ThaiBev sets out 2023 expansion plans

ThaiBev plans to invest up to $223 million in 2023, of which about 30 per cent will be allocated to the non-beer segment including food, distilled spirits, and logistics, along with the research and development of medical products.

| “We would rather focus on our existing businesses and those we have recently acquired to post the best returns,” said Thapana Sirivadhanabhakdi, president and CEO of ThaiBev. |

In 2017, ThaiBev – owned by Bangkok-based billionaire Charoen Sirivadhanabhakdi and best known for beer brand Chang – acquired 343.62 million shares, equivalent to 53.59 per cent of SABECO, at a unit price of VND320,000 (nearly $14).

ThaiBev spent $4.78 billion on the deal, however, after only two years the company saw nearly half of its investment in the Vietnamese brewer eroded amidst the pandemic and the strict regulations of Decree No.100/2019/ND-CP outlining sanctions for drink-driving.

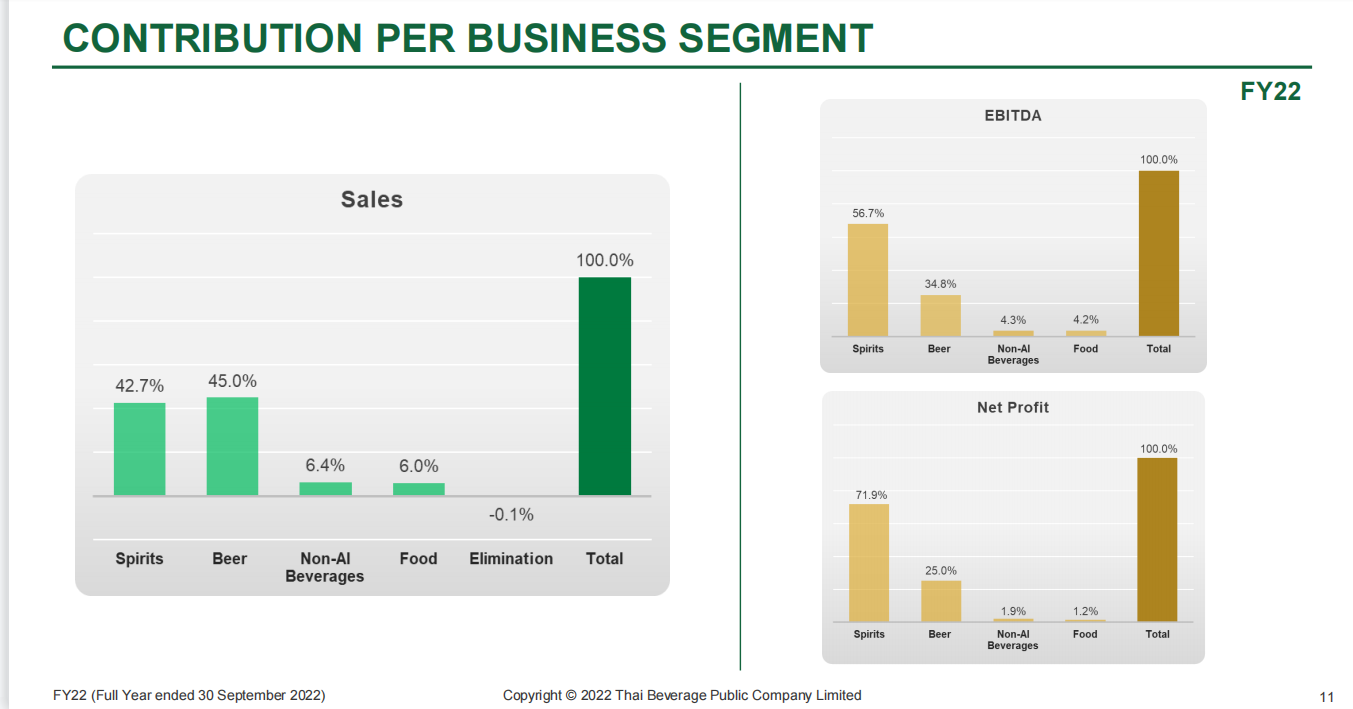

However, ThaiBev has reported earnings of $1.16 billion for FY2022 up to September 30, up 22 per cent over 2021. Sales revenue increased by 13.2 per cent on-year to $10.5 million as the easing of travel restrictions drove growth in all business segments.

Its net profit rose substantially by 26.2 per cent to $1.32 million, in which the beer business registered a considerable 143.6 per cent growth.

Sirivadhanabhakdi confirmed at the company’s annual press conference in September that, "SABECO is our crown jewel – a rare asset among all brewing assets in the region."

|

| ThaiBev's business consists of four segments – spirits, beer, non-alcoholic beverages, and food. Source: ThaiBev's website |

Last year, ThaiBev had to refute allegations for the second time that it was looking for a buyer for SABECO as rumours resurfaced that it was looking to sell its 53.6 per cent stake in the subsidiary due to its slow performance.

However, SABECO raised net revenues by 44 per cent and profit after tax by 75 per cent in the first nine months of 2022, climbing to $1.08 billion and $191.3 million respectively. The company is also one of the top ten listed businesses on the Vietnamese stock exchange with the greatest deposits.

This year, SABECO targets $1.5 billion in net revenue and $200 million in after-tax profit, a respective increase of 32 and 17 per cent on-year. Thus far, the group has accomplished 96.6 per cent of its profit goal.

According to SSI Securities, management anticipates gross margins to recover further in the future as the company still has room to cut costs across numerous activities.

In the context of rising operating interest rates, the banking industry's loan expansion plans remain closely limited and all firms face cash flow management challenges. According to SSI Securities, SABECO has great forecasting ability and effective financial management skills, allowing it to maintain the lead in cash flow even in the current period.

It added that this contributes to the group's and its brands' increased strength and efficiency, allowing the businesses to capitalise on the chance to accelerate the company's long-term strategic goals.

| ThaiBev denies it will sell stake in Sabeco Thailand’s Thai Beverage Public Co Ltd has denied it is seeking potential investors to buy its business in Vietnam. |

| ThaiBev and VietBev present Lunar New Year gifts to disadvantaged students Vietnam Beverage Co., Ltd. (VietBev) has just presented 750 Lunar New Year gifts and school equipment valued at around $32,600 to the Vietnam Fatherland Front Committees of Ha Tinh, Quang Binh, and Quang Ngai provinces. |

| ThaiBev spin-off pinpoints dedicated beer group growth Thai Beverage Public Company, known as ThaiBev, has announced its intention for BeerCo – which comprises ThaiBev’s brewing operations in Thailand and Vietnam – to resume its plan of a proposed spin-off offering of its brewery unit in Singapore and thus kicking off its restructuring. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version