ICAEW forecasts Southeast Asia GDP growth to slow in 2019

|

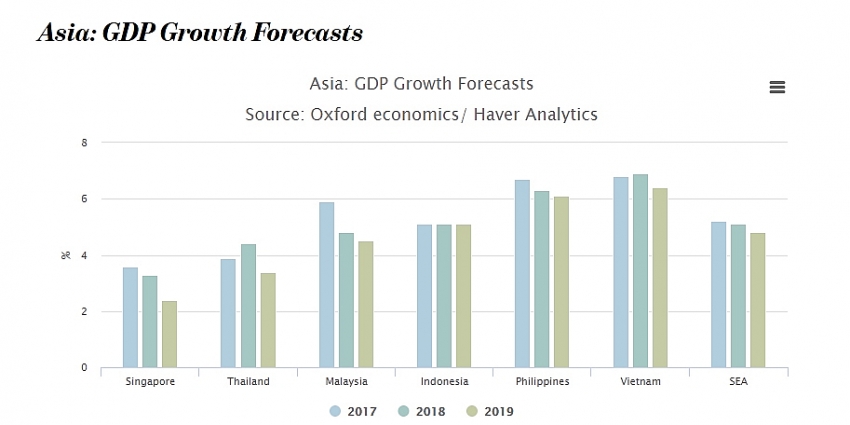

Economic growth continued to moderate across most SEA economies in the third quarter of 2018, with the average GDP growth slowing down to 4.8 per cent on-year, from 5.2 per cent in the second quarter of 2018. Vietnam was the exception with GDP growth accelerating to 6.9 per cent, up from 6.7 per cent in the second quarter as FDI inflows continued to support growth in manufacturing activity and exports.

GDP growth across the region is set to slow next year, as many of the region’s economies are small, open, and heavily dependent on exports to China, due to both supply-chain linkages as well as tightening Chinese domestic demand. Amongst SEA economies, Singapore is expected to experience the sharpest slowdown, with the country’s GDP growth set to moderate from an expected 3.3 per cent in 2018 to 2.5 per cent in 2019. Conversely, Indonesia and the Philippines will be the least affected. As such, while growth is set to ease in Vietnam, Indonesia, and the Philippines in 2019, they will still be amongst the top ten fastest growing economies globally.

“In line with our simulation of US-China tariffs, we expect Asian economies with the closest ties to China to experience the hardest hit in a trade war,” said Sian Fenner, ICAEW Economic Advisor & Oxford Economics Lead Asia Economist. “Against a challenging global backdrop, we expect that the knock-on impact of the US-China trade war will be greater in 2019, resulting in a trimmed growth forecast for the region to 5 per cent in 2019, with the global macroeconomic context still reasonably constructive.”

Domestic demand will likely provide some relief amid a more difficult outlook for exports. Expansionary fiscal policy will help, with fiscal spending expected to be strong in Indonesia, Thailand, and the Philippines ahead of upcoming elections in the first half of 2019. In addition, many governments in the region, including Indonesia and Malaysia, are expected to miss their ambitious fiscal consolidation targets for 2019. In Vietnam, while the government’s fiscal position has improved, there is limited space for any expansionary fiscal policy next year.

However, domestic demand growth is unlikely to reach the stellar pace achieved in 2018, in part because of lower monetary policy support. Indonesia and the Philippines have been more aggressive than their peers with policy rates raised 175bp a piece, in a bid to support their respective currencies. Looking ahead, central banks are expected to continue tightening over 2019.

Mark Billington, ICAEW regional director, Southeast Asia, said, “Although domestic demand has held up well this year, it is unlikely to reach the stellar pace achieved in 2018, partly due to lower monetary policy support. Combined with a moderation in export growth, we expect GDP growth across all of the SEA economies to ease next year, as a result of the ongoing US-China trade conflict and tighter global monetary conditions.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version