Vietnam collects $78 million in tax from foreign tech giants in 2022

|

| Vietnam collects $78 million in tax from cross-border platforms in 2022 |

According to the department, in March 2022, it launched the information portal for foreign service providers. As of the end of October last year, over 40 foreign service providers had registered and declared tax on the information portal for foreign service providers.

Meta, Google, Microsoft, TikTok, Netflix, and Apple, which account for 90 per cent of revenue from e-commerce services on cross-border digital platforms, have declared and paid taxes in Vietnam, totalling tens of millions of dollars. For example, Google paid $28.8 million, Meta (Facebook) $34.5 million, and Apple with $7.56 million.

These cross-border platforms, which account for 90 per cent of revenue from e-commerce services on cross-border digital platforms, have declared and paid tax in Vietnam, totalling tens of millions of dollars. Tax revenue collected from cross-border platforms has increased thanks to the launch of the electronic information portal.

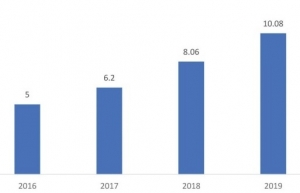

Tax revenue collected from cross-border and e-commerce platforms grew by 130 per cent on average in 2018-2021, with $52.17 million) per year.

According to the General Department of Taxation, the results show positive signs for the cooperation between the taxation authorities and foreign service providers in declaring and paying tax. It also shows the seriousness and prestige of the foreign service providers in their e-commerce trading activity in Vietnam.

Trading on e-commerce and digital platforms in Vietnam has huge potential. According to the 2022 White Book on Vietnam’s e-commerce, the B2C market is valued at $16.4 billion in 2022 and is expected to reach $39 billion by 2025, the second largest in Southeast Asia.

Reports indicate that the number of Vietnamese users buying goods via foreign websites has increased from 36 per cent to 43 per cent in 2021.

| Promoting exports via e-commerce platforms Policymakers, businesses, and experts gathered at a workshop in October to discuss increasing opportunities to boost exports via cross-border e-commerce platforms. |

| Retailers across industries ramping up user-friendly e-commerce offerings As Vietnam is in its strongest-ever stage of increasing exports via cross-border e-commerce platforms, domestic and international stakeholders are betting on new products and services to meet growing demand. |

| Discussions to facilitate alcohol sales on e-commerce platforms With the ongoing development of e-commerce, stakeholders are urging for the completion of a relevant legal framework for the management of the alcoholic drinks business on e-commerce platforms. |

| Vietnam’s draft e-transaction law and the highlights within The current Vietnamese Law on E-transactions 2005 is based upon the model Law on E-Commerce, which is outdated, and its terms are difficult to apply in practice. Meanwhile, e-commerce transactions are increasingly developing due to changing user demands and habits since the COVID-19 pandemic. |

| Lalamove plans to boost presence in Vietnam Lalamove, a leader in logistics solutions for e-commerce and businesses, has seen good performance over the past few years. Paul Loo, COO at Lalamove, discussed future plans to develop the business, with VIR’s Bich Thuy. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version