VIB programme offers zero interest, zero fees, and more

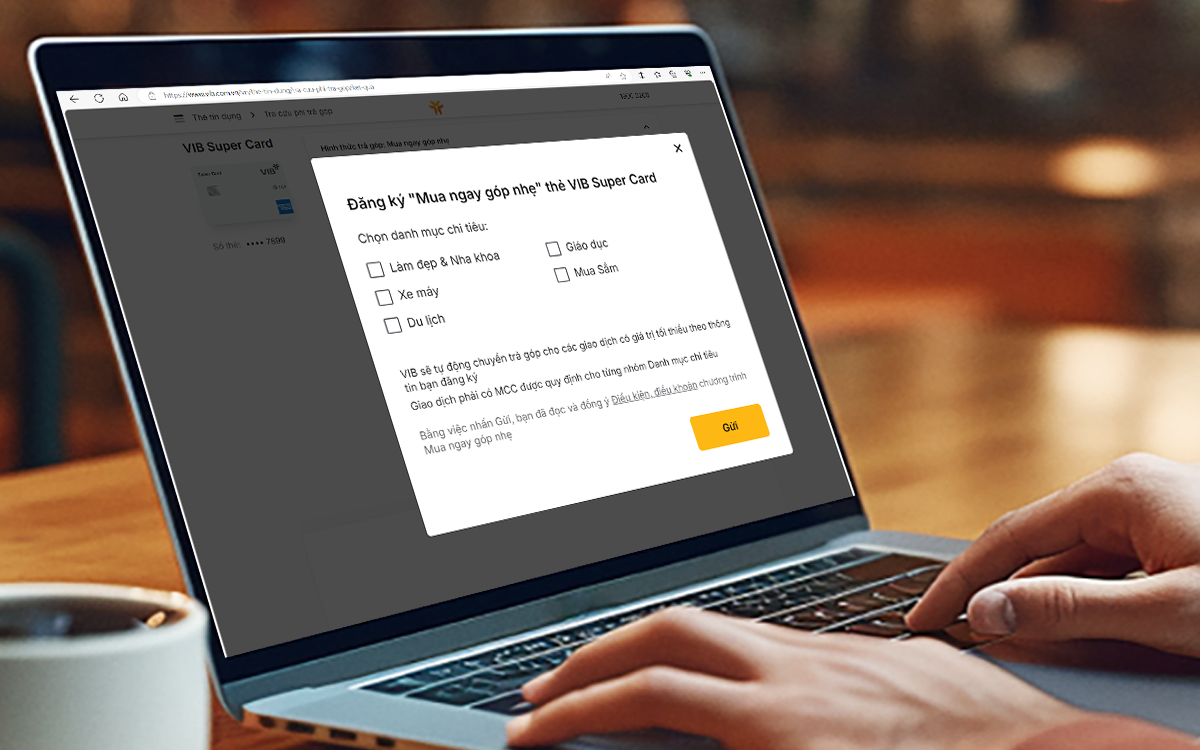

The “Buy now, pay later” programme, to last until the end of the year, only takes a few minutes to register for, via the programme's website.

Customers who register to open a new credit card before September 30 will immediately receive the benefit of a first-year annual fee refund, if they spend within 30 days of card activation and no later than 45 days from card issuance, starting from only VND1 million ($40).

VIB's cardholders can choose the term and monthly instalment amount to meet their personal finances.

|

A personalised touch

Based on the insights of 750,000 existing cardholders, VIB recognises that users have several spending demands. Among them, there are five popular spending categories: travel, shopping, education, motorcycles, beauty, and dentistry. These spendings to upgrade lifestyles often have a large value compared with monthly income.

Accompanying cardholders in balancing spending, whatever their situation, VIB has designed the best instalment payment programme specifically for 5 popular categories. A large sum of money is divided evenly over a period of up to 36 months to make payment easier and more effective. Thanks to automatic instalment payments for large expenses, cardholders can also upgrade their knowledge and experience in personal financial management, enjoying the life they desire.

Instead of applying general preferential policies for all customers, VIB is personalising the credit card instalment payment with 3 extended options: card product features, term, and monthly payment amount.

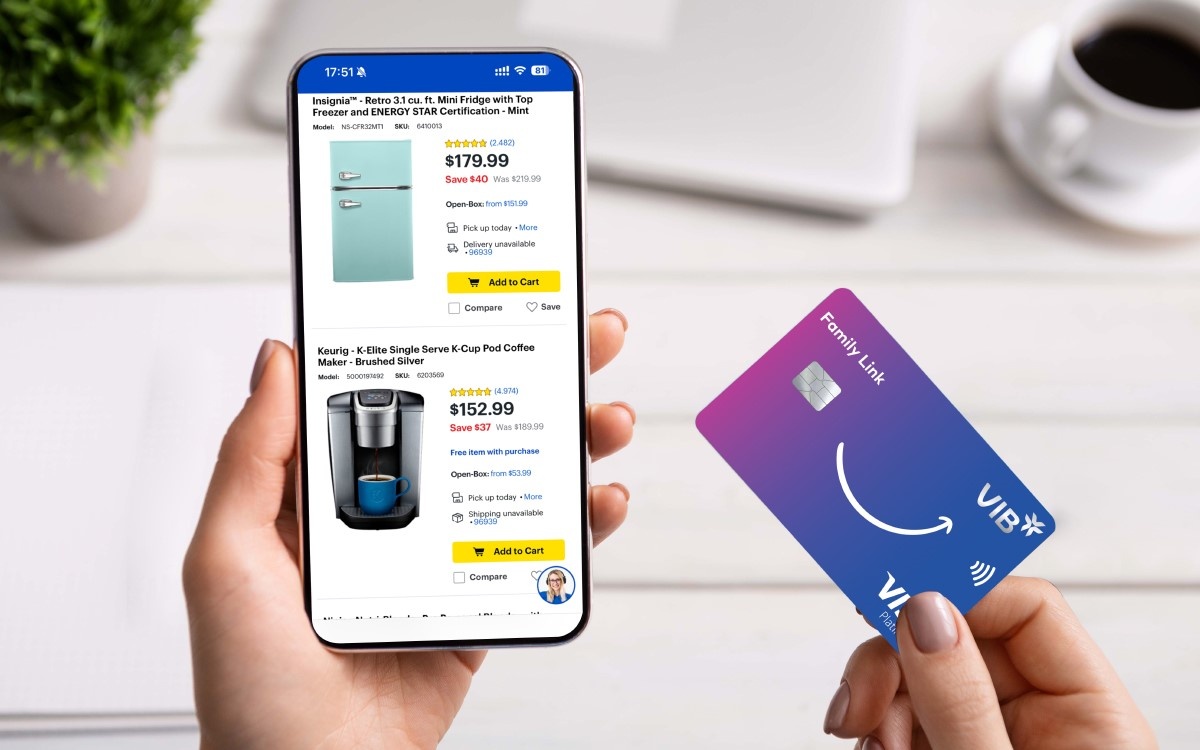

No matter the income, age, and interest of customers, VIB's ecosystem, comprising 10 specialised credit card lines, can meet their spending needs accurately and sufficiently for shopping (Cash Back, Super Card, Online Plus 2in1, LazCard), travelling (Travel Élite, Premier Boundless), and family and education (Family Link, Ivy Card).

Customers can choose any card line they own or open a new one to register for instalment payments simply and easily.

|

VIB also gives cardholders the right to choose various terms of between six and 36 months – the latter being the longest instalment period on the market today. Also, customers can choose the monthly instalment amount according to their financial capability for transactions in the five categories. The longer the term, the smaller the monthly instalment amount, the more secure personal finances are in the long term.

Normally, cardholders with families have many expenses, so it is better to register to pay in instalments for 2–5 large categories in the long term. It will be a reasonable choice to avoid disrupting daily spending. Meanwhile, cardholders who have a high and stable income can opt for the long-term instalment to invest their idle money.

With a level of personalisation that closely follows the current spending situation, VIB cardholders have the opportunity to design their own instalment payment packages that suit their income sources and have long-term, effective personal financial management plans for themselves and their families.

This is the first feature on the market enabling customers to register for instalment payments for large-value transactions automatically. Customers need to register once and this feature will apply until the customers performs the cancellation of instalment conversion on the VIB website.

Three levels of incentives

For consumers, VIB credit cards are not only a means of payment and instalment payment, but also a tool to help them optimise their spending costs. With a VIB credit card, customers can simultaneously enjoy three levels of incentives, including instalment payment programmes, exclusive privileges of each card line, and incentives from affiliated partners.

|

When registered to join the “Buy now, pay later” programme, customers can enjoy a 0 per cent interest rate policy, a free initial participation fee, and a zero monthly instalment fee for the first 3 months. Starting from the fourth month onwards, new instalment items will be subject to a monthly instalment fee of 0.4 per cent for 6 and 9-month terms and 0.8 per cent from 12 to 36-month terms. This is the lowest interest rate on the consumer finance market today.

VIB's specialised credit cards also offer exclusive privileges for each spending category. For example, Family Link offers up to 10 per cent cashback on all education, healthcare, and insurance expenses. The credit card line helps ease the burden on parent cardholders when registering to pay tuition in instalments for their children.

The Super Card offers a flexible refund up to 15 per cent for shopping, travel, dining, etc., which is also ideal for cardholders to take advantage of high-value spendings. Meanwhile, Cash Back refunds up to VND24 million ($960) per year when spending on shopping, dental services, and beauty treatments. Housewives can divide the expenses for their families’ healthcare needs without affecting their monthly income and expense balance.

VIB has worked with 150 strategic partners to create the VIB Privileges ecosystem with discounts of up to 40 per cent on many categories such as shopping (VIB Shop), dining (VIB Dine), travel (VIB Travel), transportation (VIB Move), and other needs (VIB More).

| VIB posts profits of $182 million in 2024 so far Vietnam International Bank (VIB) announced its business results for the first half of 2024, with total operating income surpassing $409 million, a slight rise compared to the same period last year. |

| VIB boosts credit card ecosystem Vietnam International Bank (VIB) continues to consolidate its growth and increase its spending market share via tech, promotions, and improving the user experience. |

| VIB the most 'viral' bank on social media The summer media race became more vibrant among banks in June, with a 29 per cent increase in engagement and participation in discussions across social networking sites compared with the previous month. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version