MoMo shoulders mounting losses for larger market share

|

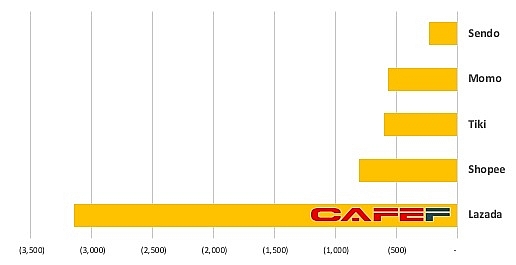

| MoMo's losses catch up to Tiki and Shopee (unit: billion dong) |

In order to ride the waves of the non-cash payment trends, intermediate payment services and e-wallets have received great investments recently. MoMo is one of the first e-wallets in the market, and as such has received ample investment.

E-payment is quite a promising sector, but it seems to “burn” a great deal of money to lure in new clients and launch promotion campaigns for competition.

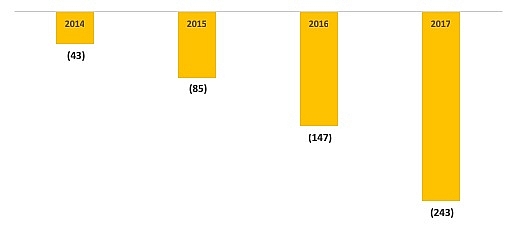

Thus, as MoMo develops and expands, the more losses it has to suffer. The company’s losses rose to VND243 billion ($10.6 million) in 2017 adding to the VND147 billion ($6.4 million) in 2016 and VND43 billion ($1.87 million) in 2014. Thereby, as of the end of 2017, MoMo’s accumulated losses stood at VND566 billion ($24.6 million), equivalent to the losses of Tiki and close to Shopee.

In 2017, MoMo’s revenue was VND1.734 trillion ($75.4 million), but gross profit was only VND34 billion ($1.48 million), which resulted in a 2.1 per cent gross profit margin, while it spent approximately VND300 billion ($13 million) on sales and management costs. Thereby, with the modest revenue and low profit margin, MoMo will not be able to turn profit in the short term.

|

| MoMo e-wallet has been reporting growing losses over the years (unit: billion dong) |

One of MoMo’s disadvantages compared to competitors is that it does not belong to any large retail system, so it has to build and maintain its own user database. Meanwhile, its competitor Zalo Pay is developed by VNG Corporation, which has an established online gaming system, social network Zalo, and affiliated company Tiki.vn, while AirPay has access to the database of SEA (Garena) Corporation, including its online gaming system, e-commerce platform Shopee, and food delivery application Now.

Thus, as opposed to MoMo, some of e-wallet companies, such as Payoo and AirPay, have managed to turn profit. In 2017, the revenue of Vietnam Esports JSC, the developer of AirPay, was nearly VND4.2 trillion ($182.6 million) and its pre-tax profit was VND67 billion ($2.9 million).

Although the losses are increasing, MoMo receives ample investment. In 2013, MoMo mobilized $5.75 million from Goldman Sachs and another $28 million from Goldman Sachs and Standard Chartered Private Equity (SCPE).

Since early 2018, MoMo seems to receive investments from foreign investors as is apparent from the several instances its business registration was changed, increasing charter capital from VND69 billion ($3 million) to VND112 billion ($4.87 million).

At the end of 2017, foreign investors held only 44 per cent of MoMo’s charter capital. However, by now, this ratio has increased to 64 per cent with some new names like Ganymede Holdings B.V and E-Mobile VN Investments I.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Mobile Version

Mobile Version