Vietnam prepared for production pressures

Since March, Nguyen Van Duc, a worker from a Japanese company manufacturing industrial spare parts at Hanoi’s Thang Long Industrial Park, has been working a reduced schedule.

“Over the past four months, with nearly another 500 workers, I have been working six hours a day instead of eight hours as normal,” Duc said, adding that his income had reduced from VND300,000 ($12.50) a day to about VND250,000 ($10.50).

“Life has become all the more difficult as our two children are about to enter the new school year, which will cost more money,” said Duc.

His wife, Do Thi Man, is an employee at Hanoi-based furniture manufacturer Narori Co., Ltd. Man is also working with a 20 per cent reduction in income since early this year due to the company’s difficulties.

Narori employs about 1,000 workers, about half of whom have had to work reduced hours, waiting patiently for a brighter outlook without daring to look for other employment from other companies.

“I once tried to look for another job, but failed as many other companies were also bogged down in difficulties, with thousands of workers like me are living in increased worries,” Man said.

|

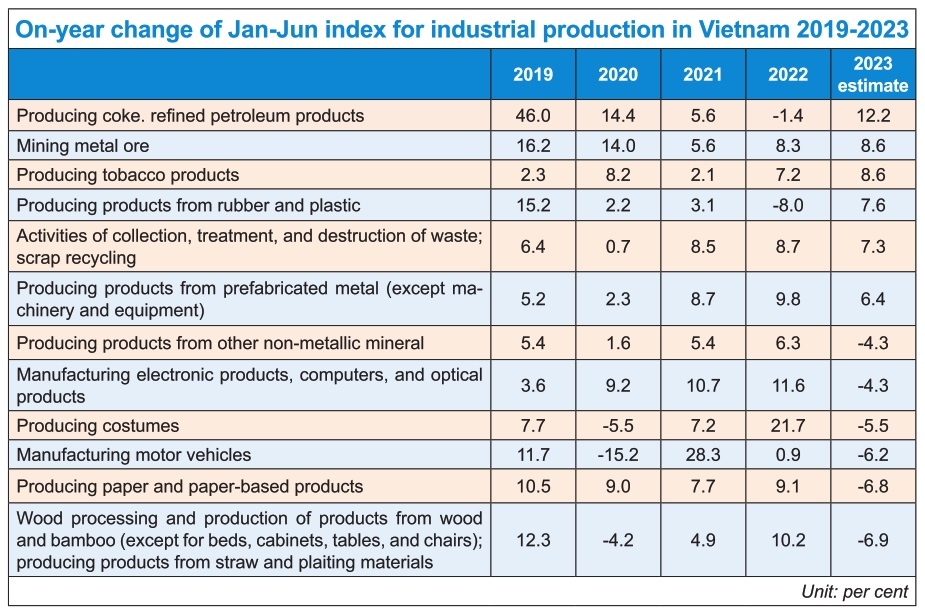

According to the General Statistics Office (GSO), Vietnam’s index for industrial production (IIP) in July increased 3.9 per cent on-month and 3.7 per cent on-year. However, poor performance of many companies has caused an on-year 0.7 per cent fall in the first seven months of this year.

In the corresponding periods from 2019 and 2022, the on-year rate expanded 9.4, 2.6, 7.6, and 8.6 per cent, respectively.

“Such a grey situation has been attributed to the world economy facing massive difficulties in the first months of this year which have had negative impacts on the domestic production activities,” the GSO stated.

The IIP for processing and manufacturing, which creates more than 80 per cent of industrial growth, reduced 1 per cent compared to the same period last year when such IIP increased 9.5 per cent on-year.

The IIP of the electricity production and distribution climbed only 1.4 per cent on-year, while the IIP of the industry of water supply and waste management and treatment climbed 6.3 per cent, and the mining industry declined 1.2 per cent on-year.

In a specific case, difficulties have hit state-owned PetroVietnam hard. This group reported that its total six-month revenue is estimated to be $14.52 billion, down 8 per cent on-year.

PetroVietnam’s total export turnover in the first half of this year reached $1.17 billion, down 26 per cent on-year - including a reduction of 8 per cent in the first two months, 17 per cent in the first quarter, 21 per cent in the first four months, and 16 per cent in the first five months.

PetroVietnam’s production of some key products decreased on-year, such as crude oil (5.31 million tonnes – down 2 per cent); and production of nitrate (874,700 tonnes – down 6 per cent. Moreover, PetroVietnam’s consumption of some products also went down, such as liquefied petroleum gas (3 per cent), crude oil (3 per cent), and condensate (25 per cent).

Meanwhile, Electricity of Vietnam (EVN) has also reported a limited performance in the first six months of this year, when its gross industrial output is estimated to hit $8.08 billion, up only 1.77 per cent on-year. In which, electricity produced and purchased is estimated to be over 131 billion kWh, up merely 1.63 per cent, and commercialised electricity is estimated to total 118.92 billion kWh, up only 1.77 per cent.

EVN also reported that it is expected to continue facing increased difficulties in production and business activities due to a very high climb in assorted input materials. For example, the price of imported coal is set to increase by 2.32 times as compared to 2021, and 5.3 times over 2020; while the oil price is expected to increase by 1.22 times against 2021 and 2.06 times as compared to 2020. What is more, the exchange rate in 2023 is also forecast to stay higher than the average level of 2022 – affecting the group’s performance.

In July about 13,700 businesses were newly established, and registered at $5.28 billion, with total registered employees of nearly 79,000 – down by 1.2 per cent in the number of enterprises, 8.6 per cent in registered capital, and 24 per cent in the number of registered employee, respectively, compared to June.

In the first seven months of 2023, Vietnam saw 89,600 newly established businesses registered at $34.76 billion, using 589,000 workers. This was up by 0.2 per cent in the number of enterprises, but down 17.1 per cent in registered capital and 5.2 per cent in the number of employees compared to the same period last year.

| Industrial expansions help record stronger absorption The industrial estate market was a bright spot in Vietnam in the first half of 2023 with a positive absorption rate in industrial land, ready-built factories, and warehouses both north and south. |

| Supply shortages remain in industrial property frame New supply in the industrial real estate market will slow in the second half due to the influence of legal procedures as well as a decrease in demand from the manufacturing industries. |

| Thai Nguyen hails foreign investment Thai Nguyen is becoming a conducive location for foreign-led investments and expansion. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version