ltd., and Super Delta Pte., Ltd., are Traphaco’s biggest shareholders with stakes of 35.67, 24.99, and 15.12 per cent, respectively.

Similarly, IMP, the fourth-biggest drugmaker, in December, approved the board of directors’ resolution in which they agree to spend VND7.37 billion ($320,500) on the Vinh Loc high-tech antibiotics plant.

IMP is now operating three plants, including one put into operation in the third quarter of 2019, and is developing a further facility, with its opening scheduled for this year. IMP’s new factories focus on the manufacturing of western medicines which meet the standards set out by EU-GMP certification.

IMP’s big shareholders are Vinapharm (22.87 per cent), and overseas investors (48.48 per cent). Its foreign ownership limit is 49 per cent.

In this trend, DHG, despite being the largest publicly-traded drugmaker, is not an exception. The group will boost technology transfer and co-operation with major Japanese stakeholder Taisho in upgrading its beta-lactam factory to increase access to the ETC channel and exports to Russia and Moldova. Currently, DHG, in which Taisho has completed a transaction to raise ownership to over 50 per cent, exports products to 14 countries.

Industry insiders believed that the recent developments of SaVipharm, DHG, Domesco, IMP, and Traphaco are just the opening initiatives. With the wide influence of Industry 4.0 and amid stiffening competition among multinational corporations (MNCs), they need to make more to adapt to the new changes of the pharmacy and healthcare sector when a number of new policies are performed.

2019 was a challenging year for domestic pharmaceutical firms. Although the drug giants have yet to make available their business results for the year, industry insiders see lower-than-expected performance, driven by no growth in the over-the-counter (OTC), and difficulties in the ETC channel due to tender regulations.

According to market researcher IMS, the local pharmaceutical market saw no growth in the OTC channel in the third quarter of 2019, although OTC makes up the majority of their revenue. For example, the segment now accounts for 92 per cent of Traphaco’s revenue.

Worse still, the issuance of a circular is more sluggish than expected, thus preventing them from taking advantage of the ETC channel. Moreover, their key projects are competed against heavily by fake products.

|

GRASSROOTS HEALTHCARE

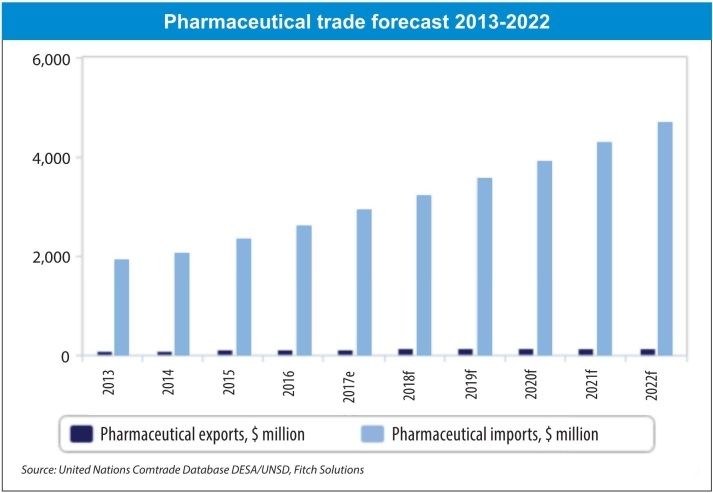

According to the MoH, Vietnamese drug manufacturers are able to meet half of the total medicine market demand, while imports cover the remaining half. In addition, approximately 60 per cent of pharmaceutical end products, 90 per cent of active pharmaceutical ingredients, and most raw materials for the production of pharmaceuticals are currently imported. Thus, big opportunities abound for MNCs.

The last 12 months were also demanding for MNCs, with legal barriers being a concern. Such corporations require a feasible transition period together with clear technical guidelines for the transition to foreign-invested enterprises’ (FIEs) establishment and, for their feasible operation in the future, legalise FIEs’ right to build up and protect the brands by themselves or by supporting the fee for the distributors to carry out marketing activities.

As a result, MNCs have taken a new approach to ease difficulties and to better cash in on the local market, with grassroots healthcare a target, involving Novartis, Zuellig Pharma, Sanofi, GSK, and Pfizer among others.

In particular, global drug giant Novartis in December signed an MoU with the MoH on raising primary healthcare in Vietnam through activities at commune and district levels from next year. Zuellig Pharma, one of the largest healthcare services groups in Asia, has presented more than 600 innovative eZCooler boxes to the representatives of six provinces to raise access to vaccines in remote areas.

Similarly, 2019 saw around one million Vietnamese children vaccinated with the GSK pneumococcal vaccine since it first became available five years ago.

“In 2020, we will continue contributing to Vietnam’s healthcare development in both prevention and treatment. We will do this through evolving and improving our healthcare professional education and training activities, contributing to efforts to tackle serious healthcare issues such as antibiotic resistance and non-communicable diseases like asthma and chronic obstructive pulmonary disease, and improving immunisation coverage at grassroots levels,” Daniel Millard, chief representative of GSK Vietnam, told VIR.

Evidently, Novartis, Zuellig Pharma, Sanofi, GSK, and Pfizer target grassroots healthcare as this is one of the top priorities of the Vietnamese healthcare sector currently. In the smart healthcare development sphere, one of the targets is to boost IT application at healthcare facilities, including those at the grassroots level, thus easing hospital overloads.

The country is also facing challenges in increasing healthcare expenditure, increasing health insurance coverage, financial capacity, and capacity to provide healthcare services. Meanwhile, many problems remain unsolved, including the reimbursement process and more. Thus, it is calling for the involvement of the private sector to join the MoH’s efforts to fight non-communicable diseases and to increase people’s access to healthcare.

The giants are expecting the enforcement of the historic EU-Vietnam Free Trade Agreement (EVFTA), which will bring more business and investment opportunities. The landmark deal will open the Vietnamese market in fields that the country has been seeking particular solutions to for years, such as intellectual property rights, direct pharmaceuticals imports, and tenders among others.

With high growth potential, driven by double-digit growth forecast in the next five years, reaching an estimated $7.7 billion in 2021 from the current $5 billion, Vietnam’s healthcare sector is expected to see a big change in the picture of foreign investment soon on the back of the EVFTA.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version