Booming solar power: signal for worry or delight?

|

By Mai Van Trung - an energy expert

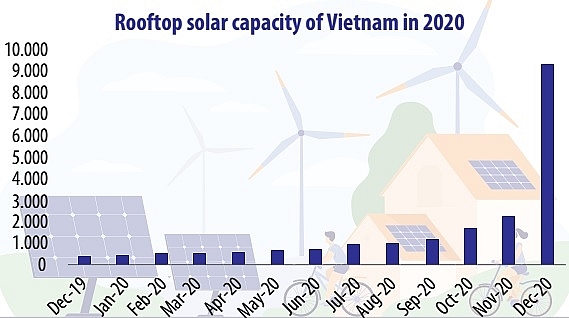

According to Electricity of Vietnam (EVN), the solar power capacity in the power mix has reached 25 per cent at 19,400MWp, with rooftop solar accounting for 9,300MWp. Vietnam overtook Thailand as the champion in solar power development – Thailand’s power development plan expects to get 12,725MW up to 2037.

The percentage of renewable power in solar and wind in the mix of Vietnam should be higher after 2021 due to numerous wind power projects being commissioned. The record comes from multiple projects of less than 1MW being allowed at the same site, a financially attractive FiT2, and strong support from local bankers.

However, the intermittent nature of solar power has recently raised many technical and financial concerns, particularly in the context of the low demand and delays in the grid’s frequency regulation projects.

Technically, curtailment will occur for not only more power plants but also bigger power reduction. There is no assurance that rooftop solar projects are out of the curtailment schedules. Solar and wind farms were the victims of the curtailment by up to 3,000MW during the last week of 2020, because there are power regulators installed and controlled by the National Load Dispatch Centre.

It is expected to have automatic power regulation schemes for rooftop solar clusters as well shared losses with big renewable power plants. The rush for FiT2 resulted in a huge demand for local contractors in which many of them have just entered the market within the last several months.

It is expected there will be many underperforming solar systems and inefficient operations and maintenance, especially those named mini-farms. They use remote and cheap land to develop such clusters without nearby commercial and/or industrial loads, which might bring about pressures on distribution or transmission lines. They are also more at risk of landslides during the flooding season in Central Vietnam.

Financially speaking, the huge penetration of solar rooftop systems into the power mix could enable the increase of the average distribution selling price set by EVN that is VND1,864.44 per kWh excluding VAT, according to Decision No.648/QD-BCT dated March 2019 on adjusting average retail price of electricity and regulating price of electricity. The price was set before the original FiT deadline in 2019.

Assuming that the production cost of EVN is at the FiT2 for solar farms (7.09 US cents per kWh) and the exchange rate is around VND23,000 per US dollar, estimates of the subsidised amount of money by EVN in 2021 for solar power sources can be easily calculated. In order to keep the average selling price, increasing the curtailment or adding more solar power plants and rooftop solar systems with a very low FiT3 rate could compensate the subsidisation of EVN.

The former option could hurt financial indicators of many projects because of the leverage from bankers. The latter will distract potential investors to put the money down. Moreover, the capacity absorption of the national grid is limited due to the intermittency of solar power.

There is a declining trend of engineering, procurement, and construction costs of rooftop solar over time that can be utilised if the absorption capacity of the grid is available even with the storage added. Vietnam has plans for solar power auctions but the qualified projects are small and located in lower solar irradiance.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Sustainable Energy

- 16th national conference on nuclear science and technology opens in Danang

- Technology and Energy Forum 2023 to open in Quang Ninh

- Asia Clean Capital Vietnam receives backing from Swiss Investment Manager

- Amazon scales renewable energy to fight climate change

- Universal Alloy Corporation Vietnam partners with Asia Clean Capital Vietnam

Related Contents

Latest News

More News

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

Mobile Version

Mobile Version