Rosier times ahead for Vietnam’s startup scene in 2022

What do you think about the prospects of Vietnam’s startup ecosystem in 2022 and beyond?

Despite many challenges, many investors continue to view Vietnam as an appealing market in Southeast Asia. Vietnam, behind Singapore and Indonesia, is considered the third most dynamic economy in ASEAN, according to a report from two Singapore-based venture capital funds, Cento Ventures and ESP Capital.

Apart from its negative consequences, the pandemic has also been a potent stimulus for the emergence of revolutionary business strategies. In 2021, MoMo has become Vietnam’s latest unicorn while other start-ups received funding worth tens to hundreds of millions of dollars in the fintech, edtech, and blockchain game. Moreover, Vietnam’s startup ecosystem also sees the launch of many projects that resolve social and environmental issues.

Which sectors will become the next trends in the startup scene?

At the moment, the prominent startup trend in Vietnam is centred on business projects that contribute to community development and sustainability such as clean energy, recycling, reduced energy consumption, and jobs for the disadvantaged.

An example of an emerging startup is Green Power – a company that provides renewable energy for houses, industrial firms, and construction projects such as M-Building, an office in Ho Chi Minh City’s District 7, Anland Complex, and Ecopark. These projects have also received the EDGE certification from the International Finance Corporation, a member of the World Bank Group, for meeting energy conservation and resource efficiency standards. Further information about the projects can be found at itifund.com

Additionally, the market also sees eco-friendly products from startups like Fasgreat, which manufactures activewear products made from recycled poly fabrics, and GreenJoy, a Ho Chi Minh City-based firm producing grass straws.

|

| Activewear products are made from recycled polyfabrics by Fasgreat |

How would you estimate the development potential of Vietnam’s startup ecosystem?

It is huge. Vietnam currently has approximately 3,800 innovative startups. In which, there are four businesses valued at over $1 billion: VNG, VNLife, MOMO, and Sky Mavis, as well as 11 businesses valued at over $100 million.

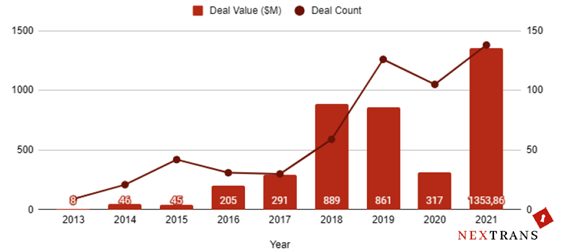

Between 2016 and 2019, investment capital flows into the technology industry surged eightfold, while the number of successful transactions increased fourfold. Following the pandemic, emerging sectors will see a huge potential for startup projects to develop.

In 2020, investment capital was reduced by half because of the pandemic. However, the market swiftly recovered in 2021, with the total investment capital reaching $1.3 billion, with over 1,300 successful business deals. It was also a breakthrough year for fintech, e-commerce, food and beverage, games, and blockchain firms.

|

| Deal value and count among Vietnamese startups from 2013 to 2021 |

How would you evaluate Vietnam’s startup ecosystem for investment funds?

Vietnam’s startup ecosystem has been considered an attractive destination for many investors, including ITI Fund (itifund.com), a startup investment fund founded by 4M Group, contributing to the diversified and sustainable development of the startup ecosystem in Vietnam, aiming to generate special values for the community and society.

The fund currently invests in early-stage startups in many emerging sectors including digital technology, high-tech agriculture, education, and healthcare, among others.

In addition to finance, the fund also accompanies businesses in strategy and management consultation, bringing indirect benefits such as knowledge, experience, and a network of contacts. ITI Fund will invest at least $100,000 into early-stage projects in Vietnam.

The ITI Fund team has more than 50 years of experience and operates with more than 500 employees, over 10,000 workers and a global network of 10 representative offices around the world.

|

| Management Board of ITI Fund |

In addition, ITI Fund also has a team of legal consultants with 20 years of experience working in multinational corporations, as well as a team of financial consultants with more than 15 years of experience.

Along with its main motto “Startup Together”, ITI Fund’s experience will catalyse the development of potential startups in Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Tag:

Tag:

Mobile Version

Mobile Version