SABECO reaps rewards with Q3 results

The company, known as SABECO, last week released its consolidated financial statement for the third quarter of 2022, in which the 2022 advance dividend payment in cash was approved by the Board of Directors.

The payout ratio is 25 per cent par value or VND2,500 (10 US cents) per share and the payment date is specified as January 11, 2023.

The recently filed financial statement for Q3 showed that SABECO’s net revenues hit $375.2 million, an increase of 101.6 per cent over the same period the previous year. Profit after tax increased by 195.5 per cent on-year to $60.4 million.

|

| SABECO’s top brands continue to dominate entertainment events up and down the country |

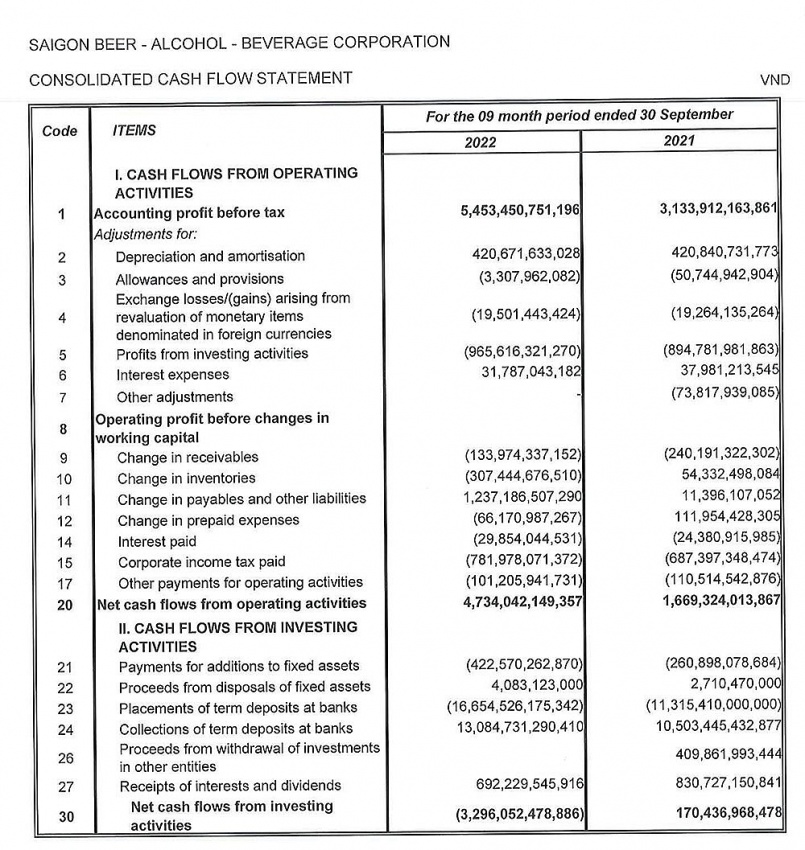

Over the first nine months of 2022, the company increased net revenues by 44 per cent and profit after tax by 75 per cent, to $1.08 billion and $191.3 million, respectively. It has a cash deposit of up to VND20.6 trillion ($877.4 million) for terms over three months and less than one year, and is in the top 10 listed companies with the largest deposits on the Vietnamese stock exchange.

In the context of increasing operating interest rates, credit growth targets of the banking industry are still strictly controlled, and businesses all face certain difficulties in cash flow management. However, SABECO boasts strong forecasting ability and effective financial management capacity, thereby maintaining the initiative in cash flow even in the current period, according to SSI Securities.

This further contributes to increasing the strength and efficiency of the group and its brands, helping businesses to take advantage of the opportunity to accelerate to realise the company’s long-term strategic goals, it added.

Abundant cash flow is also one of the factors that has been increasing the attractiveness of SABECO stock in the market recently, in part because the company is committed to maintaining regular dividend payments. Its dividend policy has been maintained, even during the pandemic peak and while contending with new, tougher legislation on drink-driving.

|

This year, SABECO targets $1.5 billion in net revenues and $200 million in after-tax profit, a respective increase of 32 and 17 per cent on-year. Thus far, the group has accomplished 96.6 per cent of its profit goal.

According to MB Securities, although the price of raw materials such as barley and aluminium has increased since 2021, thanks to maintaining a leading market share and with the advantage of long-term experience in the industry, SAEBCO has calculated to pre-order key raw materials to ensure production and reduce pressure on prices.

Meanwhile, the company is transferring the increase from raw material costs to product selling prices without adversely affecting market share or sales volume. Therefore, gross margin has maintained a gradual improvement trend in recent quarters.

Consumption of raw materials and energy in the brewing process has been cut down continuously. Malt (2 per cent drop), rice (2 per cent drop), and hop seed extraction (9 per cent drop) costs fell on-year, while enzyme costs fell 32 per cent. At the same time, the cost of electricity and water also fell by 10 and 20 per cent respectively over the same period.

In the future, management expects gross margins to continue to recover, as the company still has room to cut costs across many activities.

SABECO includes 26 breweries, eight with solar power systems installed, and 11 trading subsidiaries, and has a distribution network consisting of thousands of retailers nationwide.

SABECO is proud to offer a brand portfolio that consists of some of the most well-loved beer brands in Vietnam, including Lac Viet, Bia Saigon Chill, Bia 333, Bia Saigon Special, Bia Saigon Export, Bia Saigon Lager, and Bia Saigon Gold.

| SABECO accomplished 96.6 per cent of its profit goal in nine months SABECO's net sale and profit after tax reaped sweet fruits in the third quarter thanks to the resurgence of global tourism, increased consumer demand, improved production, and cost savings. |

| Bia Saigon Chill wins at Asia Beer Championship 2022 Asia Beer Championship 2022 gave awards to Bia Saigon, the leading brand of Saigon Beer-Alcohol-Beverage Corporation (SABECO), for its outstanding beers and its innovation to meet customer needs on October 28. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version