Trade war shifts FDI flows to Vietnam

|

Vu Tien Loc, chairman of the Vietnam Chamber of Commerce and Industry (VCCI), felt excited when he recently met with a number of foreign investors from the EU, Japan, and South Korea. These investors told him that they want to shift their production from China to the Southeast Asian region, with Vietnam featuring prominently on their radar, in order to limit risks caused by the ongoing US-China trade tensions.

“The US-China trade war has a bad impact on production in China. Meanwhile, Japan and South Korea are implementing their ‘Look South’ policies, which highly value the Vietnamese business climate,” Loc said. “In the eyes of these foreign investors, Vietnam is surging as one of the most attractive markets, because the country has high growth potential and a large network of free trade agreements (FTAs).”

A prominent market

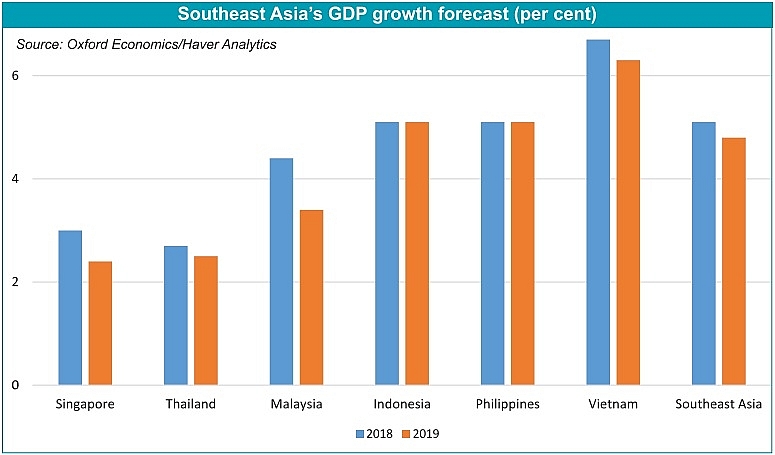

According to the Institute of Chartered Accountants in England and Wales’ (ICAEW) latest “Economic Insight: South-East Asia report” released last week, Southeast Asia’s GDP growth is expected to cool due to moderating Chinese import demand and escalating US-China trade tensions dampening exports and business investment.

“However, among Southeast Asian economies, Vietnam is expected to continue to outperform the region with the economy forecast to grow by 6.7 per cent in 2018 and 6.3 per cent in 2019,” the report said (see box).

“Amid increasing global headwinds, including escalating US-China trade tensions, and the added pressures of a stronger US dollar and rising US interest rates, we expect economic growth across the region to cool further in the second half of 2018 through 2019. This is against the backdrop of cooling Chinese import demand and increased trade protectionism,” said Sian Fenner, ICAEW economic advisor and Oxford Economics lead Asia economist.

The Vietnamese economy grew by 6.98 per cent in the first nine months of this year, following a rise of 7.45 per cent in the first quarter and 7.08 per cent in the first half of this year, according to the General Statistics Office (GSO).

One of the key reasons behind Vietnam’s outperforming the region is that despite its large amount of exports to China, the country’s exports have not been affected too much by the US-China trade war, because China’s demand for these products is still on the rise. For example, in the first nine months of this year, Vietnam’s total exports to China hit $23.4 billion in turnover, up 25.2 per cent, with mobilephones and spare parts up 75.7 per cent on-year, textiles up 43.1 per cent, and electronics products and computers up 23.3 per cent, according to the GSO. In addition, Vietnam currently has a large export market network based on its 16 multilateral and bilateral FTAs as well as an increasingly attractive investment and business climate.

“Despite the increasingly complicated developments in the world, including the ongoing US-China trade war, Vietnam has been strongly growing and becoming one of the world’s manufacturing bases. It is also a fulcrum for global transnational groups which supply competitive products and services globally,” said Prime Minister Nguyen Xuan Phuc at the recent Vietnam Business Summit attended by thousands of foreign and Vietnamese business executives in Hanoi. “Vietnam’s external trade activities have reached more than 200 per cent of the GDP.”

Meanwhile, other regional nations were hit by the trade friction, according to the ICAEW. For instance, for Indonesia, the report said, “As easing Chinese demand and global trade growth coincide with rising US-China trade tensions, Indonesia’s export growth is likely to decelerate over this year’s second half. Indonesia’s year-on-year growth is forecast to slow slightly during the second half of this year and to continue to stay at 5.1 per cent in both 2018 and 2019.”

“Many of the region’s economies are small, open, and heavily dependent on exports, with a high level of exports to China. Added to this is the high import content of many Chinese exports, which means that some economies such as Malaysia and Singapore indirectly export a large volume of their exports to the US via China. In a challenging export environment and with rising protectionist sentiments, we expect overall growth momentum in the region to ease in the second half of 2018 into 2019,” said Mark Billington, ICAEW regional director for Southeast Asia.

According to worldsrichestcountries.com, China is currently the largest importer of ASEAN exports. For example, last year, Singapore’s exports to China amounted to $54 billion or 14.5 per cent of its overall exports, Thailand’s were $29.4 billion or 12.4 per cent, Malaysia’s $29.4 billion or 13.5 per cent, Indonesia’s $23 billion or 13.7 per cent, the Philippines’ $7 billion or 11.1 per cent, and Vietnam’s $35.3 billion or 16.5 per cent.

Attracting FDI from China

The trade war between the US and China intensified early last week as the two economic superpowers hit each other with their biggest round of tariffs yet. The US imposed new 10-per-cent tariffs on $200 billion worth of Chinese goods, spanning thousands of products, including food seasonings, baseball gloves, network routers, and industrial machinery parts. China retaliated immediately with new taxes of 5 to 10 per cent on $60 billion worth of US goods such as meat, chemicals, clothes, and auto parts.

The moves are a significant escalation in the growing conflict between the world’s top two economies.

However, experts said the duelling tariff plans will help Vietnam lure more foreign direct investment (FDI) from China, where production and labour costs are increasing. Vietnam is offering enterprises and investors a minimum wage which is only 59 per cent of the one in China and 70 per cent of the one in Thailand.

“In the last few years, driven by rising labour costs, the need for diversification, and the government’s focus shifting from labour-intensive sectors to high-tech industries, Chinese as well as foreign firms operating in China have slowly shifted their manufacturing activities to Southeast Asia, especially Vietnam,” said Koushan Das, assistant manager of the business intelligence unit under Dezan Shira and Associates, Asia’s largest independent FDI practice. “In addition to these factors, the escalating trade war between the US and China has accelerated the trend of foreign investors realigning their supply chains.”

Adam Sitkoff, executive director of the American Chamber of Commerce in Hanoi, also told VIR, “US companies, similar to companies from many other countries, are constantly adjusting their supply chains to stay competitive. It is possible that some companies will look at shifting production from China to Vietnam to avoid higher tariffs.”

Also, according to a US-backed law firm specialised in providing consultancy for US investors in Vietnam, with this war going on, foreign businesses, including US firms, in China will find it more difficult to stay competitive amidst rising tariffs.

“They will have to think about another market outside of China. However, it is not easy for them to immediately shift their production out of China, because China is a global manufacturing hub and has joined the global value chains that many global firms are involved in,” a firm consultant told VIR. “Instead of moving the whole of their facilities out of China, these investors tend to choose to supplement their China-based facilities with low-cost inputs sourced from other markets like Vietnam, which currently boasts a large network of FTAs. Vietnam remains attractive to US investors.”

A recent survey by the Japan External Trade Organisation involving more than 4,630 Japanese businesspeople investing in 20 nations and territories, including 652 active in Vietnam, showed that 70 per cent of respondents said they will expand their business in Vietnam and continue considering the country an important investment destination. The same rate is only 48 per cent for China. Some 65.1 per cent of respondents said they are performing at a profit in Vietnam.

Not only Japanese investors, but also those from South Korea are said to be looking to expand their business in Vietnam instead of focusing on China. Hong Sun, vice chairman of the Korea Chamber of Business in Vietnam representing over 6,000 South Korean businesses in the country, told VIR that the US-China trade war is “prompting many South Korean businesses to come to Vietnam from China.”

Currently, many South Korean companies produce goods in China in order to export them to the US. “However, the very high US tariffs on Chinese goods worry South Korean investors. Thus, they must seek alternative places for trade in goods,” Sun said. “Vietnam is an ideal place, as production costs are lower and it has FTAs with many nations around the world. South Korean investors are turning Vietnam into their new production bases.”

Loc from VCCI said he believed that Vietnam would continue being a bright spot for business and investment in Southeast Asia. “Multinational groups are coming to Vietnam in large numbers. Over the past years, they have been heavily investing in China. However, the US-China trade war has prompted the groups to shift away from China, and Vietnam is the first location they may select as the country is the nearest to China and boasts many FTAs,” Loc said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version